- Canada

- /

- Office REITs

- /

- TSX:INO.UN

We Discuss Why Inovalis Real Estate Investment Trust's (TSE:INO.UN) CEO May Deserve A Higher Pay Packet

Shareholders will be pleased by the robust performance of Inovalis Real Estate Investment Trust (TSE:INO.UN) recently and this will be kept in mind in the upcoming AGM on 13 July 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Inovalis Real Estate Investment Trust

Comparing Inovalis Real Estate Investment Trust's CEO Compensation With the industry

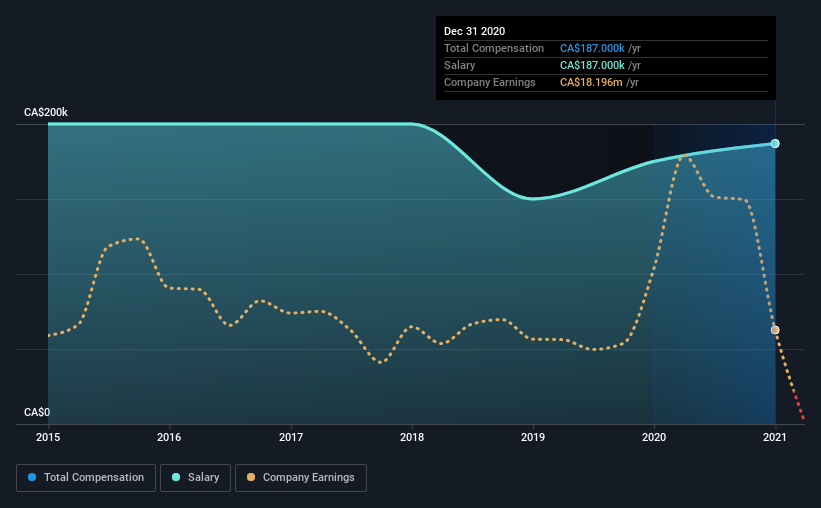

At the time of writing, our data shows that Inovalis Real Estate Investment Trust has a market capitalization of CA$329m, and reported total annual CEO compensation of CA$187k for the year to December 2020. That's just a smallish increase of 6.9% on last year. Notably, the salary of CA$187k is the entirety of the CEO compensation.

For comparison, other companies in the same industry with market capitalizations ranging between CA$123m and CA$494m had a median total CEO compensation of CA$500k. Accordingly, Inovalis Real Estate Investment Trust pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$187k | CA$175k | 100% |

| Other | - | - | - |

| Total Compensation | CA$187k | CA$175k | 100% |

On an industry level, around 35% of total compensation represents salary and 65% is other remuneration. Speaking on a company level, Inovalis Real Estate Investment Trust prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Inovalis Real Estate Investment Trust's Growth Numbers

Inovalis Real Estate Investment Trust has seen its funds from operations (FFO) increase by 1.0% per year over the past three years. Its revenue is down 32% over the previous year.

We generally like to see a little revenue growth, but the modest improvement in FFO is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Inovalis Real Estate Investment Trust Been A Good Investment?

With a total shareholder return of 29% over three years, Inovalis Real Estate Investment Trust shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Inovalis Real Estate Investment Trust rewards its CEO solely through a salary, ignoring non-salary benefits completely. Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Inovalis Real Estate Investment Trust (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Inovalis Real Estate Investment Trust, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:INO.UN

Inovalis Real Estate Investment Trust

Inovalis REIT is a real estate investment trust listed on the Toronto Stock Exchange in Canada.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.