- Canada

- /

- Real Estate

- /

- TSX:DRM

It's Unlikely That Dream Unlimited Corp.'s (TSE:DRM) CEO Will See A Huge Pay Rise This Year

Under the guidance of CEO Michael Cooper, Dream Unlimited Corp. (TSE:DRM) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 07 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Dream Unlimited

Comparing Dream Unlimited Corp.'s CEO Compensation With the industry

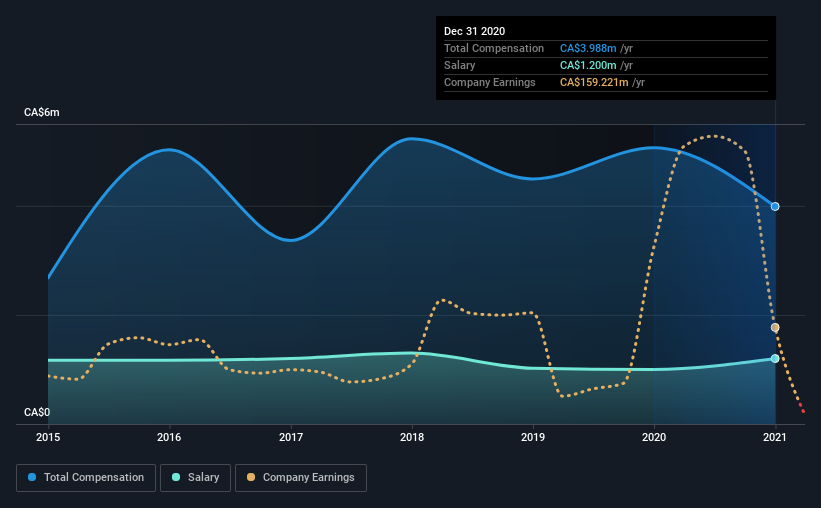

Our data indicates that Dream Unlimited Corp. has a market capitalization of CA$1.1b, and total annual CEO compensation was reported as CA$4.0m for the year to December 2020. Notably, that's a decrease of 21% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$1.2m.

On examining similar-sized companies in the industry with market capitalizations between CA$483m and CA$1.9b, we discovered that the median CEO total compensation of that group was CA$2.2m. Accordingly, our analysis reveals that Dream Unlimited Corp. pays Michael Cooper north of the industry median. What's more, Michael Cooper holds CA$2.0m worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$1.2m | CA$1.0m | 30% |

| Other | CA$2.8m | CA$4.1m | 70% |

| Total Compensation | CA$4.0m | CA$5.1m | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. It's interesting to note that Dream Unlimited allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Dream Unlimited Corp.'s Growth

Dream Unlimited Corp.'s earnings per share (EPS) grew 25% per year over the last three years. Its revenue is down 68% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Dream Unlimited Corp. Been A Good Investment?

With a total shareholder return of 24% over three years, Dream Unlimited Corp. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Dream Unlimited that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:DRM

Dream Unlimited

Dream Unlimited Corp. formerly known as Dundee Realty Corporation is a real estate investment firm.

Low and slightly overvalued.