- Canada

- /

- Retail REITs

- /

- TSX:CRR.UN

Crombie REIT (TSX:CRR.UN): Does Current Valuation Reveal Hidden Opportunity for Investors?

Reviewed by Kshitija Bhandaru

See our latest analysis for Crombie Real Estate Investment Trust.

Zooming out from the latest moves, Crombie Real Estate Investment Trust’s share price has gained more than 13% year-to-date, while its total shareholder return stands at nearly 3% for the past year. The combination of steady price momentum and substantial five-year total returns suggests that longer-term investors continue to benefit, even as the market considers near-term uncertainty and evolving sentiment around real estate assets.

If Crombie’s steady run has you curious about other resilient performers, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets and a solid five-year performance, investors are left to wonder: does Crombie offer hidden value, or are expectations for future growth already fully reflected?

Price-to-Earnings of 17.2x: Is it justified?

Crombie Real Estate Investment Trust currently trades with a price-to-earnings ratio of 17.2x, modestly below its peer average and well beneath the broader industry benchmark. This suggests relative undervaluation at its last close of CA$15.09.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings, capturing market expectations for future profitability. For real estate investment trusts like Crombie, a lower P/E could indicate the market is cautious about its earnings outlook or not fully recognizing its profit potential.

This multiple not only stands below the peer group average of 17.8x but also lags the North American Retail REITs industry average of 23.7x. This underscores Crombie’s considerable value on a relative basis. Should sentiment improve or earnings prove resilient, there is potential for its valuation to move closer to these industry standards.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.2 (UNDERVALUED)

However, Crombie’s value case could weaken if broader economic pressures dampen retail demand or if sentiment in real estate shifts against the sector.

Find out about the key risks to this Crombie Real Estate Investment Trust narrative.

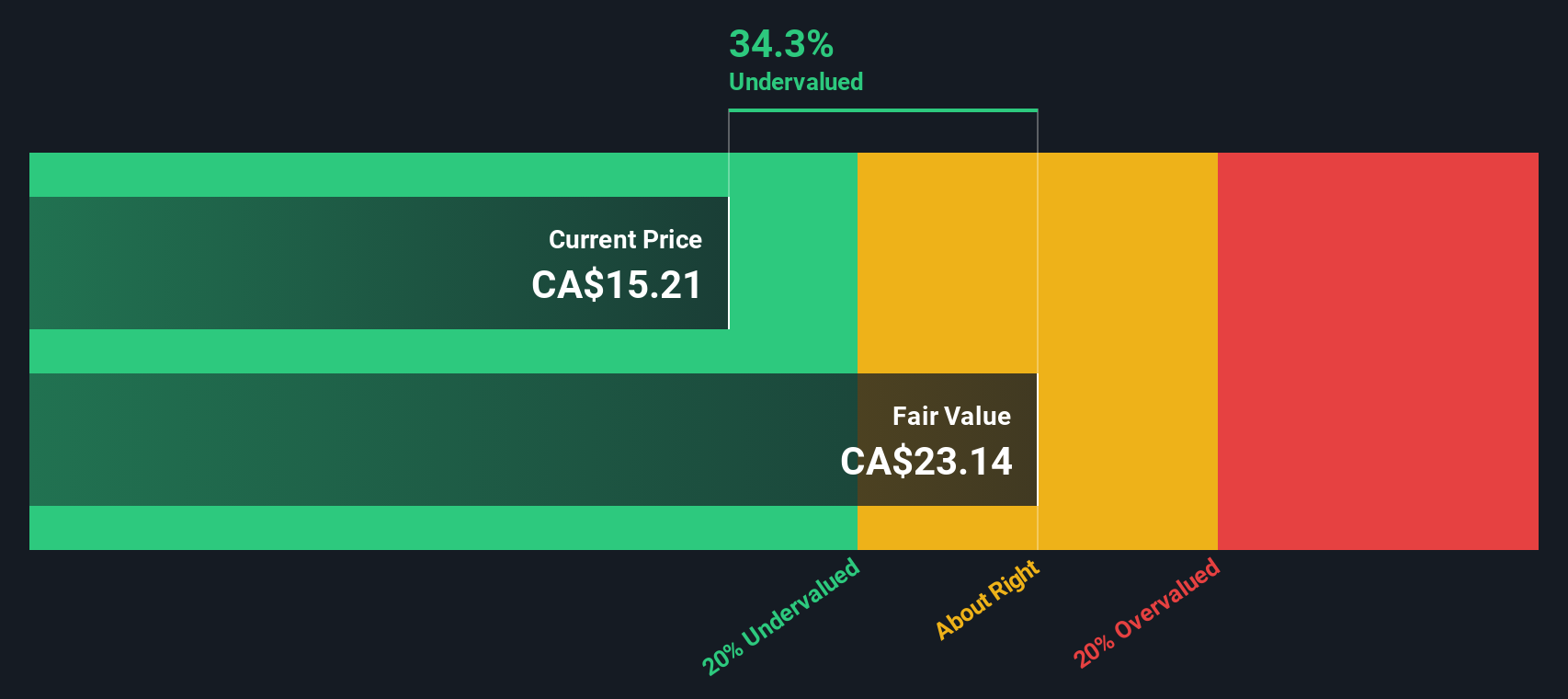

Another View: The SWS DCF Model Says Shares Are Even Cheaper

While Crombie’s price-to-earnings ratio suggests undervaluation compared to peers, our DCF model paints an even starker picture. The SWS DCF model estimates fair value at CA$23.25, which means Crombie is trading at a 35% discount. Valuation methods may vary, but can the market ignore this gap for long?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crombie Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crombie Real Estate Investment Trust Narrative

If you want to interpret Crombie Real Estate Investment Trust’s data your way, you can quickly build your own perspective in just a few minutes, then Do it your way

A great starting point for your Crombie Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move smarter by tapping into fresh opportunities. Get ahead of the curve by checking out tailored lists that spotlight under-the-radar prospects across the market.

- Unlock high-yielding opportunities and secure reliable returns with these 20 dividend stocks with yields > 3% for stocks offering standout income potential.

- Spot trailblazers defining the future of medicine and innovation as you browse these 33 healthcare AI stocks packed with transformative healthcare AI players.

- Accelerate your search for value by targeting growth at a discount. Hunt for compelling buys among these 874 undervalued stocks based on cash flows based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRR.UN

Crombie Real Estate Investment Trust

Crombie invests in real estate with a vision of enriching communities together by building spaces and value today that leave a positive impact on tomorrow.

6 star dividend payer and good value.

Market Insights

Community Narratives