- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

How Investors Are Reacting To Boardwalk REIT (TSX:BEI.UN) Expanding With Saskatchewan Townhome Acquisitions

Reviewed by Simply Wall St

- Earlier this month, Boardwalk Real Estate Investment Trust completed the acquisition of three modern Saskatchewan townhome communities, totaling 235 suites in Saskatoon and Regina, for C$71.1 million at an approximate 5.2% cap rate.

- This off-market purchase not only expands the Trust's presence in two of Canada’s strongest rental markets but also brings operational efficiencies by aligning new assets with existing neighboring properties.

- We'll explore how expanding in Saskatoon and Regina strengthens Boardwalk's investment narrative through greater scale and enhanced operational synergies.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

What Is Boardwalk Real Estate Investment Trust's Investment Narrative?

For Boardwalk Real Estate Investment Trust, the big picture often comes down to belief in steady rental market strength, effective portfolio growth, and prudent cost controls. The Trust’s latest acquisition in Saskatchewan is a meaningful move, as it adds scale in two strong rental markets with modern assets at a cap rate that seems consistent with current sector dynamics. In the short term, this deal could act as a modest catalyst by improving operational efficiency and potentially solidifying recurring income, especially since these properties are near existing Boardwalk communities. However, any immediate impact on the Trust’s biggest risks―such as recent trends of declining net income and some insider selling―may be limited. While portfolio expansion is a positive narrative, investors face ongoing questions around stable profit margins, debt coverage, and the sustainability of recent dividend increases given softer earnings trends. Yet, continuing headwinds such as lower net income and high one-off gains remain important to watch.

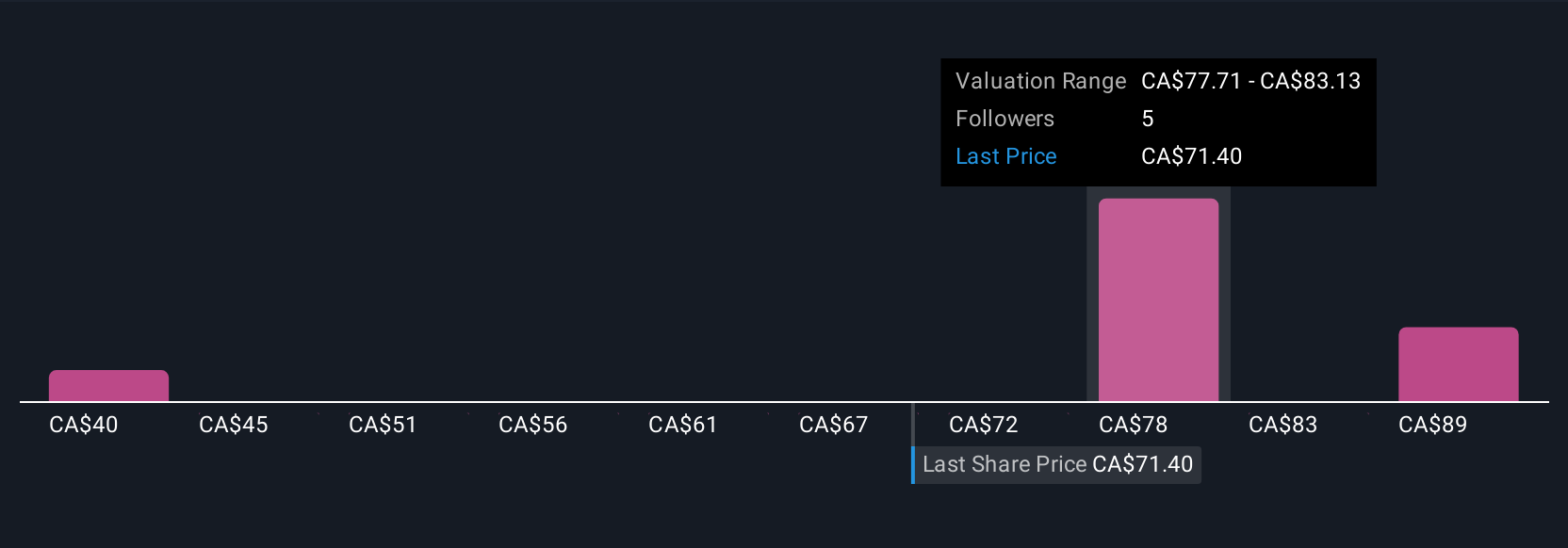

Boardwalk Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Boardwalk Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boardwalk Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Boardwalk Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boardwalk Real Estate Investment Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boardwalk Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and is a leading owner/operator of multi-family rental communities.

Moderate and good value.

Market Insights

Community Narratives