- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

January 2025's Undervalued Small Caps On TSX With Insider Action

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of rising bond yields and evolving economic indicators, small-cap stocks on the TSX are capturing attention amid a backdrop of strong economic growth and a bumpy disinflation process. In this environment, identifying promising small-cap companies often involves looking at those with robust fundamentals and potential insider activity that might signal confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 11.7x | 3.1x | 46.78% | ★★★★★★ |

| First National Financial | 13.7x | 3.9x | 45.46% | ★★★★★☆ |

| Nexus Industrial REIT | 12.1x | 3.0x | 28.40% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.0x | -75.34% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.3x | 21.70% | ★★★★☆☆ |

| Savaria | 31.0x | 1.7x | 27.37% | ★★★☆☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -110.03% | ★★★☆☆☆ |

| Parex Resources | 3.8x | 0.9x | -10.96% | ★★★☆☆☆ |

| Calfrac Well Services | 12.2x | 0.2x | 47.27% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.1x | 0.6x | -80.95% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Allied Gold (TSX:AAUC)

Simply Wall St Value Rating: ★★★☆☆☆

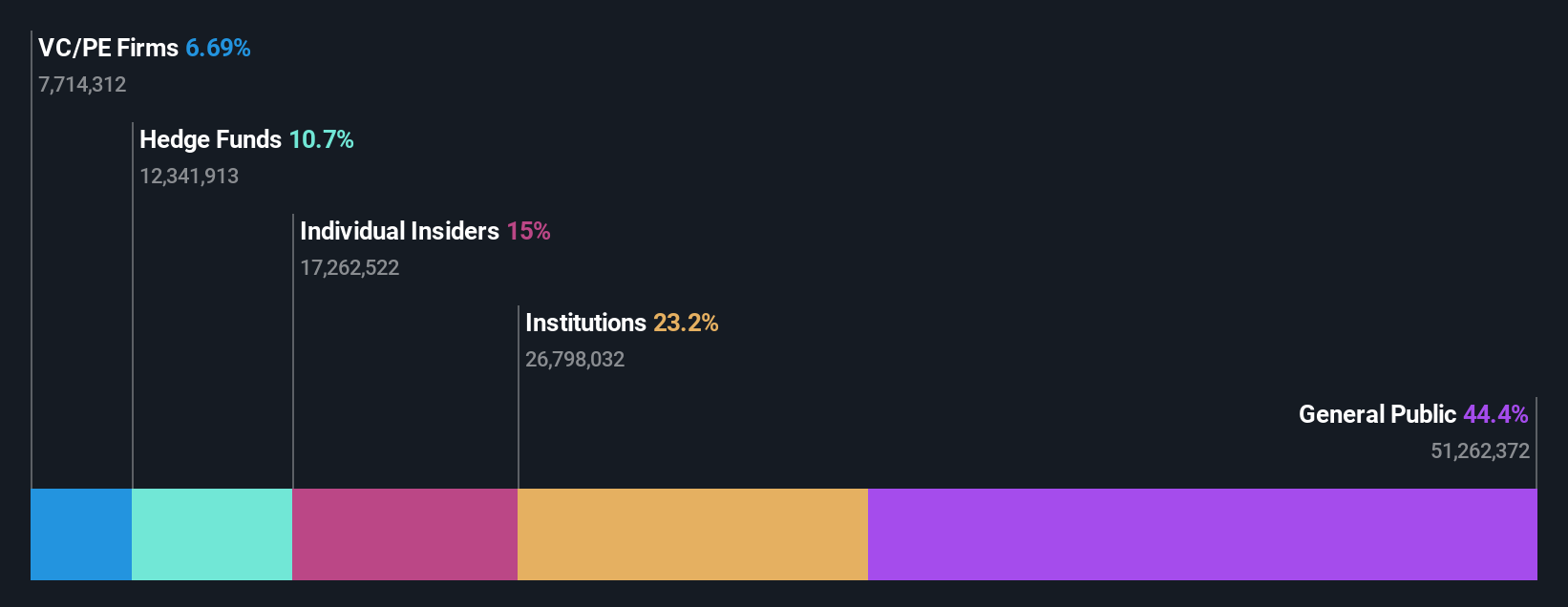

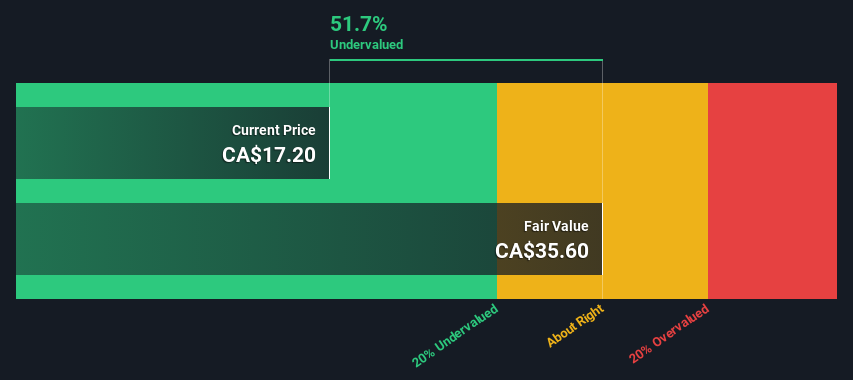

Overview: Allied Gold is a mining company focused on the exploration and production of gold, operating primarily through its Agbaou, Bonikro, and Sadiola mines with a market cap of $2.5 billion.

Operations: Allied Gold generates revenue primarily from its Agbaou, Bonikro, and Sadiola mines. The company's gross profit margin showed variability over recent periods, with the most recent figure at 32.50%. Operating expenses and non-operating expenses significantly impact net income, which has been negative in several recent quarters.

PE: -8.1x

Allied Gold, a Canadian company with a focus on gold production, recently reported solid fourth-quarter results, producing 99,632 ounces of gold. Insider confidence is evident as Peter Marrone purchased 871,000 shares for approximately US$2.7 million between November and December 2024. The company's strategic $175 million streaming transaction with Wheaton Precious Metals supports its growth ambitions at the Kurmuk project in Ethiopia. Despite past dilution concerns and external borrowing risks, earnings are forecasted to grow significantly by 83% annually.

Kiwetinohk Energy (TSX:KEC)

Simply Wall St Value Rating: ★★★☆☆☆

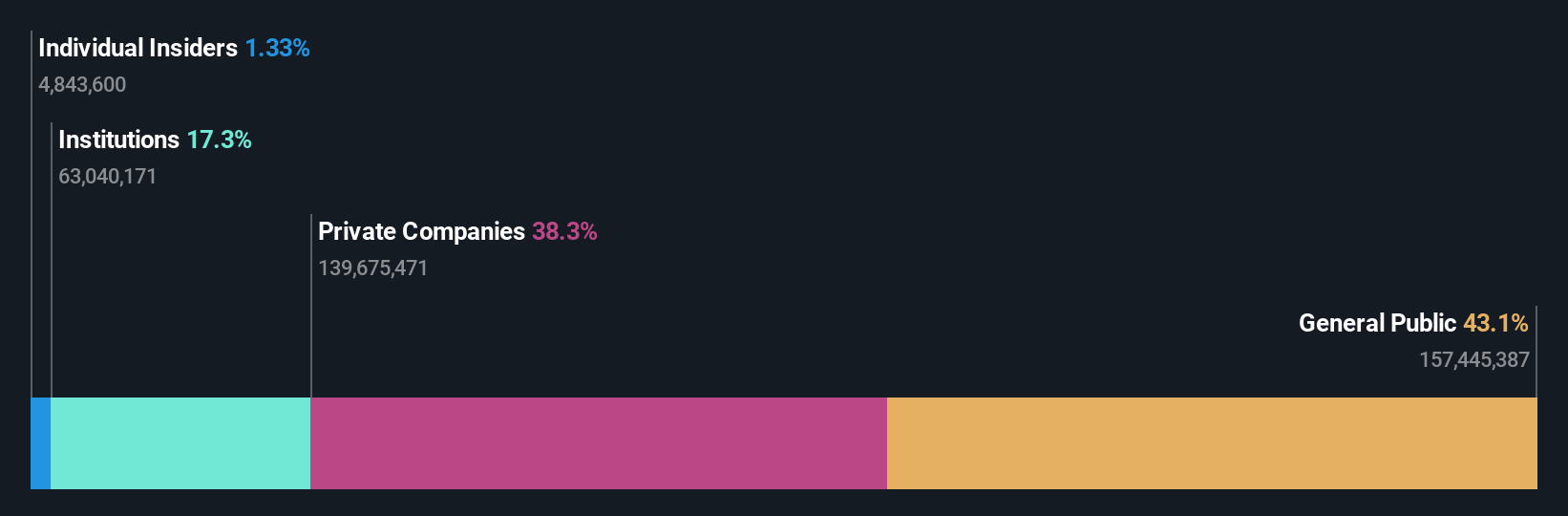

Overview: Kiwetinohk Energy focuses on the exploration and development of petroleum and natural gas, with a market capitalization of CA$1.02 billion.

Operations: The company generates its revenue primarily from the exploration and development of petroleum and natural gas, with a recent gross profit margin of 61.95%. Operating expenses, including general and administrative costs, significantly impact its financial performance.

PE: 11.2x

Kiwetinohk Energy, a smaller player in Canada's energy sector, shows potential despite facing challenges. Their profit margin has decreased to 14% from last year's 34.3%, yet revenue is forecasted to grow by over 11% annually. The company relies entirely on external borrowing for funding, which carries higher risk but also opportunity for growth. Insider confidence is evident with Michael Hantzsch purchasing 4,000 shares worth C$62,600 in January 2025. Recently appointed board member Alicia Kilmer brings strategic expertise that could steer future developments positively. A share repurchase program aims to enhance shareholder value by buying back up to 5% of issued shares by December 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Kiwetinohk Energy.

Understand Kiwetinohk Energy's track record by examining our Past report.

StorageVault Canada (TSX:SVI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: StorageVault Canada operates in the self-storage industry, offering services in self-storage, portable storage, and management solutions, with a market cap of CA$2.40 billion.

Operations: The company's revenue primarily comes from self-storage, with additional contributions from portable storage and management services. The gross profit margin has shown a variable trend, reaching 66.34% as of September 2024.

PE: -27.8x

StorageVault Canada, a small-cap company, is navigating through challenging financial waters with a net loss of C$6.97 million in Q3 2024 despite increasing revenues to C$78.96 million. The company recently expanded by acquiring two stores for C$10.5 million and increased its quarterly dividend slightly to C$0.002932 per share, signaling confidence in future cash flows. Deborah Robinson's appointment as an independent director enhances board expertise, potentially steering strategic governance improvements amidst reliance on external borrowing for funding.

Taking Advantage

- Click through to start exploring the rest of the 27 Undervalued TSX Small Caps With Insider Buying now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives