- Canada

- /

- Real Estate

- /

- TSX:SVI

Cardinal Energy And 2 Other TSX Undervalued Small Caps With Insider Buying In Canada

Reviewed by Simply Wall St

In recent months, the Canadian market has experienced fluctuations, with small-cap stocks on the TSX showing varied performance amidst broader economic indicators and shifting investor sentiment. As investors navigate these conditions, identifying stocks with strong fundamentals and potential insider confidence can be crucial for uncovering opportunities in the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 45.31% | ★★★★★★ |

| Parex Resources | 3.5x | 0.8x | 25.87% | ★★★★★★ |

| Nexus Industrial REIT | 12.2x | 3.1x | 29.56% | ★★★★★★ |

| Sagicor Financial | 1.1x | 0.3x | 37.32% | ★★★★★★ |

| First National Financial | 13.3x | 3.8x | 43.92% | ★★★★☆☆ |

| Calfrac Well Services | 11.7x | 0.2x | 36.43% | ★★★★☆☆ |

| Baytex Energy | NA | 0.8x | -93.69% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -107.91% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.4x | -206.50% | ★★★☆☆☆ |

| StorageVault Canada | NA | 4.8x | -668.32% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Cardinal Energy (TSX:CJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Cardinal Energy is a Canadian company primarily engaged in the exploration and production of oil and gas, with a market capitalization of approximately CA$1.04 billion.

Operations: Cardinal Energy generates revenue primarily from its oil and gas exploration and production activities, with recent quarterly revenue reported at CA$495.52 million. The company's cost of goods sold (COGS) for the same period was CA$208.15 million, leading to a gross profit of CA$287.38 million and a gross profit margin of 57.99%. Operating expenses were recorded at CA$137.90 million, which impacts the overall profitability metrics such as net income margin, noted at 20.77% in the latest data available.

PE: 9.3x

Cardinal Energy, a Canadian company, is drawing attention for its insider confidence, with John Festival purchasing 50,050 shares for C$310K in November 2024. Despite a dip in Q3 revenue to C$119.76M from C$139.87M the previous year and reduced profit margins to 20.8%, Cardinal's increased credit facilities to C$275M bolster their capital program and future projects like the Reford steam-assisted gravity drainage initiative. Regular dividends of C$0.06 per share continue supporting investor returns amidst these strategic moves.

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified company involved in manufacturing and aerospace & aviation operations, with a market capitalization of approximately CA$2.21 billion.

Operations: The company generates revenue primarily from its Aerospace & Aviation and Manufacturing segments, with the former contributing CA$1.61 billion and the latter CA$1.01 billion. Over recent periods, gross profit margin has shown a slight upward trend, reaching 35.72% as of September 2024. Operating expenses have increased alongside revenues, amounting to CA$633.54 million in the latest period, impacting overall profitability.

PE: 21.9x

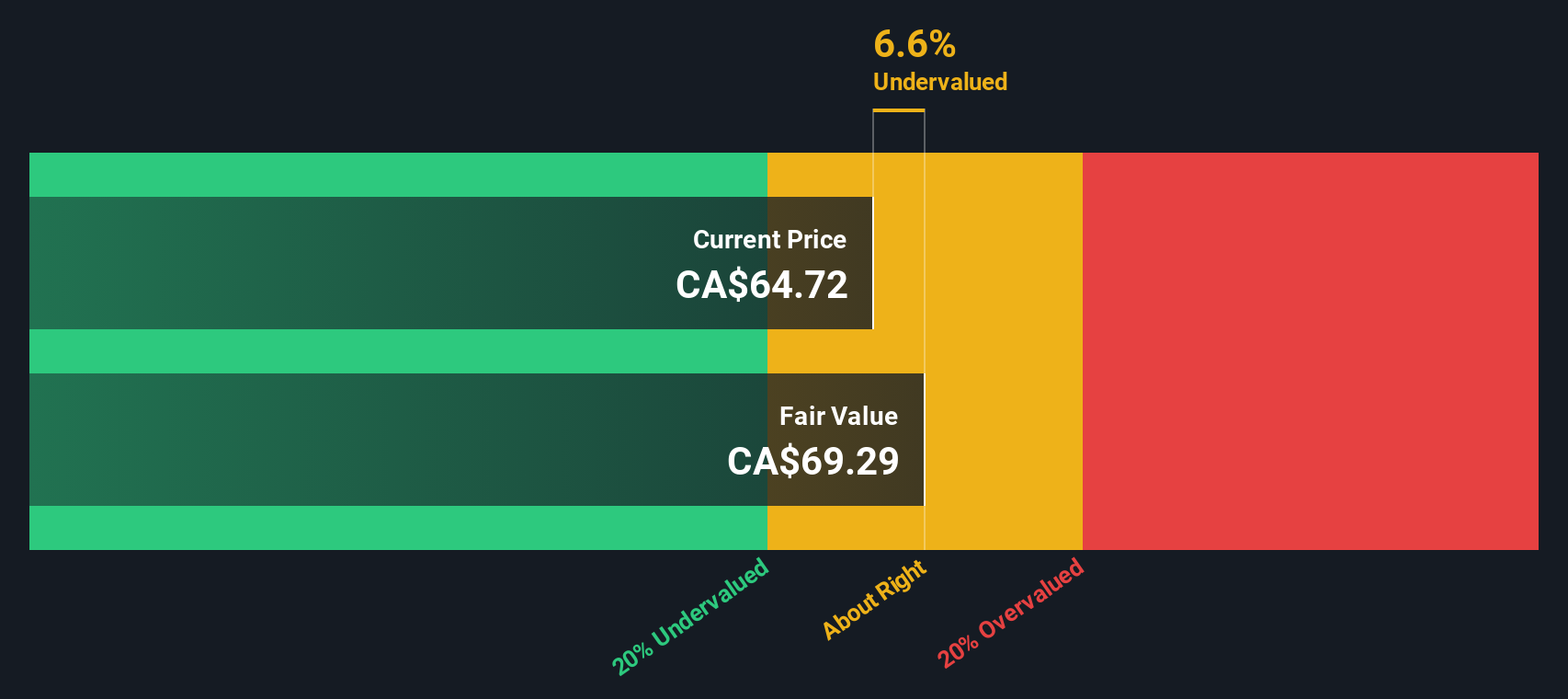

Exchange Income, a smaller Canadian company, has shown insider confidence with recent share purchases. Despite facing challenges with earnings not fully covering interest payments and shareholder dilution over the past year, the company continues to distribute dividends of C$0.22 per share monthly. For Q3 2024, revenue increased to C$709.86 million from C$687.67 million the previous year, while net income rose to C$55.89 million from C$49.52 million a year ago, indicating potential for future growth amidst its financial hurdles.

- Click here to discover the nuances of Exchange Income with our detailed analytical valuation report.

Assess Exchange Income's past performance with our detailed historical performance reports.

StorageVault Canada (TSX:SVI)

Simply Wall St Value Rating: ★★★☆☆☆

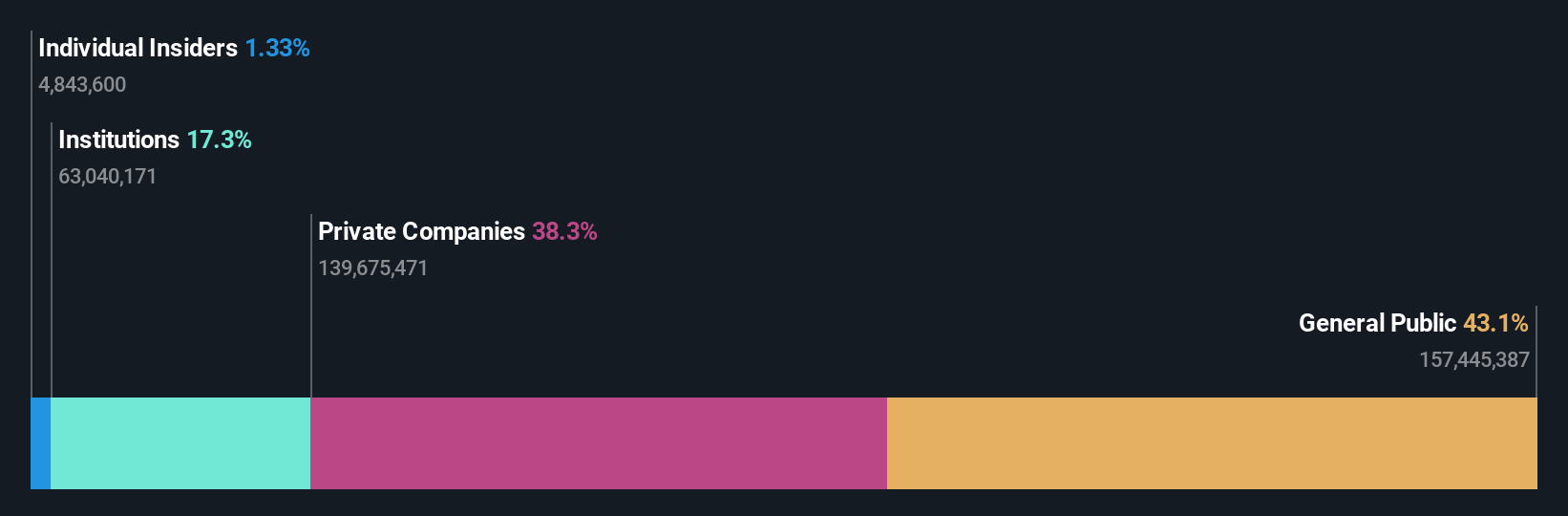

Overview: StorageVault Canada operates in the self-storage industry, providing self-storage and portable storage solutions, with a market cap of approximately CA$2.5 billion.

Operations: The company's revenue primarily stems from self-storage services, complemented by portable storage and management divisions. The gross profit margin has shown a notable upward trend, reaching 66.34% in the latest period. Operating expenses are significant, with general and administrative costs being a major component.

PE: -28.1x

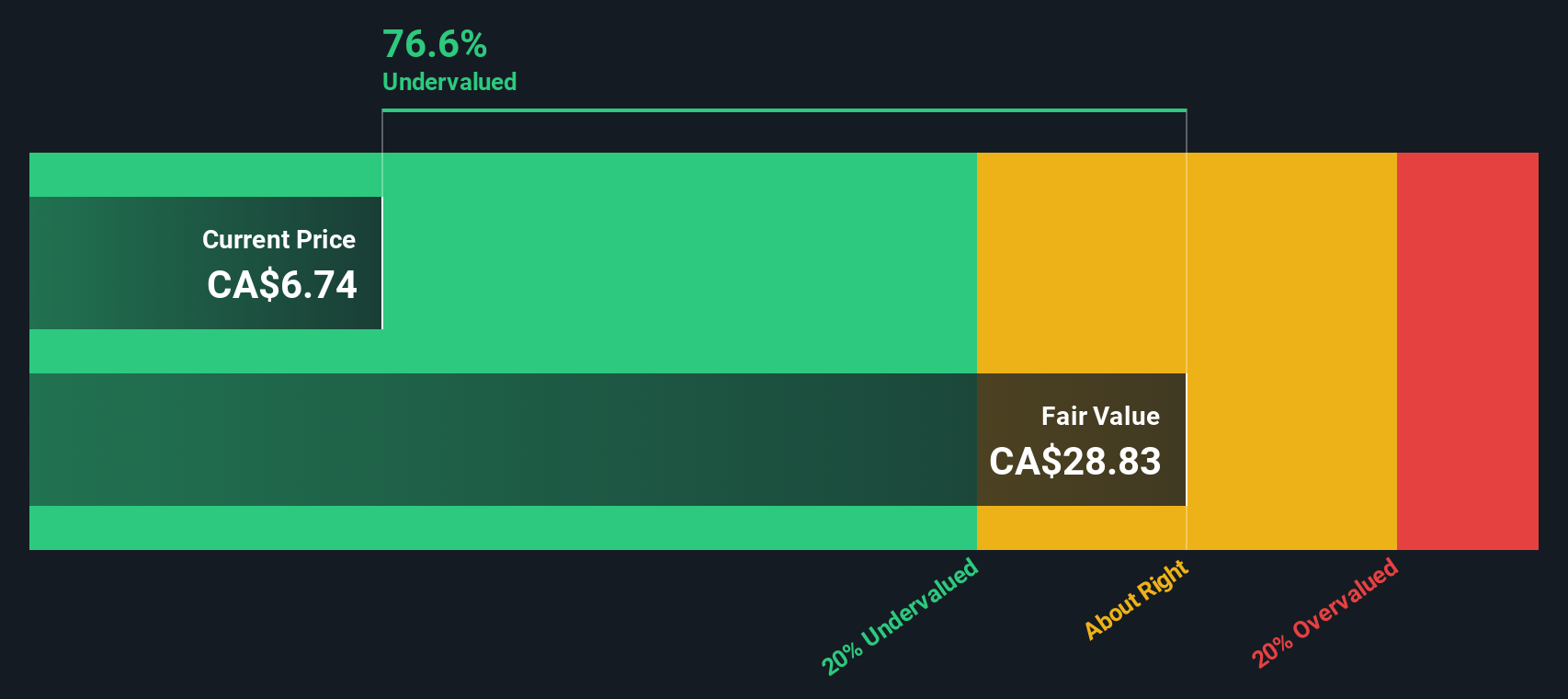

StorageVault Canada, a smaller player in the storage sector, recently expanded its footprint by acquiring two Ontario locations for C$10.5 million using available funds. Despite reporting a net loss of C$6.97 million in Q3 2024, revenue increased to C$78.96 million from the previous year. Insider confidence is reflected through share purchases over recent months, suggesting optimism about future prospects despite reliance on external borrowing for funding needs.

- Navigate through the intricacies of StorageVault Canada with our comprehensive valuation report here.

Understand StorageVault Canada's track record by examining our Past report.

Turning Ideas Into Actions

- Dive into all 23 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives