- Canada

- /

- Real Estate

- /

- TSX:MEQ

The total return for Mainstreet Equity (TSE:MEQ) investors has risen faster than earnings growth over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term Mainstreet Equity Corp. (TSE:MEQ) shareholders would be well aware of this, since the stock is up 205% in five years. On top of that, the share price is up 14% in about a quarter.

In light of the stock dropping 3.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Mainstreet Equity

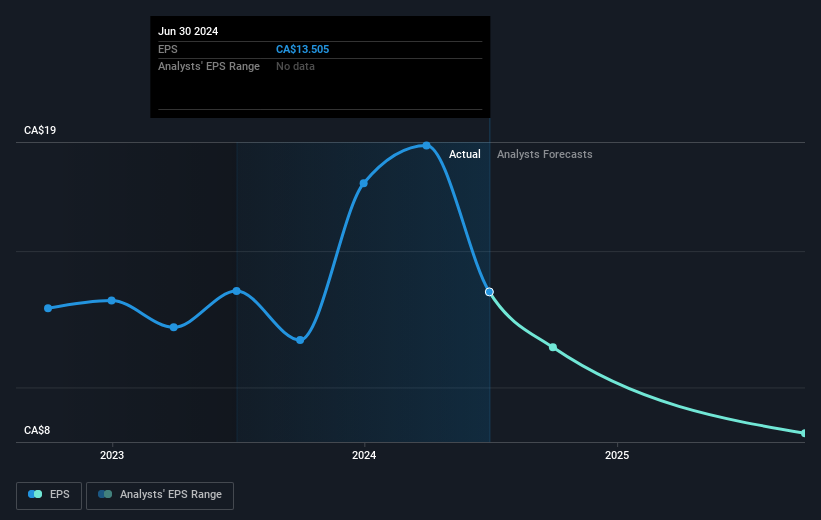

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Mainstreet Equity managed to grow its earnings per share at 14% a year. This EPS growth is lower than the 25% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Mainstreet Equity's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Mainstreet Equity shareholders have received a total shareholder return of 41% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 25%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Mainstreet Equity better, we need to consider many other factors. Even so, be aware that Mainstreet Equity is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MEQ

Mainstreet Equity

Engages in the acquisition, redevelopment, repositioning, and management of mid-market residential rental apartment buildings in Western Canada.

Low with questionable track record.

Market Insights

Community Narratives