- Canada

- /

- Real Estate

- /

- TSX:FSV

Does FirstService’s Recent Share Slump Now Present a Fair Valuation Opportunity?

Reviewed by Bailey Pemberton

- If you are wondering whether FirstService is quietly turning into a bargain or still priced for perfection, this breakdown will help you decide if the current tag on FSV really makes sense.

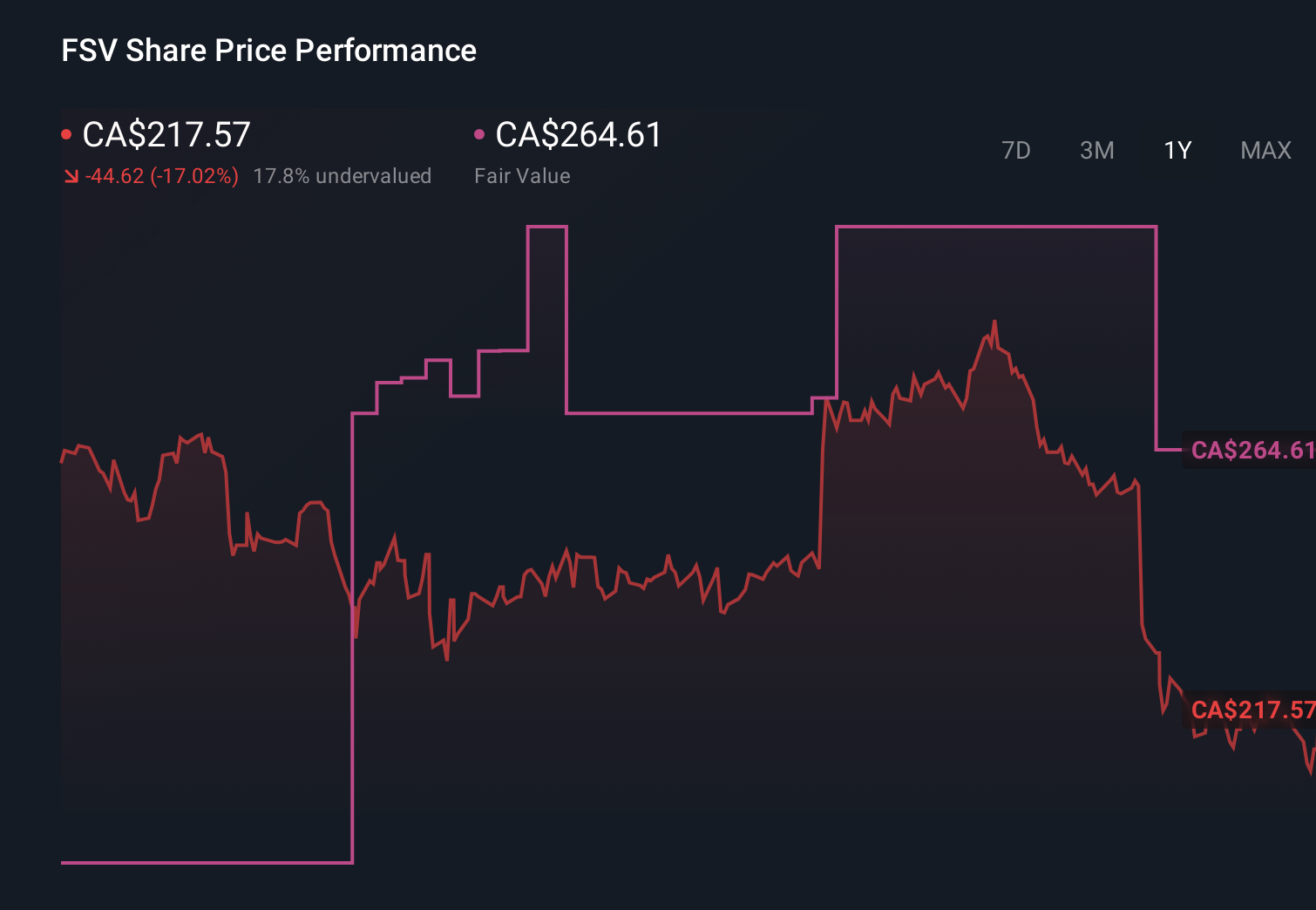

- The stock now trades around CA$212, up a modest 0.8% over the last week and 0.6% over the past month, but still down 17.7% year to date and 18.6% over the last 12 months despite a solid 30.2% gain over three years and 25.3% over five.

- Recently, investors have been reacting to a stream of updates around the broader North American property and services market. This has shifted sentiment on companies tied to commercial and residential real estate. At the same time, FirstService has been in focus as markets reassess how resilient property services businesses can be in a higher rate environment and a more cautious transaction backdrop.

- Right now, FirstService only scores 0/6 on our valuation checks, which you can see in detail in its valuation score. In the next sections we will unpack what different valuation methods say about the stock and finish by looking at a smarter way to think about its true worth.

FirstService scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FirstService Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For FirstService, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

FirstService generated about $296.2 Million in free cash flow over the last twelve months. Analysts provide detailed forecasts for the next few years, with free cash flow projected to reach around $319.6 Million by 2027. Simply Wall St then extrapolates these estimates out to 2035, with modest mid single digit growth in annual cash flows. All of these future cash flows are discounted back to a single present value and then divided by the number of shares to get an intrinsic value per share.

This DCF model suggests a fair value of roughly CA$173 per share, which is about 22.5% below the current market price around CA$212, implying that the stock screens as clearly overvalued on this basis alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FirstService may be overvalued by 22.5%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FirstService Price vs Earnings

For profitable companies like FirstService, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing and lower risk businesses deserve higher PE multiples, while slower growing or riskier ones tend to trade on lower multiples.

FirstService currently trades on a PE of about 50.8x, which is more than three times the broader Real Estate industry average of roughly 14.8x and also above the peer group average of around 46.8x. To move beyond these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable PE should be after factoring in earnings growth prospects, the company’s industry, profit margins, market value and specific risk profile.

This Fair Ratio for FirstService comes out at about 44.2x, lower than the stock’s current 50.8x. Because this framework adjusts for both growth and risk, it is a more tailored benchmark than simple industry or peer averages and suggests the market is paying a premium above what those fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FirstService Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that connects your view of a company’s story to a financial forecast and then to a fair value. This helps you decide whether to buy or sell by comparing that fair value to the current price, and it updates dynamically as new news or earnings arrive. For FirstService, one investor might build a Narrative around aging buildings, outsourcing and bolt-on acquisitions that supports a higher fair value near CA$305. Another might focus on roofing headwinds, weather risk and slower organic growth to arrive at a more cautious fair value closer to CA$205. Seeing these contrasting story-driven forecasts side by side makes it easier to choose the Narrative that best matches your own expectations and risk tolerance, while still keeping the numbers front and center.

Do you think there's more to the story for FirstService? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FSV

FirstService

Provides residential property management and other essential property services to residential and commercial customers in the United States and Canada.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion