- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

Top TSX Growth Stocks With High Insider Ownership For August 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of moderated services inflation and a slightly elevated unemployment rate, investors are keenly observing how these factors might influence growth opportunities. In such an environment, stocks with high insider ownership often stand out as they can indicate strong confidence from those closest to the company's operations, making them potentially attractive options for investors seeking stability and growth.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Robex Resources (TSXV:RBX) | 24.4% | 87.4% |

| Propel Holdings (TSX:PRL) | 36.3% | 31.1% |

| PowerBank (NEOE:SUNN) | 15.9% | 52.1% |

| Orla Mining (TSX:OLA) | 11.2% | 66.8% |

| goeasy (TSX:GSY) | 21.9% | 20.2% |

| First National Financial (TSX:FN) | 38.4% | 22.1% |

| Enterprise Group (TSX:E) | 32.2% | 70.3% |

| Discovery Silver (TSX:DSV) | 14.9% | 42.6% |

| Burcon NutraScience (TSX:BU) | 15.3% | 125.9% |

| Aritzia (TSX:ATZ) | 17.2% | 27.6% |

Let's review some notable picks from our screened stocks.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

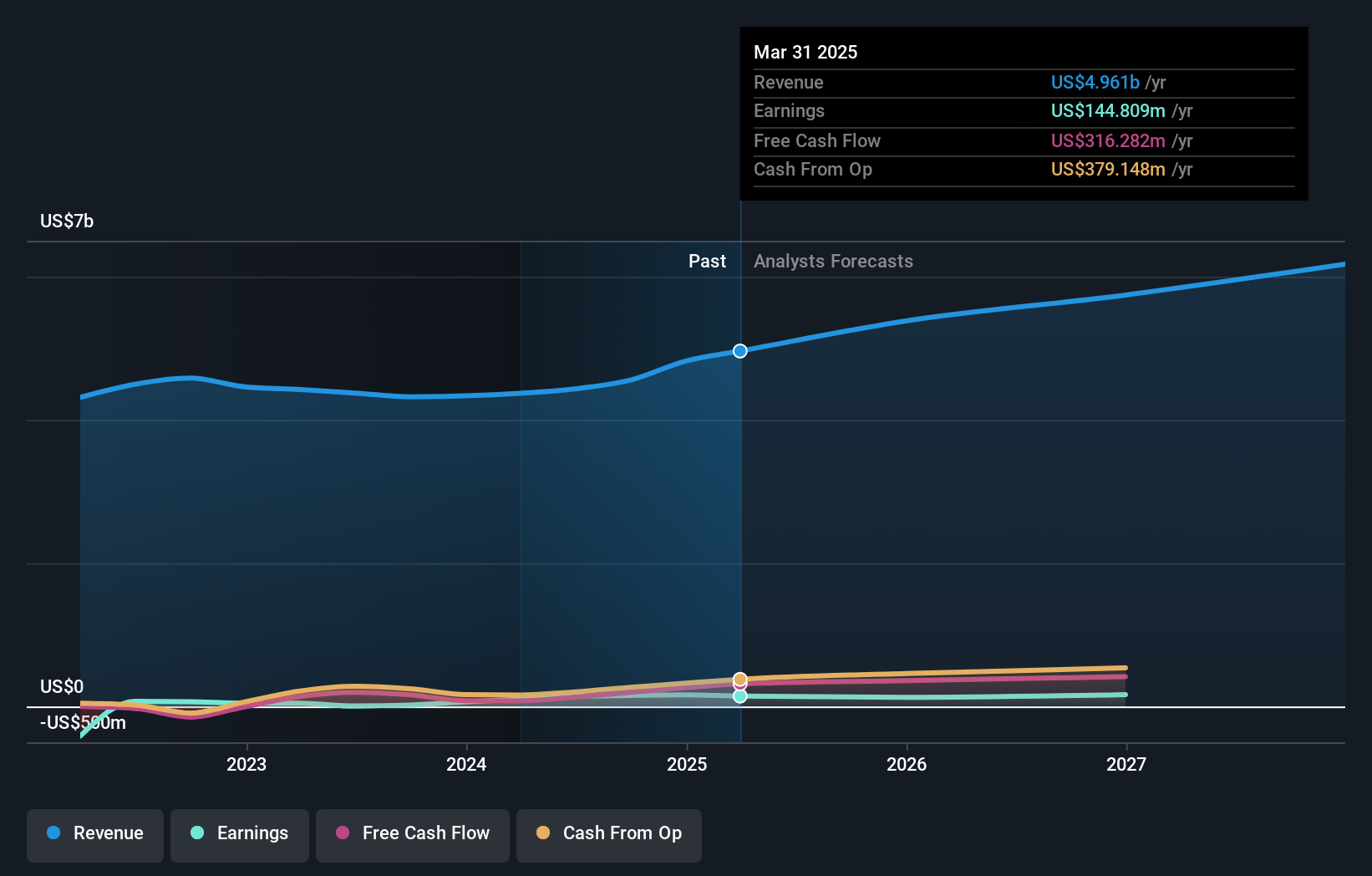

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa and has a market capitalization of CA$2.07 billion.

Operations: The company's revenue is primarily derived from its operations at the Agbaou Mine ($201.54 million), Bonikro Mine ($224.17 million), and Sadiola Mine ($476.02 million).

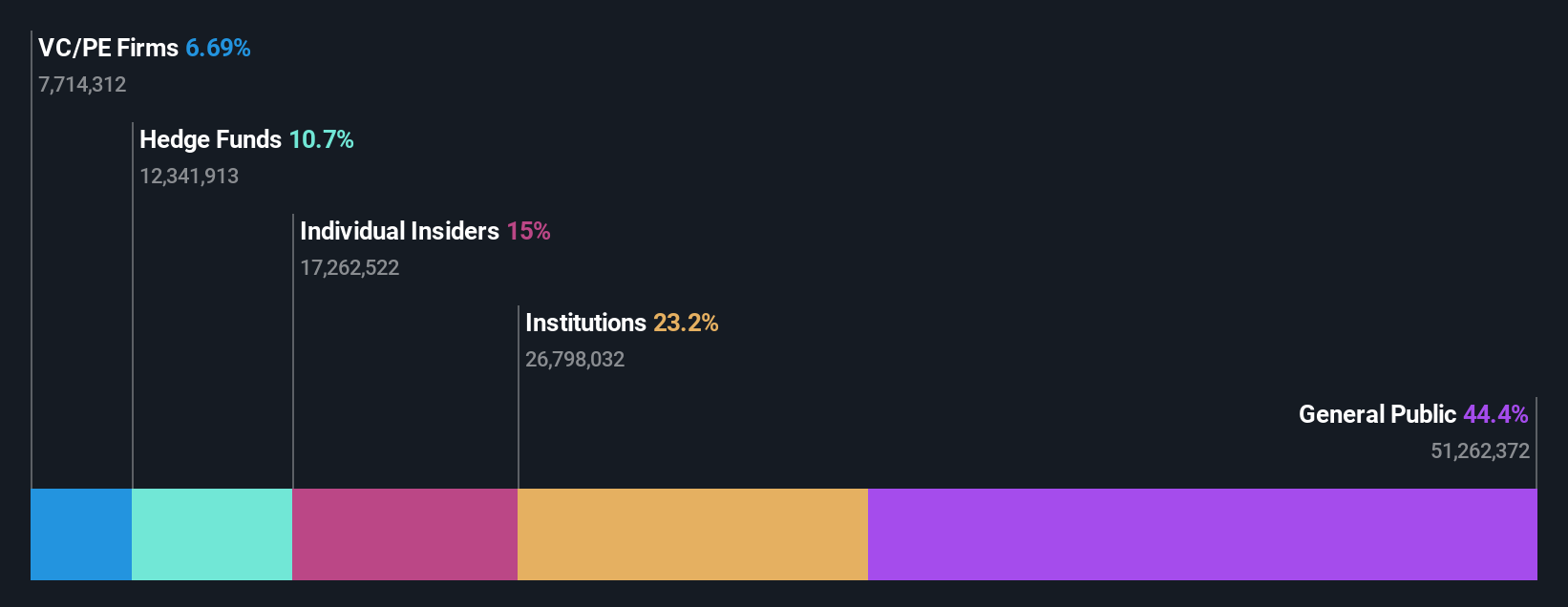

Insider Ownership: 16%

Earnings Growth Forecast: 59.8% p.a.

Allied Gold has recently transitioned to the NYSE and executed a 1:3 stock split, indicating strategic growth moves. The company reported strong Q1 2025 earnings with US$346.41 million in sales, up from US$175.07 million the previous year, and turned profitable with a net income of US$15.12 million. Insider activity shows more buying than selling recently, although not in large volumes. Revenue is forecasted to grow at 23% annually, outpacing the Canadian market significantly.

- Click here and access our complete growth analysis report to understand the dynamics of Allied Gold.

- In light of our recent valuation report, it seems possible that Allied Gold is trading behind its estimated value.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colliers International Group Inc. is a global provider of commercial real estate services to corporate and institutional clients across various regions, with a market cap of CA$10.52 billion.

Operations: The company's revenue segments consist of Engineering at $1.55 billion, Real Estate Services at $3.10 billion, and Investment Management at $516.36 million.

Insider Ownership: 14.1%

Earnings Growth Forecast: 40.3% p.a.

Colliers International Group has seen substantial insider activity, although recent months recorded significant selling. Despite a decline in profit margins and net income, the company raised its 2025 earnings guidance due to acquisitions like RoundShield. Earnings are forecasted to grow significantly faster than the Canadian market, driven by strategic expansions such as launching Harrison Street Private Wealth. However, revenue growth is projected at a modest pace compared to earnings growth expectations.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility Colliers International Group's shares may be trading at a premium.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of CA$1.35 billion.

Operations: The company generates revenue of $492.16 million from providing lending-related services to borrowers, banks, and other institutions.

Insider Ownership: 36.3%

Earnings Growth Forecast: 31.1% p.a.

Propel Holdings demonstrates robust growth potential, with earnings and revenue forecasted to significantly outpace the Canadian market. Despite recent insider selling, substantial buying has also occurred over the past three months. The company reported strong first-quarter results, with a notable increase in both revenue and net income. However, its debt coverage by operating cash flow is inadequate. Analysts expect a 25.9% stock price rise, although dividends remain poorly covered by free cash flows despite an increased payout.

- Unlock comprehensive insights into our analysis of Propel Holdings stock in this growth report.

- Our expertly prepared valuation report Propel Holdings implies its share price may be lower than expected.

Make It Happen

- Investigate our full lineup of 46 Fast Growing TSX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Community Narratives