- Canada

- /

- Real Estate

- /

- TSX:CIGI

Is Philip Gardner’s Appointment as Chief Transformation Officer Altering the Investment Case for Colliers (TSX:CIGI)?

Reviewed by Simply Wall St

- Earlier this week, Colliers International Group announced the appointment of Philip Gardner as its first chief transformation and growth officer, a newly created role under UK CEO John Munday.

- This leadership addition underscores Colliers’ drive to accelerate business modernization, digital innovation, and the integration of ESG principles across global operations.

- We’ll examine how Gardner’s focus on digital transformation and sustainable expansion could influence Colliers’ investment narrative and long-term outlook.

Colliers International Group Investment Narrative Recap

Shareholders in Colliers International Group are typically aligned with a belief in secular growth via expansion in commercial real estate and recurring revenues across global engineering and capital markets platforms. The arrival of Philip Gardner as Chief Transformation and Growth Officer may support Colliers’ drive for digital transformation and ESG integration, but these changes do not materially shift the company’s biggest short term catalysts, such as a rebound in capital markets activity, or the key ongoing risk from currency headwinds and macroeconomic uncertainty, which remain central to the investment case.

Among recent company developments, the launch of a share repurchase program for up to 4,300,000 shares stands out as an action with potential to support earnings per share and signal confidence in Colliers’ intrinsic value. In context, buybacks may amplify any positive impacts from efficiency and modernization efforts, though success will also depend on Colliers’ ability to manage margin pressures in segments facing integration risks.

However, investors should be aware of the potential revenue and earnings impacts if prevailing exchange rates...

Read the full narrative on Colliers International Group (it's free!)

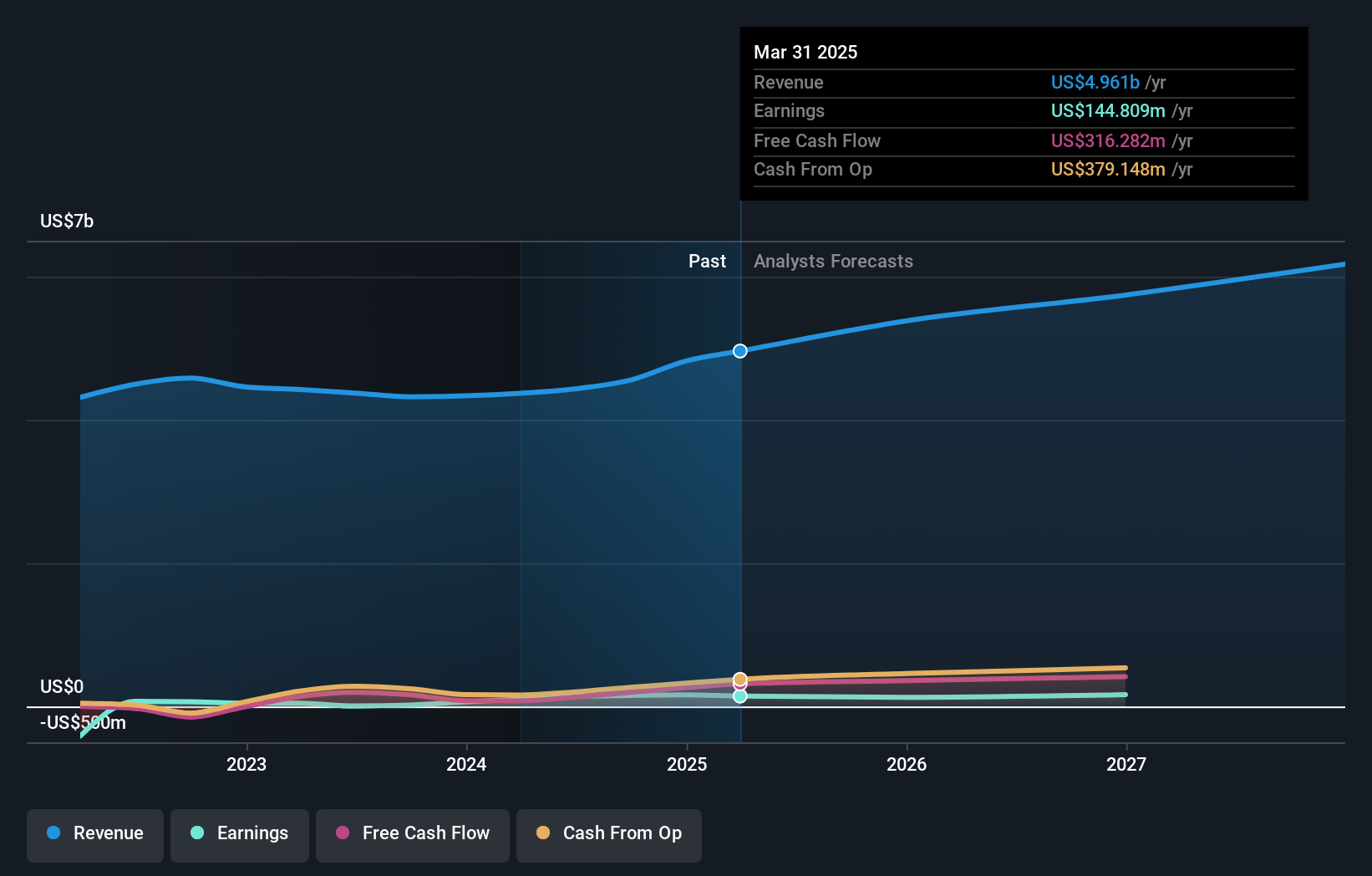

Colliers International Group's narrative projects $6.1 billion revenue and $207.0 million earnings by 2028. This requires 8.4% yearly revenue growth and an increase of $45.3 million in earnings from $161.7 million.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Colliers land between C$207.92 and C$248.06. While individual outlooks vary, Colliers continues to face risk from foreign exchange rates that could affect reported results in coming quarters.

Build Your Own Colliers International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Colliers International Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Colliers International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Colliers International Group's overall financial health at a glance.

No Opportunity In Colliers International Group?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives