- Canada

- /

- Metals and Mining

- /

- TSXV:EML

Top TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has been experiencing a dynamic period, with investors closely monitoring economic trends and portfolio strategies to align with their long-term financial goals. For those interested in smaller or newer companies, penny stocks—despite the term's somewhat outdated connotation—remain relevant as an investment area offering potential value. This article will explore several penny stocks that stand out for their financial strength, making them intriguing options for investors seeking promising opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.54 | CA$13.61M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.24 | CA$115M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$33.04M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.86 | CA$3.11B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.92 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Electric Metals (USA) (TSXV:EML)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Electric Metals (USA) Limited focuses on the acquisition, exploration, and development of mineral properties in the United States, Canada, and Australia with a market cap of CA$8.68 million.

Operations: Electric Metals (USA) Limited has not reported any revenue segments.

Market Cap: CA$8.68M

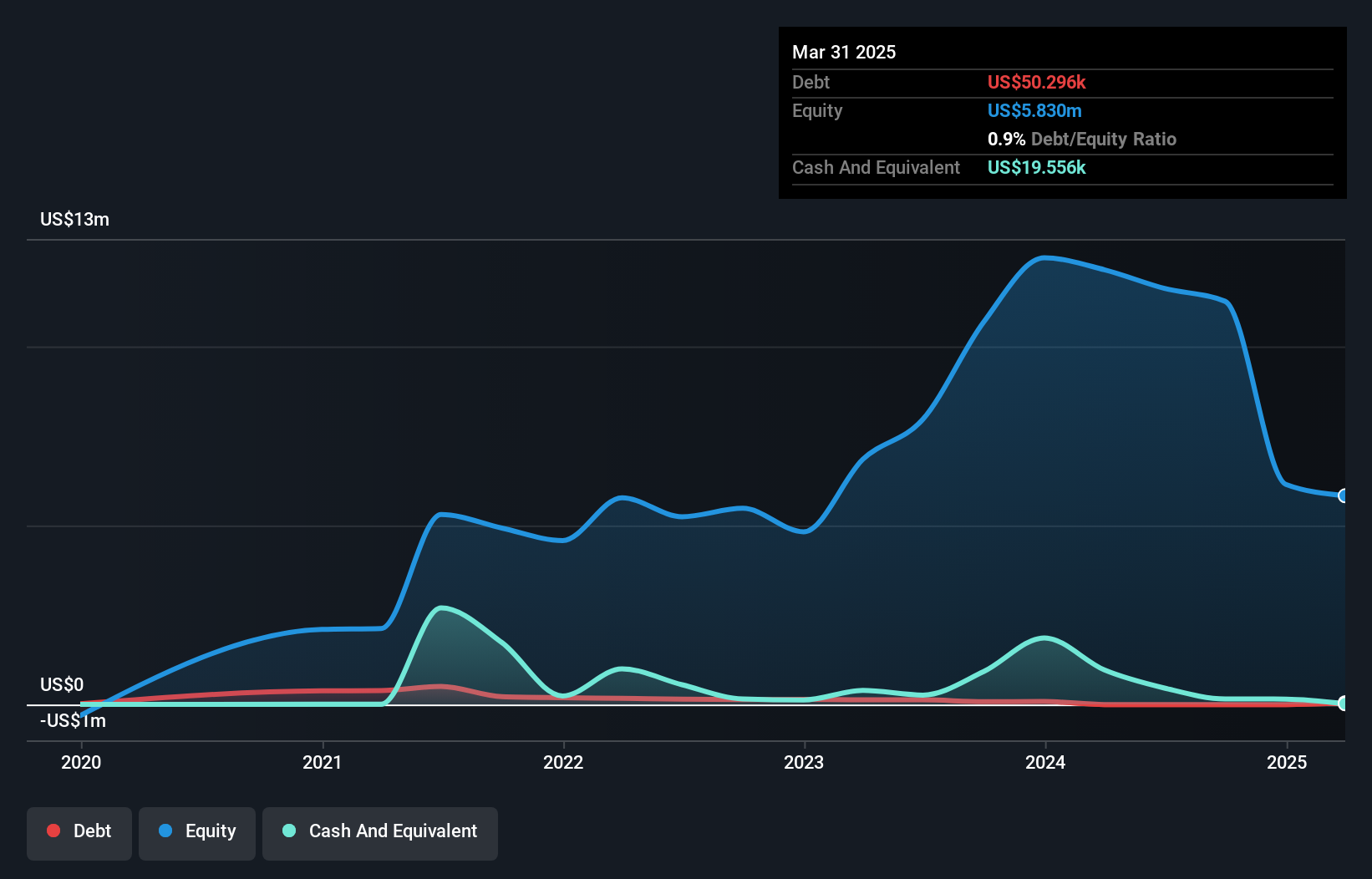

Electric Metals (USA) Limited, with a market cap of CA$8.68 million, is pre-revenue and focuses on mineral property development. Despite being debt-free, the company faces challenges such as high stock volatility and short-term liabilities exceeding assets. Recent metallurgical testing at the Emily manganese deposit showed promising results for producing high-purity manganese sulfate monohydrate (HPMSM), crucial for lithium-ion batteries, potentially positioning Electric Metals in the growing battery materials market. However, its board's inexperience and limited cash runway highlight risks that investors should consider alongside these developments.

- Get an in-depth perspective on Electric Metals (USA)'s performance by reading our balance sheet health report here.

- Learn about Electric Metals (USA)'s historical performance here.

Stuhini Exploration (TSXV:STU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stuhini Exploration Ltd. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$5.58 million.

Operations: There are no reported revenue segments for this mineral exploration company focused on properties in Canada and the United States.

Market Cap: CA$5.58M

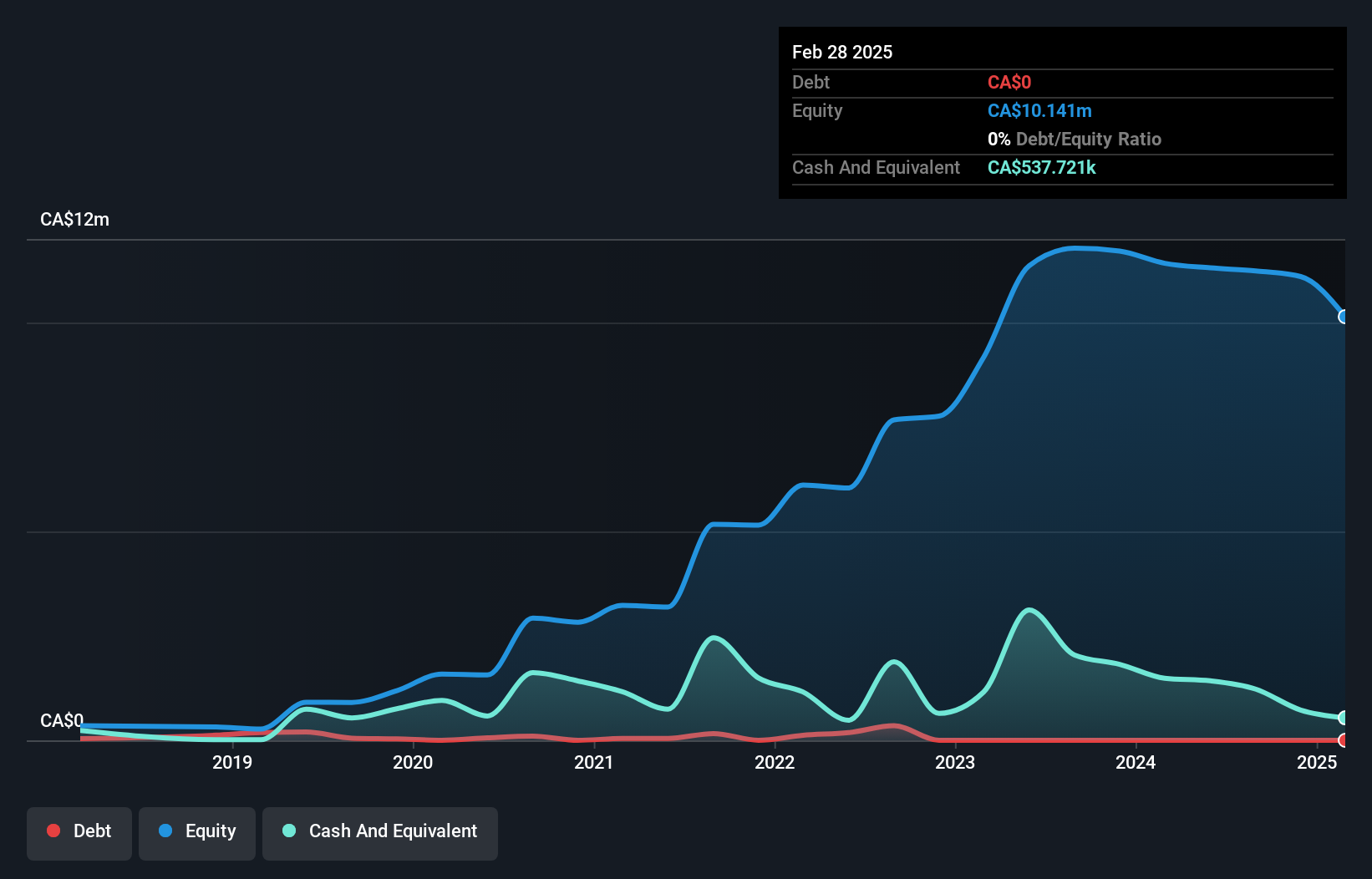

Stuhini Exploration Ltd., with a market cap of CA$5.58 million, is pre-revenue and focused on mineral exploration projects in Canada and the U.S. The company remains debt-free, boasting an experienced management team with over seven years of average tenure. Despite its high stock volatility compared to most Canadian stocks, Stuhini's recent strategic expansions in Nevada—acquiring interests in the Jersey Valley and Red Hills properties—demonstrate potential growth opportunities. These projects are located in geologically favorable settings with historical indications of mineralization, although past exploration data is limited and profitability challenges persist.

- Take a closer look at Stuhini Exploration's potential here in our financial health report.

- Explore historical data to track Stuhini Exploration's performance over time in our past results report.

Voyageur Pharmaceuticals (TSXV:VM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Voyageur Pharmaceuticals Ltd. focuses on acquiring, exploring, and developing raw materials for pharmaceutical products in British Columbia, Canada, and Utah, with a market cap of CA$9.76 million.

Operations: Voyageur Pharmaceuticals Ltd. has not reported any specific revenue segments.

Market Cap: CA$9.76M

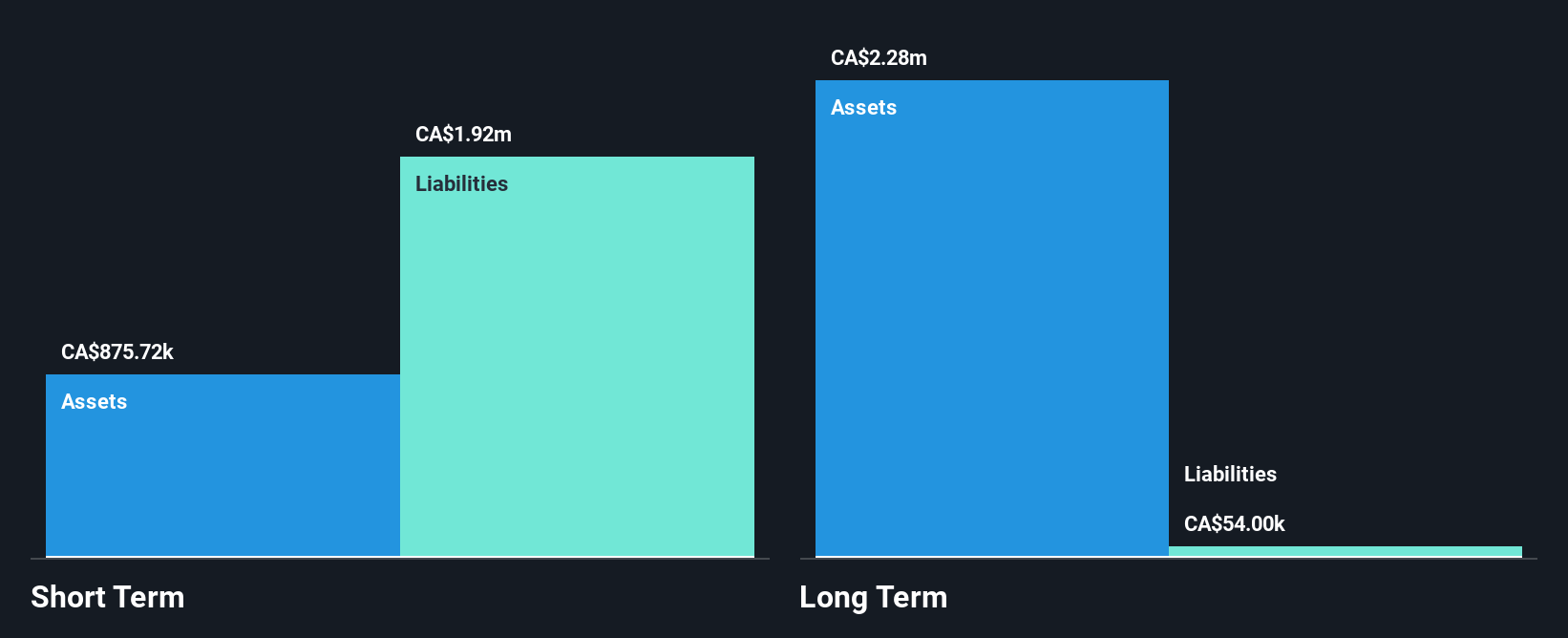

Voyageur Pharmaceuticals Ltd., with a market cap of CA$9.76 million, is pre-revenue and focuses on developing raw materials for pharmaceuticals. The company has experienced management but faces challenges with high share price volatility and recent shareholder dilution. Its financial position shows short-term liabilities exceeding assets, though long-term liabilities are covered. Recent earnings reports indicate increasing net losses, while a private placement aims to raise up to CA$1 million for future growth initiatives. The appointment of Dr. Iryna Saranchova as Chief Science Officer highlights the company's commitment to advancing its scientific research capabilities in pharmaceutical development.

- Navigate through the intricacies of Voyageur Pharmaceuticals with our comprehensive balance sheet health report here.

- Understand Voyageur Pharmaceuticals' track record by examining our performance history report.

Summing It All Up

- Reveal the 935 hidden gems among our TSX Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Metals (USA) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EML

Electric Metals (USA)

Engages in the acquisition, exploration, and development of mineral properties in the United States, Canada, and Australia.

Excellent balance sheet slight.