The Canadian market is navigating a period of economic uncertainty, with the Bank of Canada cutting rates in response to potential U.S. tariffs and a recent contraction in GDP. Amid these conditions, investors may find opportunities in penny stocks—an investment area that, while historically associated with riskier ventures, can spotlight smaller companies offering substantial value. By identifying those with strong financials and clear growth potential, investors can uncover promising opportunities within this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$184.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.74 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$440.43M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$122.01M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$619.87M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$15.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.97 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Irving Resources Inc. is a junior exploration stage company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$19.94 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$19.94M

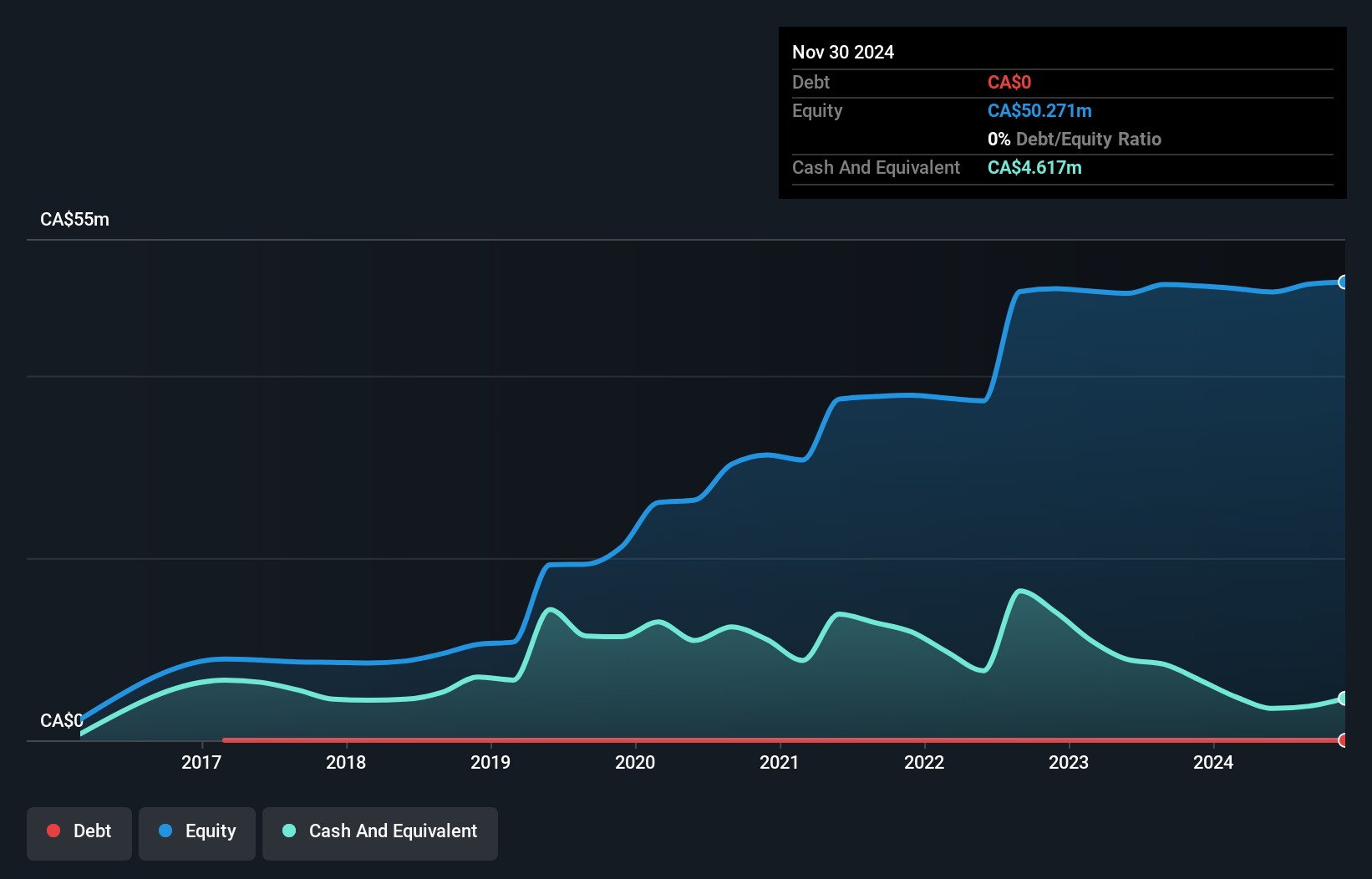

Irving Resources, with a market cap of CA$19.94 million, is a pre-revenue junior exploration company focusing on mineral properties in Canada and Japan. Recent developments include drilling activities at the Omu gold project in Japan, where promising quartz veining was encountered. The company's financials show improved net income for the recent quarter compared to losses previously reported. Despite its unprofitability and high volatility, Irving's debt-free status and sufficient short-term assets provide some financial stability. The experienced management team adds credibility as they continue exploring potential gold-bearing sites through strategic partnerships and joint ventures.

- Navigate through the intricacies of Irving Resources with our comprehensive balance sheet health report here.

- Assess Irving Resources' previous results with our detailed historical performance reports.

Next Hydrogen Solutions (TSXV:NXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next Hydrogen Solutions Inc. develops and produces water electrolyzers designed to integrate with intermittent renewable energy, with a market cap of CA$13.51 million.

Operations: The company generates revenue of CA$2.06 million from the development and sale of electrolyzers and balance of plant equipment.

Market Cap: CA$13.51M

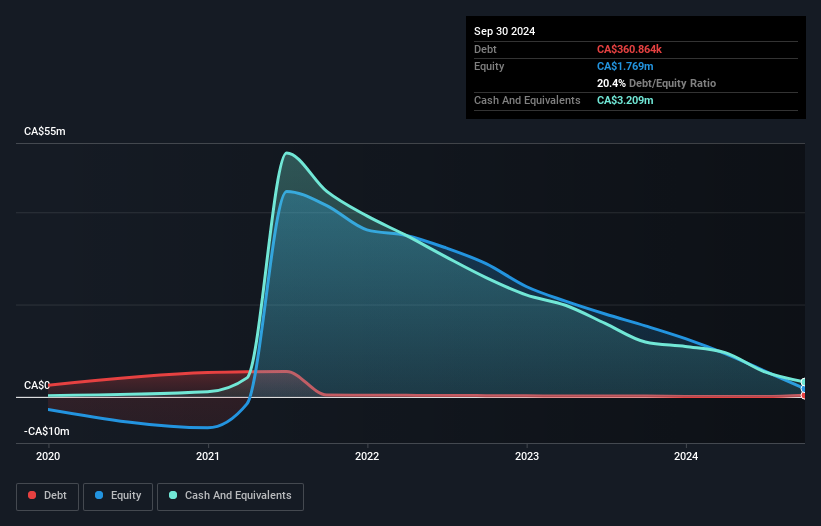

Next Hydrogen Solutions, with a market cap of CA$13.51 million, is currently unprofitable and generates limited revenue of CA$2.06 million from its electrolyzer business. The company's short-term assets cover its short-term liabilities but fall short against long-term obligations. Recent financial results indicate increasing losses, with a net loss of CA$3.92 million for the latest quarter compared to the previous year. The company recently raised capital through private placements to bolster its cash runway, which remains limited despite having more cash than debt. Management changes and ongoing development in hydrogen technology projects mark recent strategic moves amidst high share price volatility.

- Click here to discover the nuances of Next Hydrogen Solutions with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Next Hydrogen Solutions' track record.

Rubicon Organics (TSXV:ROMJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rubicon Organics Inc. is involved in the production, processing, and sale of organic cannabis for recreational and medical use in Canada, with a market cap of CA$19.78 million.

Operations: The company generates revenue of CA$44.49 million from its cannabis production and sales operations.

Market Cap: CA$19.78M

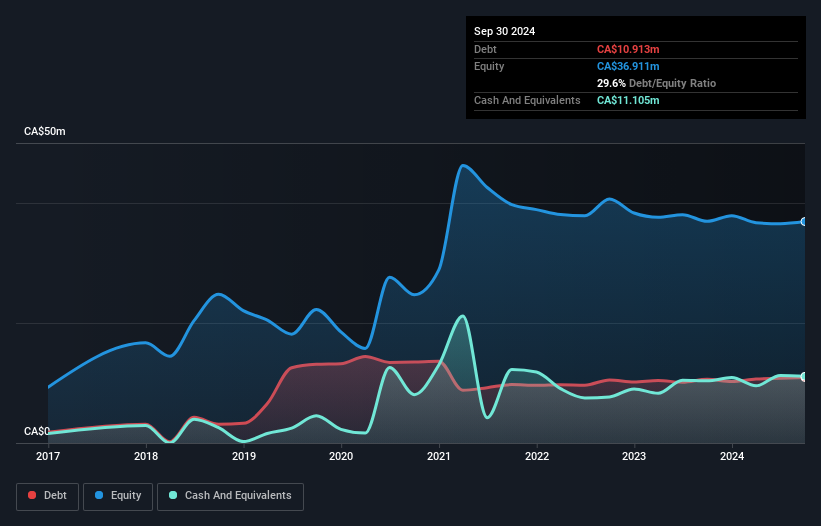

Rubicon Organics, with a market cap of CA$19.78 million, is unprofitable but has seen revenue growth to CA$44.49 million from its cannabis operations. The company has reduced its debt-to-equity ratio significantly over the past five years and maintains more cash than total debt, ensuring a stable financial position despite high share price volatility. Recent strategic moves include securing CA$10 million in credit facilities to refinance existing debt and promoting Melanie Ramsey to COO, reflecting a focus on operational efficiency and scalability. While Rubicon is not forecasted to achieve profitability soon, it holds sufficient cash runway for over three years.

- Jump into the full analysis health report here for a deeper understanding of Rubicon Organics.

- Evaluate Rubicon Organics' prospects by accessing our earnings growth report.

Seize The Opportunity

- Get an in-depth perspective on all 933 TSX Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rubicon Organics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ROMJ

Rubicon Organics

Engages in the production, processing, and sale of organic cannabis for the recreational and medical-use markets in Canada and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives