Can You Imagine How Elated High Tide's (CVE:HITI) Shareholders Feel About Its 315% Share Price Gain?

While High Tide Inc. (CVE:HITI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 22% in the last quarter. But over the last year the share price has taken off like one of Elon Musk's rockets. Indeed, the share price is up a whopping 315% in that time. So it is not that surprising to see the stock retrace a little. The real question is whether the fundamental business performance can justify the strong increase over the long term.

See our latest analysis for High Tide

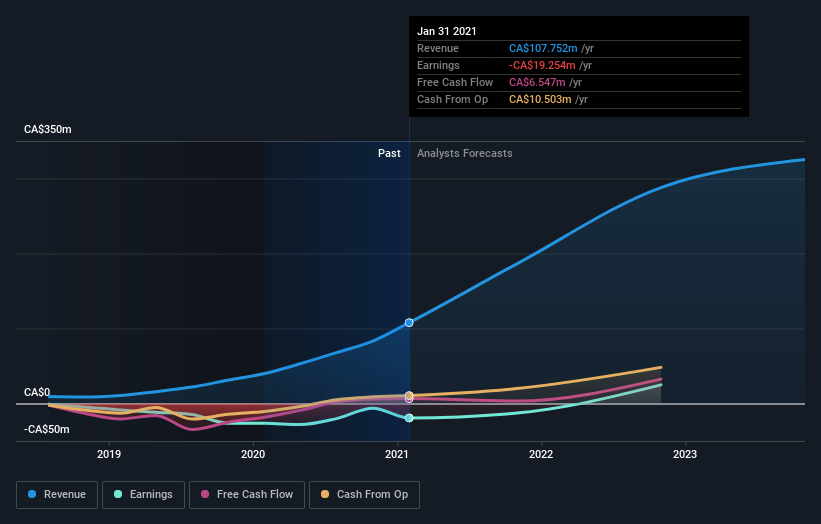

Because High Tide made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, High Tide's revenue grew by 168%. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 315% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think High Tide will earn in the future (free profit forecasts).

A Different Perspective

High Tide boasts a total shareholder return of 315% for the last year. We regret to report that the share price is down 22% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand High Tide better, we need to consider many other factors. Even so, be aware that High Tide is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if High Tide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:HITI

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026