- Canada

- /

- Healthcare Services

- /

- TSXV:EBM

The Eastwood Bio-Medical Canada (CVE:EBM) Share Price Is Up 1892% And Shareholders Are Euphoric

For us, stock picking is in large part the hunt for the truly magnificent stocks. But when you hold the right stock for the right time period, the rewards can be truly huge. Take, for example, the Eastwood Bio-Medical Canada Inc. (CVE:EBM) share price, which skyrocketed 1892% over three years. It's also good to see the share price up 79% over the last quarter.

It really delights us to see such great share price performance for investors.

View 4 warning signs we detected for Eastwood Bio-Medical Canada

Because Eastwood Bio-Medical Canada made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Eastwood Bio-Medical Canada saw its revenue grow at 42% per year. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 171% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Eastwood Bio-Medical Canada can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

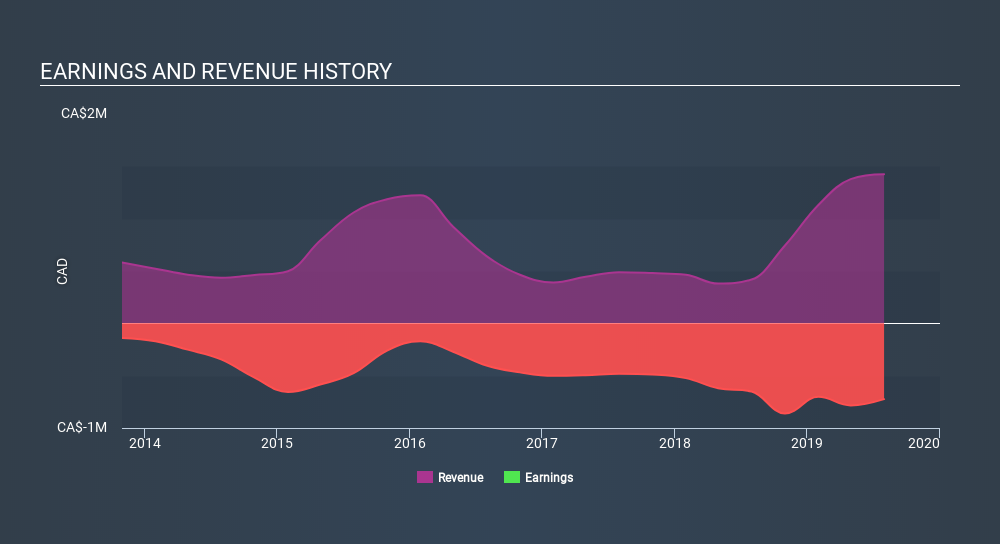

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Fundamentally, investors are buying a company's future earnings, but the stability of the business can influence the price they're willing to pay. For example, we've discovered 4 warning signs for Eastwood Bio-Medical Canada (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

The last twelve months weren't great for Eastwood Bio-Medical Canada shares, which cost holders 54%, while the market was up about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 171% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before spending more time on Eastwood Bio-Medical Canada it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:EBM

Eastwood Bio-Medical Canada

Eastwood Bio-Medical Canada Inc. markets and distributes natural health products under the Eleotin brand in Canada, the United States, and Asia.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026