Market Might Still Lack Some Conviction On Valeo Pharma Inc. (TSE:VPH) Even After 55% Share Price Boost

Those holding Valeo Pharma Inc. (TSE:VPH) shares would be relieved that the share price has rebounded 55% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

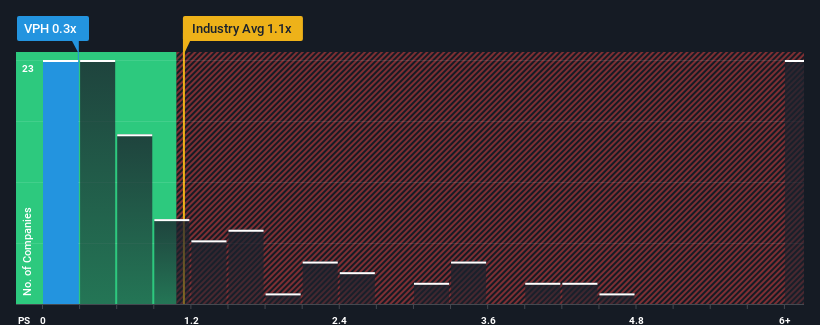

Even after such a large jump in price, considering around half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Valeo Pharma as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Valeo Pharma

How Has Valeo Pharma Performed Recently?

With revenue growth that's superior to most other companies of late, Valeo Pharma has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Valeo Pharma.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Valeo Pharma's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 48% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.6%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Valeo Pharma's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Valeo Pharma's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Valeo Pharma's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 6 warning signs for Valeo Pharma (3 make us uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VPH

Valeo Pharma

A specialty pharmaceutical company, engages in the acquisition, in-licensing brands, and sale of pharmaceuticals and hospital specialty products for unmet medical needs in Canada.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives