- Canada

- /

- Metals and Mining

- /

- TSXV:RDS

Oncolytics Biotech And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

With the Canadian economy experiencing a contraction in November and a recent interest rate cut by the Bank of Canada due to tariff uncertainties, investors are navigating a complex landscape. In such times, penny stocks—often smaller or newer companies—can offer intriguing opportunities for those looking beyond established names. While the term "penny stocks" may seem outdated, these investments continue to hold potential for growth and value, especially when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$180.96M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.73 | CA$1.03B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.38 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.9M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.14 | CA$226.29M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Oncolytics Biotech (TSX:ONC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oncolytics Biotech Inc. is a clinical-stage biopharmaceutical company dedicated to discovering and developing pharmaceutical products for cancer treatment, with a market cap of CA$80.93 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company focused on cancer treatment.

Market Cap: CA$80.93M

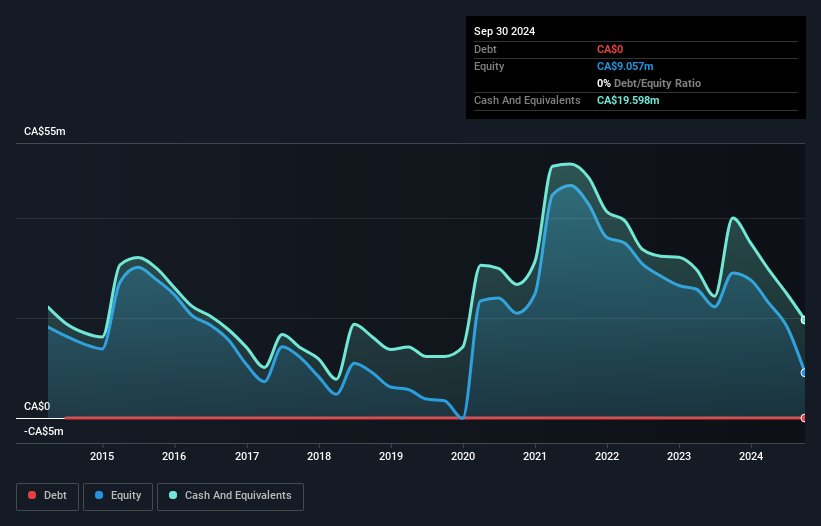

Oncolytics Biotech Inc., with a market cap of CA$80.93 million, is a pre-revenue clinical-stage biopharmaceutical company focused on cancer treatment. Despite being unprofitable and having less than a year of cash runway, its financial position shows short-term assets exceeding both short- and long-term liabilities. Recent developments include positive safety reviews for the GOBLET study's Cohort 5, evaluating pelareorep in combination with other treatments for pancreatic cancer, which has received regulatory approval from Germany's PEI to continue enrollment. The company's board and management are considered experienced, contributing to its strategic direction amidst ongoing research efforts.

- Dive into the specifics of Oncolytics Biotech here with our thorough balance sheet health report.

- Gain insights into Oncolytics Biotech's outlook and expected performance with our report on the company's earnings estimates.

Nickel 28 Capital (TSXV:NKL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nickel 28 Capital Corp. is a base metals company with a market capitalization of CA$71.16 million.

Operations: Nickel 28 Capital Corp. does not have any reported revenue segments.

Market Cap: CA$71.16M

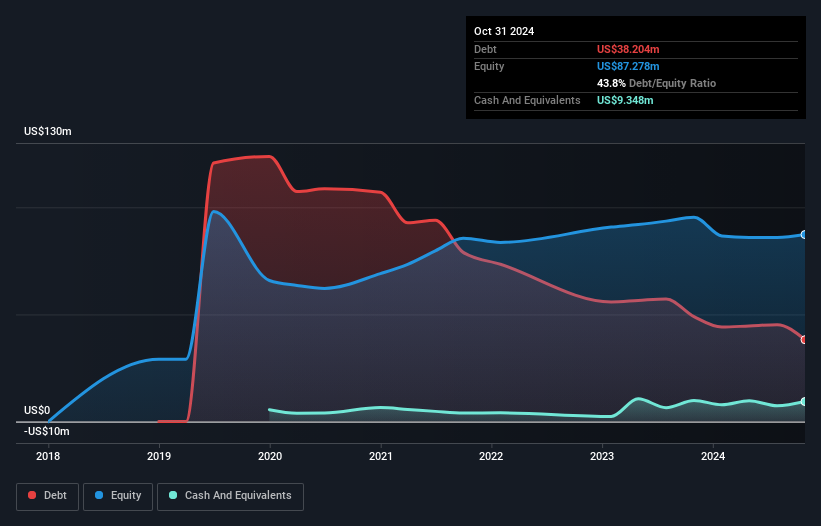

Nickel 28 Capital Corp., with a market cap of CA$71.16 million, operates as a pre-revenue base metals entity. The company has shown financial improvement by reducing its debt to equity ratio from 160.4% to 43.8% over five years, though it remains unprofitable with increasing losses at an annual rate of 14%. Recent executive changes include Craig Lennon stepping in as CEO and Cindy Davis assuming the CFO role, potentially stabilizing leadership amid ongoing legal challenges involving former President Justin Cochrane's lawsuit for wrongful dismissal and damages exceeding US$30 million. Despite these hurdles, Nickel 28 maintains a satisfactory net debt to equity ratio of 33.1%.

- Unlock comprehensive insights into our analysis of Nickel 28 Capital stock in this financial health report.

- Gain insights into Nickel 28 Capital's historical outcomes by reviewing our past performance report.

Radisson Mining Resources (TSXV:RDS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Radisson Mining Resources Inc. is a gold exploration company focused on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$124.23 million.

Operations: Radisson Mining Resources Inc. does not report any revenue segments as it is primarily engaged in the exploration and development of mining properties in Canada.

Market Cap: CA$124.23M

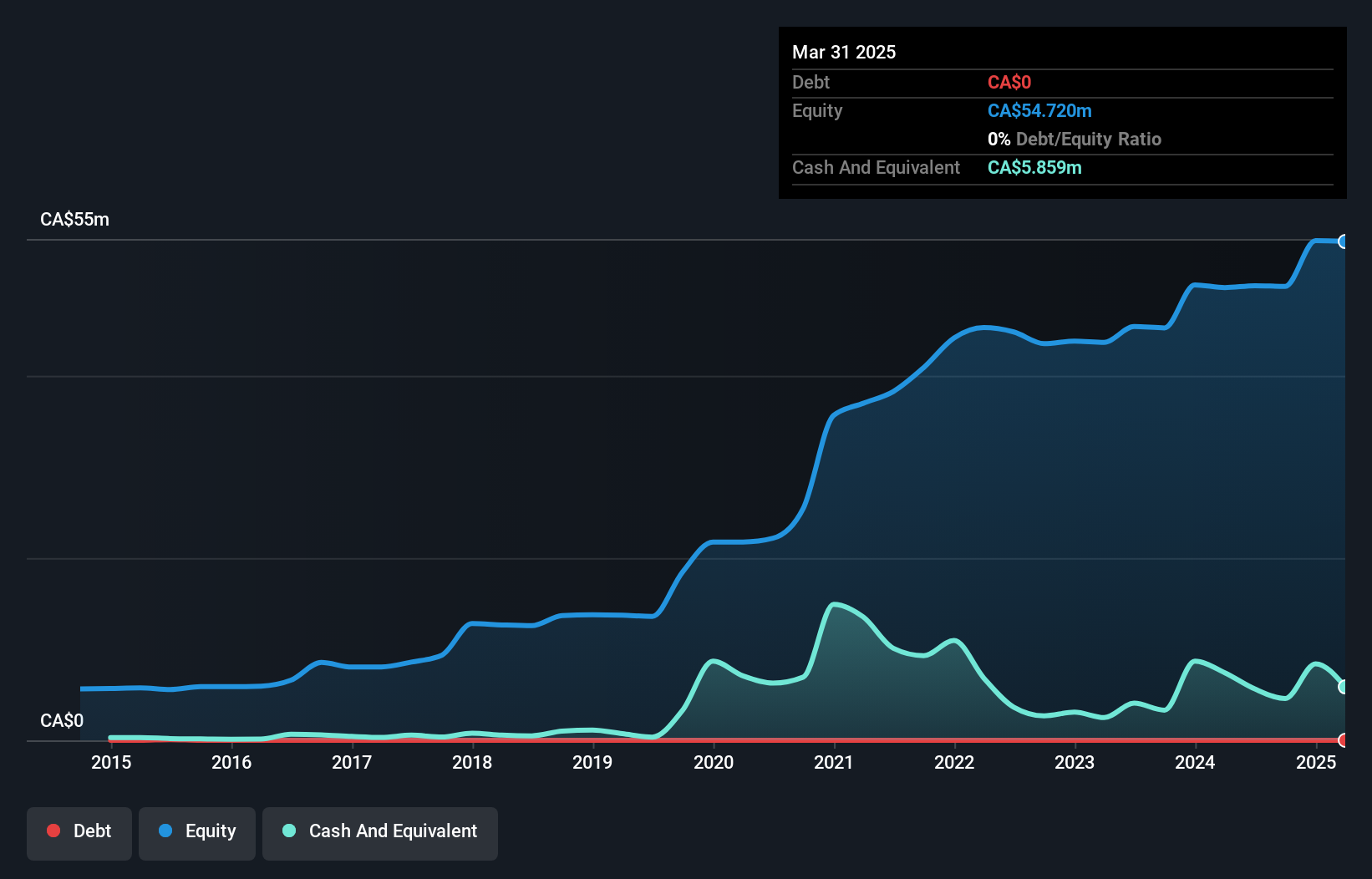

Radisson Mining Resources Inc., with a market cap of CA$124.23 million, is a pre-revenue gold exploration company focused on its O'Brien Gold Project in Quebec. Recent drill results, including an impressive 242.0 g/t Au over 1 metre from the deepest hole drilled at the project, highlight significant high-grade mineralization potential below existing resource estimates. While debt-free and having sufficient short-term assets to cover liabilities, Radisson faces challenges with unprofitability and a volatile share price. The management team and board are relatively inexperienced, which could impact strategic execution as they continue exploration efforts to delineate additional resources.

- Click to explore a detailed breakdown of our findings in Radisson Mining Resources' financial health report.

- Review our historical performance report to gain insights into Radisson Mining Resources' track record.

Turning Ideas Into Actions

- Jump into our full catalog of 934 TSX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RDS

Radisson Mining Resources

A gold exploration company, engages in the acquisition, exploration, and development of mining properties in Canada.

Excellent balance sheet slight.

Market Insights

Community Narratives