These 4 Measures Indicate That Nuvo Pharmaceuticals (TSE:MRV) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Nuvo Pharmaceuticals Inc. (TSE:MRV) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Nuvo Pharmaceuticals

How Much Debt Does Nuvo Pharmaceuticals Carry?

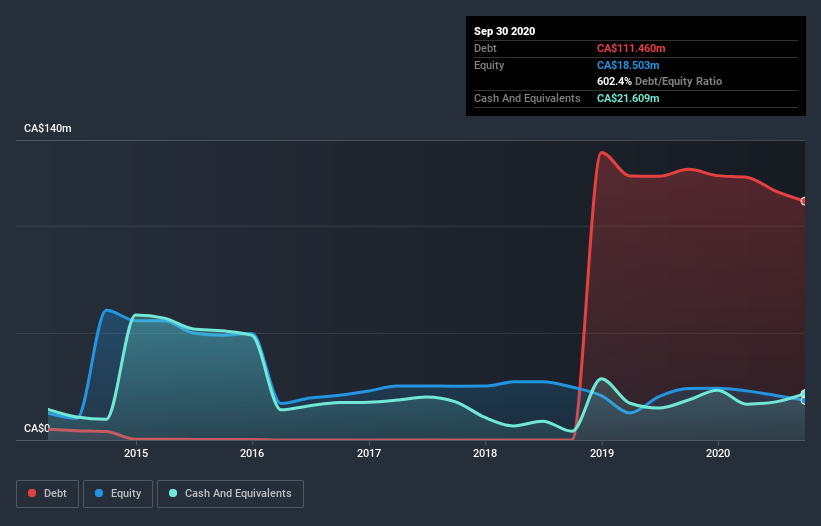

As you can see below, Nuvo Pharmaceuticals had CA$111.5m of debt at September 2020, down from CA$126.3m a year prior. However, it also had CA$21.6m in cash, and so its net debt is CA$89.9m.

A Look At Nuvo Pharmaceuticals' Liabilities

Zooming in on the latest balance sheet data, we can see that Nuvo Pharmaceuticals had liabilities of CA$15.0m due within 12 months and liabilities of CA$122.6m due beyond that. Offsetting this, it had CA$21.6m in cash and CA$10.3m in receivables that were due within 12 months. So it has liabilities totalling CA$105.8m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CA$22.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Nuvo Pharmaceuticals would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Nuvo Pharmaceuticals's net debt to EBITDA ratio of 2.6, we think its super-low interest cover of 2.1 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Pleasingly, Nuvo Pharmaceuticals is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 209% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Nuvo Pharmaceuticals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last two years, Nuvo Pharmaceuticals's free cash flow amounted to 40% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, Nuvo Pharmaceuticals's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Nuvo Pharmaceuticals has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Nuvo Pharmaceuticals (including 2 which are a bit concerning) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Nuvo Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nuvo Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MRV

Nuvo Pharmaceuticals

Nuvo Pharmaceuticals Inc., doing business as Miravo Healthcare, provides prescription and non-prescription products for pain, allergy, neurology, and dermatology worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives