Revenues Working Against Medexus Pharmaceuticals Inc.'s (TSE:MDP) Share Price Following 26% Dive

The Medexus Pharmaceuticals Inc. (TSE:MDP) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 2.8% during the last year.

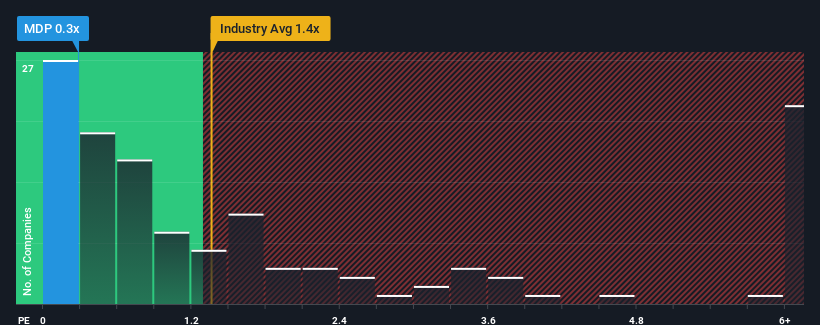

Following the heavy fall in price, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Medexus Pharmaceuticals as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Medexus Pharmaceuticals

What Does Medexus Pharmaceuticals' Recent Performance Look Like?

Recent times have been advantageous for Medexus Pharmaceuticals as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Medexus Pharmaceuticals.Is There Any Revenue Growth Forecasted For Medexus Pharmaceuticals?

Medexus Pharmaceuticals' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.8% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.2% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Medexus Pharmaceuticals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Medexus Pharmaceuticals' P/S

The southerly movements of Medexus Pharmaceuticals' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Medexus Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 4 warning signs we've spotted with Medexus Pharmaceuticals (including 1 which is a bit unpleasant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MDP

Medexus Pharmaceuticals

Operates as a pharmaceutical company in Canada and the United States.

Medium-low and undervalued.

Market Insights

Community Narratives