After Leaping 31% Medexus Pharmaceuticals Inc. (TSE:MDP) Shares Are Not Flying Under The Radar

Medexus Pharmaceuticals Inc. (TSE:MDP) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 90%.

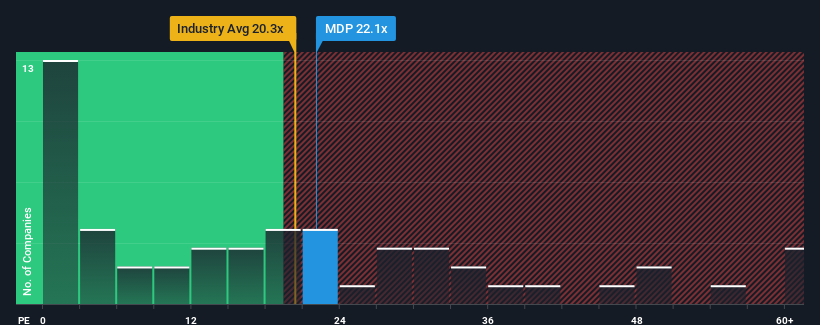

Since its price has surged higher, Medexus Pharmaceuticals' price-to-earnings (or "P/E") ratio of 22.1x might make it look like a sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Medexus Pharmaceuticals could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Medexus Pharmaceuticals

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Medexus Pharmaceuticals' is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 61%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 80% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 8.4% each year, which is noticeably less attractive.

In light of this, it's understandable that Medexus Pharmaceuticals' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Medexus Pharmaceuticals' P/E?

Medexus Pharmaceuticals' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Medexus Pharmaceuticals' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Medexus Pharmaceuticals (at least 1 which is potentially serious), and understanding these should be part of your investment process.

You might be able to find a better investment than Medexus Pharmaceuticals. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MDP

Medexus Pharmaceuticals

Operates as a pharmaceutical company in Canada and the United States.

Undervalued moderate.

Market Insights

Community Narratives