3 TSX Penny Stocks With Market Caps Under CA$30M To Consider

Reviewed by Simply Wall St

The Canadian market, like its U.S. counterpart, has been experiencing a notable upswing following the recent decisive election outcome in the United States, which has cleared a significant source of uncertainty for investors. Amid this backdrop of shifting political landscapes and economic fundamentals, penny stocks continue to capture interest as potential investment opportunities due to their affordability and growth potential. While the term "penny stocks" may seem outdated, these investments often represent smaller or newer companies that can offer unique chances for growth when backed by strong financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.67 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.91 | CA$180.11M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.31 | CA$316.75M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$5.03M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$228.59M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.65 | CA$189.71M | ★★★★★★ |

Click here to see the full list of 961 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MediPharm Labs Corp. is a pharmaceutical company that produces and sells purified, pharmaceutical-quality cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products in Canada, Australia, Germany, and internationally with a market cap of CA$26.72 million.

Operations: The company generates CA$37.76 million in revenue from the production and sale of cannabis extracts and derivative products.

Market Cap: CA$26.72M

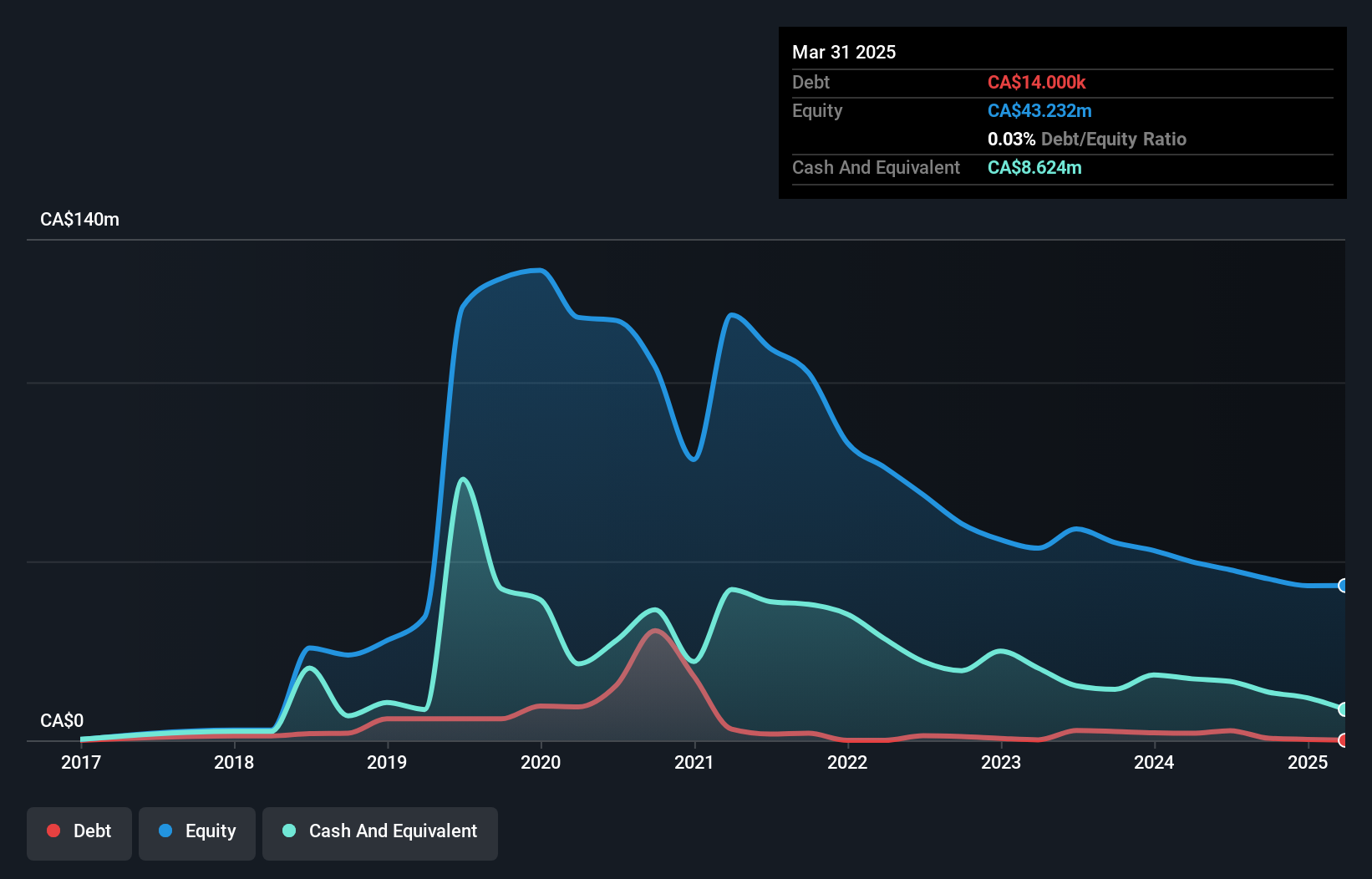

MediPharm Labs, with a market cap of CA$26.72 million, is navigating the challenges of being unprofitable but has maintained a stable cash runway for over three years based on current free cash flow. Despite negative return on equity and increased losses over the past five years, the company forecasts revenue growth at 28.85% annually. Recent leadership changes see co-founder Keith Strachan transitioning to the board while maintaining strategic influence. The company reported modest revenue increases in recent quarters and remains debt-free, offering some financial stability amid shareholder dilution concerns and ongoing profitability challenges.

- Get an in-depth perspective on MediPharm Labs' performance by reading our balance sheet health report here.

- Learn about MediPharm Labs' future growth trajectory here.

North Peak Resources (TSXV:NPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: North Peak Resources Ltd. is involved in the exploration and development of gold and silver properties, with a market cap of CA$19.13 million.

Operations: North Peak Resources Ltd. does not report any specific revenue segments as it focuses on the exploration and development of gold and silver properties.

Market Cap: CA$19.13M

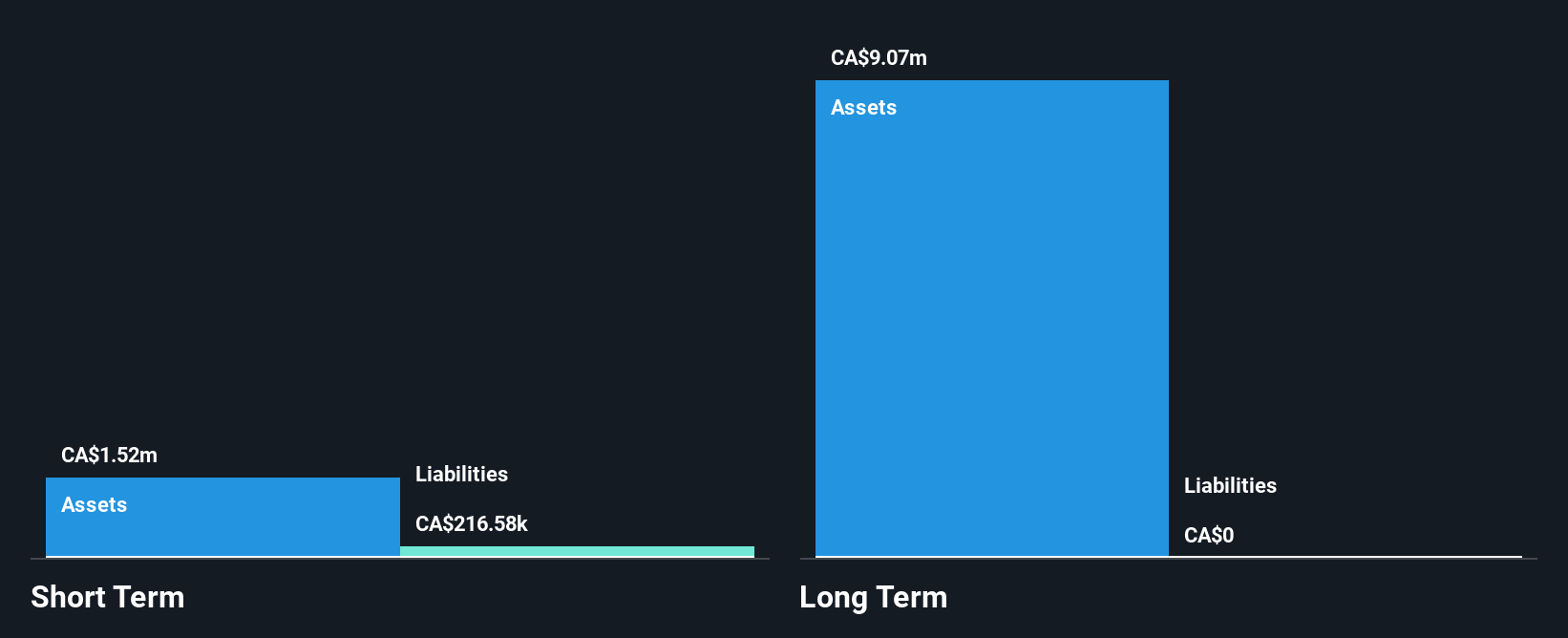

North Peak Resources, with a market cap of CA$19.13 million, is pre-revenue and focuses on gold and silver exploration. The company is debt-free, maintaining financial flexibility, and recently raised over CA$1 million through private placements to support its operations. Despite high share price volatility, North Peak has not diluted shareholders significantly over the past year. Recent drilling at its Prospect Mountain Property in Nevada revealed promising gold mineralization results, which could enhance future prospects if further exploration confirms these findings. The management team averages 2.5 years tenure, providing experienced leadership amid ongoing strategic developments.

- Dive into the specifics of North Peak Resources here with our thorough balance sheet health report.

- Gain insights into North Peak Resources' historical outcomes by reviewing our past performance report.

Wishpond Technologies (TSXV:WISH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wishpond Technologies Ltd. offers marketing-focused online business solutions across the United States, Canada, and internationally, with a market cap of CA$16.82 million.

Operations: The company generates CA$23.70 million in revenue from its Internet Software & Services segment.

Market Cap: CA$16.82M

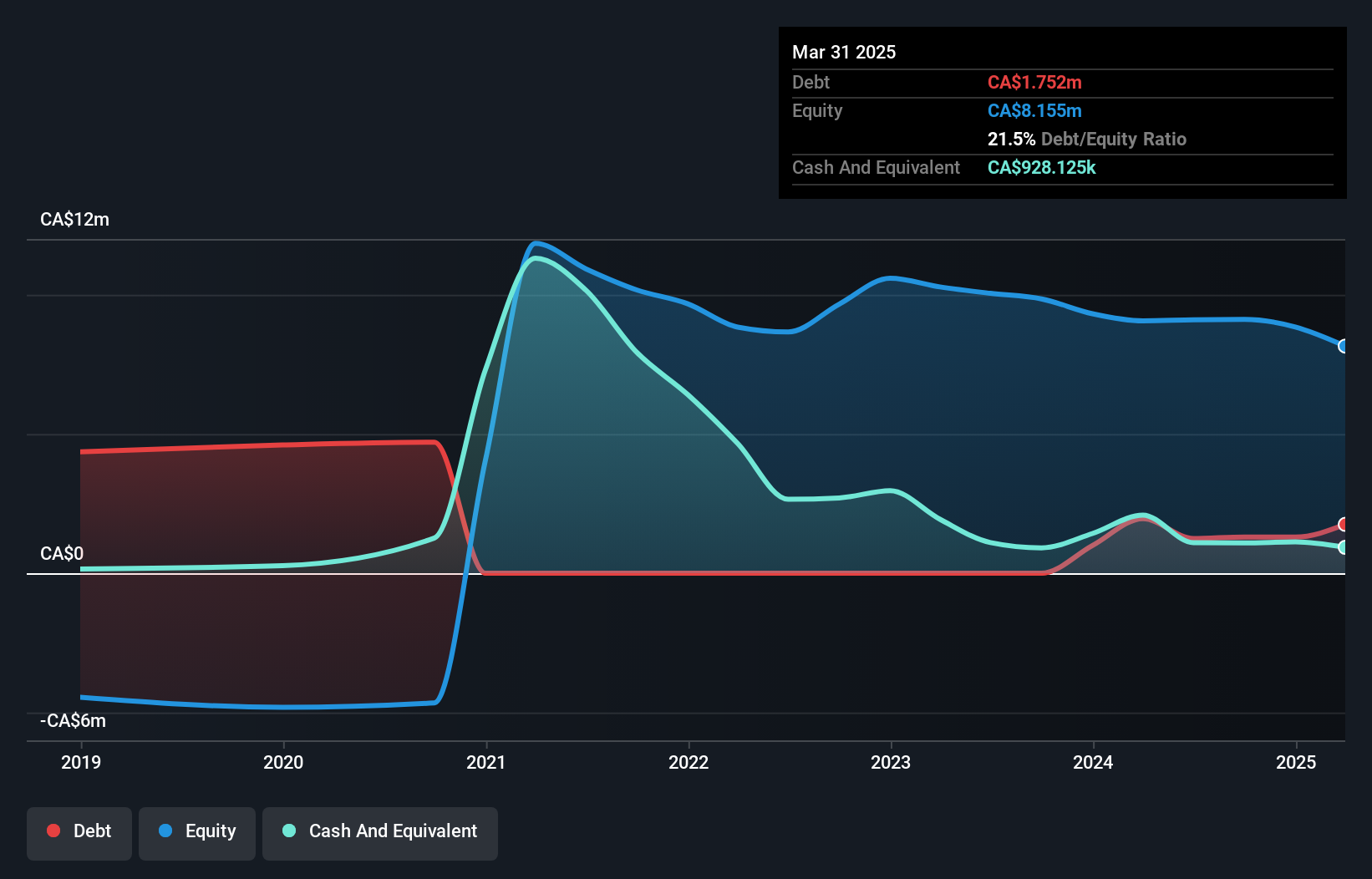

Wishpond Technologies, with a market cap of CA$16.82 million, generates CA$23.70 million in revenue and operates within the Internet Software & Services sector. Recent developments include launching an AI-powered Integrations Marketplace to enhance its SalesCloser AI tool's efficiency and sales effectiveness. While the company remains unprofitable, it has reduced losses over five years and maintains a satisfactory net debt to equity ratio of 1.6%. Despite short-term liabilities exceeding assets, Wishpond's cash runway is secure for over three years if current free cash flow levels persist, offering some financial stability amid ongoing growth initiatives.

- Click to explore a detailed breakdown of our findings in Wishpond Technologies' financial health report.

- Evaluate Wishpond Technologies' prospects by accessing our earnings growth report.

Taking Advantage

- Click through to start exploring the rest of the 958 TSX Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wishpond Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WISH

Wishpond Technologies

Provides marketing focused online business solutions in the United States, Canada, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives