HLS Therapeutics Inc. (TSE:HLS) will pay a dividend of $0.05 on the 15th of December. Including this payment, the dividend yield on the stock will be 1.5%, which is a modest boost for shareholders' returns.

See our latest analysis for HLS Therapeutics

HLS Therapeutics Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. Even though HLS Therapeutics isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share is forecast to expand by 57.0% over the next year. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

HLS Therapeutics Doesn't Have A Long Payment History

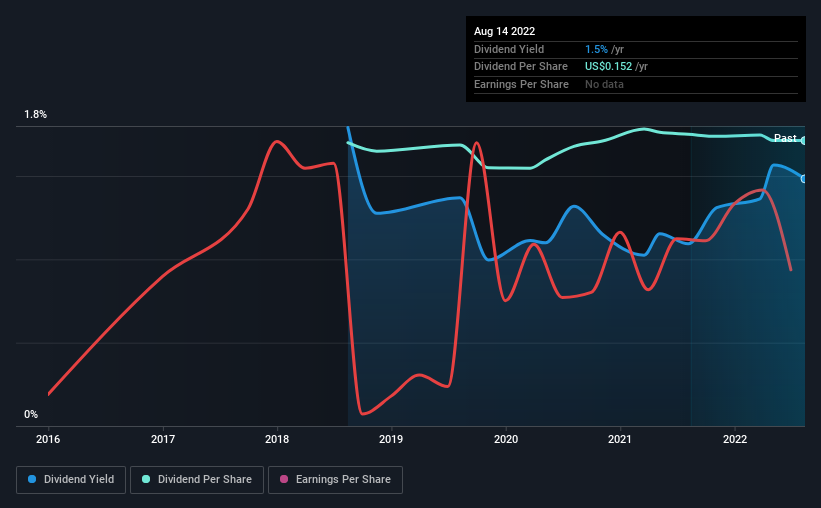

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The annual payment during the last 4 years was $0.151 in 2018, and the most recent fiscal year payment was $0.152. Dividend payments have been growing, but very slowly over the period. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. HLS Therapeutics hasn't seen much change in its earnings per share over the last five years. With no profits, we don't think HLS Therapeutics has much potential to grow the dividend in the future.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about HLS Therapeutics' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think HLS Therapeutics is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for HLS Therapeutics for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if HLS Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HLS

HLS Therapeutics

A specialty pharmaceutical company, acquires and commercializes pharmaceutical products for the treatment of psychiatric disorders, central nervous system, and cardiovascular disease in Canada, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.