Delta 9 Cannabis Inc.'s (TSE:DN) Shares Leap 122% Yet They're Still Not Telling The Full Story

Delta 9 Cannabis Inc. (TSE:DN) shareholders have had their patience rewarded with a 122% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

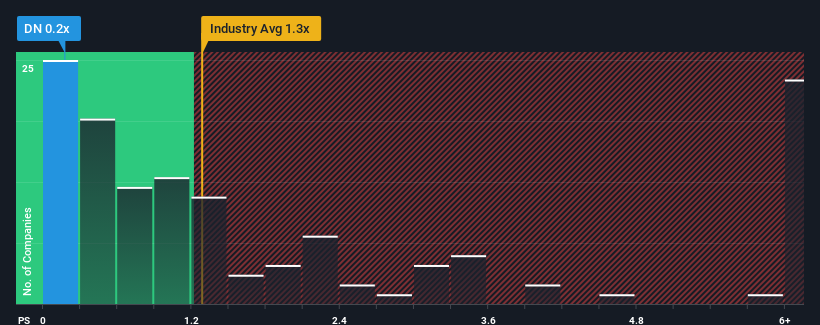

Even after such a large jump in price, Delta 9 Cannabis' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Pharmaceuticals industry in Canada, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Delta 9 Cannabis

What Does Delta 9 Cannabis' Recent Performance Look Like?

Recent times have been advantageous for Delta 9 Cannabis as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Delta 9 Cannabis' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Delta 9 Cannabis?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Delta 9 Cannabis' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 5.5% as estimated by the one analyst watching the company. With the industry predicted to deliver 5.3% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Delta 9 Cannabis' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Delta 9 Cannabis' P/S?

Delta 9 Cannabis' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Delta 9 Cannabis' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Delta 9 Cannabis you should know about.

If these risks are making you reconsider your opinion on Delta 9 Cannabis, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DN

Moderate and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026