Curaleaf Holdings (TSX:CURA) Is Up 24.0% After S&P/TSX Index Additions Amid U.S. Cannabis Policy Buzz What's Changed

Reviewed by Sasha Jovanovic

- Curaleaf Holdings was added to the S&P/TSX Composite Index, S&P/TSX Completion Index, and S&P/TSX Capped Composite Index on September 22, 2025, following a period of heightened sector activity.

- This development coincided with a major rally in cannabis stocks sparked by U.S. President Donald Trump’s endorsement of CBD for seniors and signals of possible federal policy changes.

- We’ll now examine how heightened U.S. political attention on cannabis and Curaleaf’s recent index inclusions could influence its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Curaleaf Holdings Investment Narrative Recap

To be a Curaleaf shareholder, you need conviction in the potential for favorable U.S. regulatory shifts and ongoing industry normalization to drive sustained cannabis demand, offsetting pricing pressure and steep competition. The company’s recent addition to major Canadian indices, coinciding with positive political signals from President Trump, highlights the stock’s sensitivity to regulatory momentum, but it does not directly resolve persistent margin pressures and regulatory risks that remain the primary short-term catalysts and hurdles.

Of Curaleaf's latest news, its launch of Anthem Bold, a premium, high-potency pre-roll product exclusive to key dispensaries, ties directly to the consumer adoption catalyst. This initiative aims to capture emerging trends in differentiated cannabis consumption and grow market share, but success depends on broader acceptance and effective execution while regulatory and price headwinds persist.

In contrast, investors should also watch for unresolved U.S. federal tax and regulatory risks that could unexpectedly undermine...

Read the full narrative on Curaleaf Holdings (it's free!)

Curaleaf Holdings' outlook anticipates $1.5 billion in revenue and $38.9 million in earnings by 2028. This is based on a 4.3% annual revenue growth and an increase in earnings of $305.8 million from the current level of -$266.9 million.

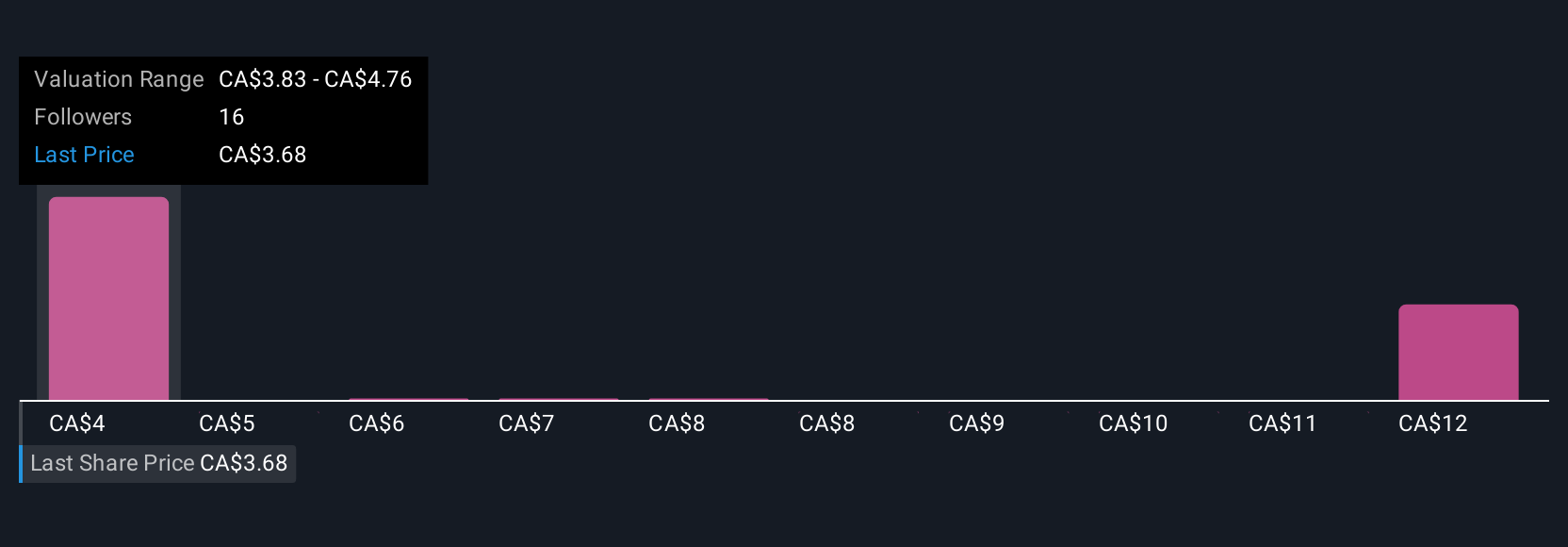

Uncover how Curaleaf Holdings' forecasts yield a CA$3.83 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates range widely, from CA$3.83 to CA$13.21 per share. While opinion is split, many are still focused on how regulatory changes could power long-term performance, making it vital to weigh different viewpoints when considering Curaleaf’s potential.

Explore 5 other fair value estimates on Curaleaf Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Curaleaf Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Curaleaf Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curaleaf Holdings' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives