Cronos Group (TSX:CRON): Assessing Value After Trump Backs Medicare CBD Coverage and Cannabis Sector Rally

Reviewed by Kshitija Bhandaru

Cronos Group (TSX:CRON) has drawn fresh attention after President Donald Trump publicly supported Medicare coverage for CBD, a first for any sitting U.S. president. The sector-wide rally reflected renewed optimism among cannabis investors.

See our latest analysis for Cronos Group.

Momentum around Cronos Group has been rebounding, supported by a sector-wide cannabis surge and the company’s addition to the S&P Global BMI Index. While short-term share price returns have been modest, the recent rally highlights renewed investor interest. The company’s long-term total shareholder returns reflect the ups and downs typical of the cannabis space, with a 1-year positive return but heavier three- and five-year declines.

If Cronos’s recent moves have you wondering what else the market is rewarding, it could be the right moment to broaden your investing radar and discover fast growing stocks with high insider ownership

But with Cronos Group showing strong revenue growth and a streak of positive momentum, investors now face a pressing question: is the stock still undervalued compared to peers, or has the market already priced in future gains?

Most Popular Narrative: 8% Undervalued

With Cronos Group’s last close at CA$3.62 and the most followed narrative estimating a fair value of CA$3.95, the gap points to cautiously optimistic upside if the company delivers on its ambitious expansion playbook.

“Expanded access to high-growth international medical cannabis markets, such as Israel, Germany, and Switzerland, positions Cronos to benefit from ongoing regulatory reforms and rising global acceptance of cannabinoid-based wellness products, boosting both top-line revenue and long-term market diversification.”

How bold are the expectations baked into this price target? The full narrative reveals the future earnings and margin leaps that set this high watermark. Curious which assumptions make the math work? Dive deeper to discover which forward-looking projections justify Cronos Group’s current valuation runway.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays at Cronos’s GrowCo facility or unexpected regulatory changes in international markets could quickly temper the current optimism regarding future growth.

Find out about the key risks to this Cronos Group narrative.

Another View: What Multiples Say About Value

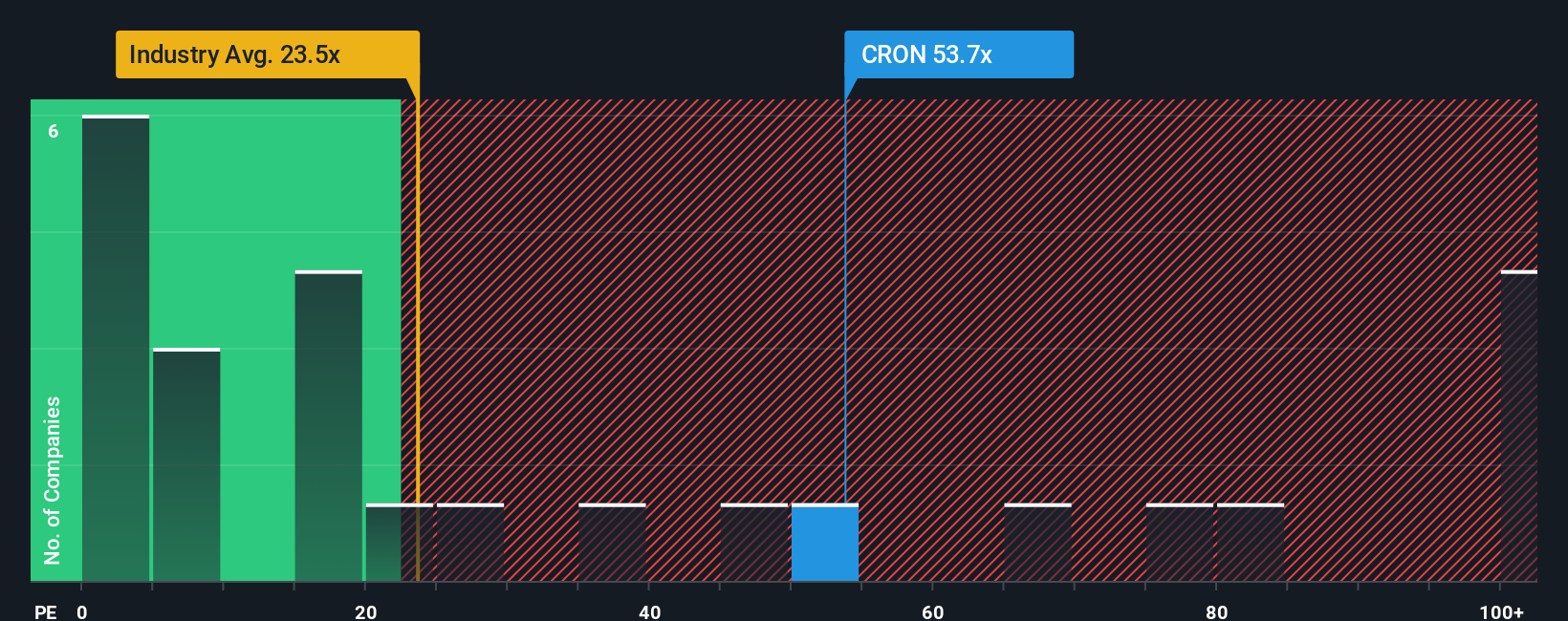

While the fair value narrative pegs Cronos Group at a modest discount, the current P/E ratio tells a different story. At 53.7x, it is significantly higher than both the sector average (36.2x) and the North American pharmaceuticals average (23.6x), as well as the fair ratio of 47.7x. This gap indicates that investors are paying a premium for future growth. However, whether such optimism is justified may depend on how expectations evolve.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cronos Group Narrative

If you have a different perspective or want to reach your own conclusions, you can build and customise a Cronos Group narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cronos Group.

Looking for more investment ideas?

You never know when the next breakthrough or profitable trend will appear. Put your investing radar to work by checking out these standout opportunities today:

- Spot undervalued potential by checking out these 909 undervalued stocks based on cash flows. Target companies flying below the market’s radar for strong cash flow returns.

- Find reliable income streams as you browse these 19 dividend stocks with yields > 3% to uncover stocks offering yields above 3% with healthy fundamentals for long-term stability.

- Get in early on high-impact innovation when you access these 24 AI penny stocks. Explore companies at the front lines of AI disruption and rapid sector growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives