With Canada's election behind it, the focus has shifted towards economic growth and trade diversification, as policymakers aim to provide fiscal stimulus and potentially lower interest rates. In this context, investors are keenly observing opportunities that align with these broader economic themes. Although 'penny stocks' might seem like a term from a bygone era, they continue to offer intriguing potential for growth when backed by strong financials. We explore several such penny stocks on the TSX that stand out for their financial resilience and potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$74.85M | ✅ 4 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.99 | CA$73.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.97 | CA$1.05B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.13 | CA$576.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$280.6M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$503.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$128.51M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.12 | CA$84.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.61 | CA$116.3M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of approximately CA$975.45 million.

Operations: The company generates revenue of $117.62 million from its cultivation, manufacture, and marketing of cannabis and cannabis-derived products segment.

Market Cap: CA$975.45M

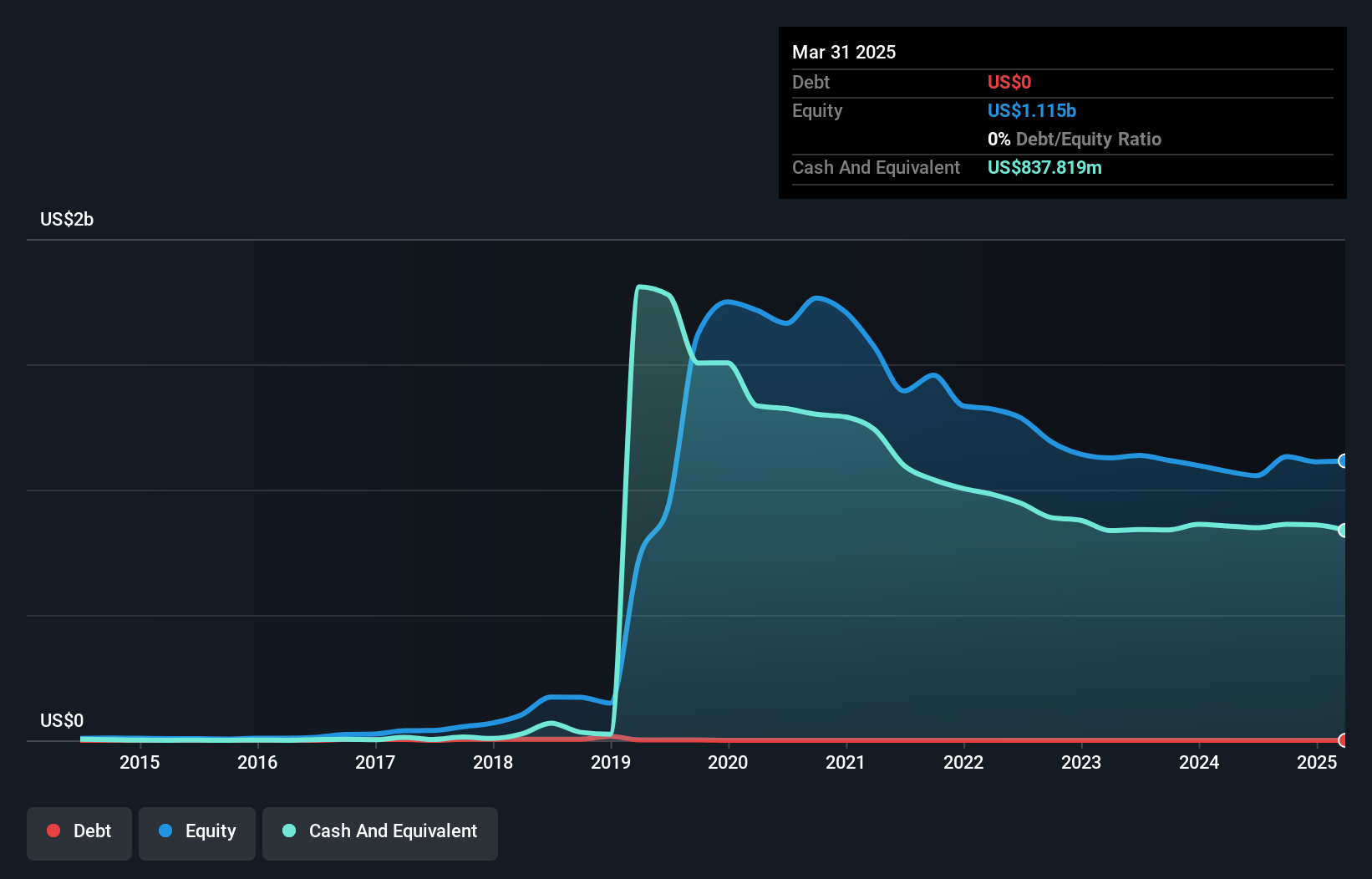

Cronos Group Inc. has transitioned to profitability, reporting net income of US$43.73 million for the latest quarter, a significant turnaround from previous losses. Despite a low return on equity of 3.6%, its price-to-earnings ratio of 17.7x suggests it is valued below the industry average, potentially offering good value for investors interested in penny stocks. The company remains debt-free with substantial short-term assets covering liabilities, enhancing financial stability. Recent product launches in its Spinach®? brand and executive changes could influence future performance, though earnings are forecasted to decline over the next three years by an average of 21.6% annually.

- Jump into the full analysis health report here for a deeper understanding of Cronos Group.

- Examine Cronos Group's earnings growth report to understand how analysts expect it to perform.

01 Communique Laboratory (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 01 Communique Laboratory Inc. offers cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$25.15 million.

Operations: The company generates revenue of CA$0.40 million from the development and marketing of its communications software.

Market Cap: CA$25.15M

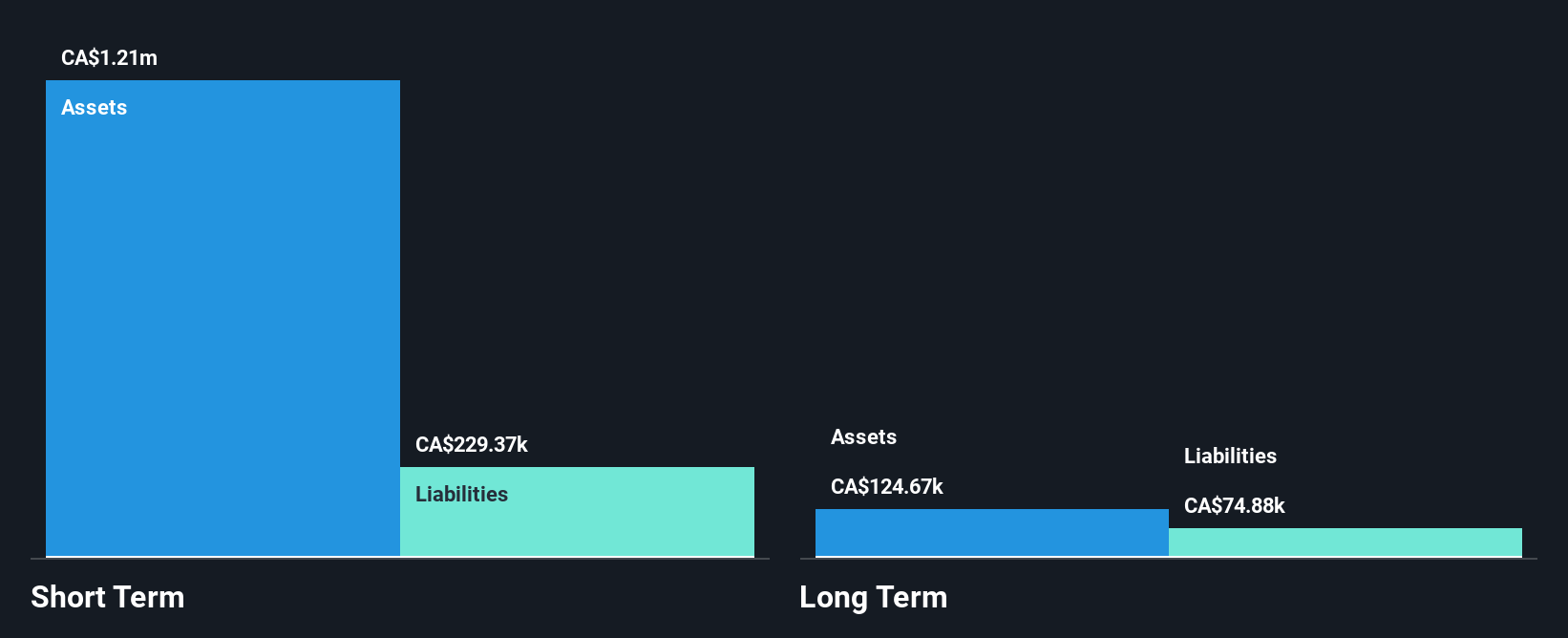

01 Communique Laboratory Inc. remains a pre-revenue company with sales of CA$0.40 million, facing ongoing losses that have increased over the past five years by 2% annually. Despite being debt-free and having sufficient cash runway for over three years, its share price has been highly volatile recently, reflecting investor uncertainty. The board is experienced with an average tenure of nearly 25 years, providing stability in governance. However, earnings for Q1 2025 showed a decline in sales to CA$0.0865 million and an increased net loss compared to last year, highlighting challenges in achieving profitability amidst fluctuating market conditions.

- Unlock comprehensive insights into our analysis of 01 Communique Laboratory stock in this financial health report.

- Gain insights into 01 Communique Laboratory's historical outcomes by reviewing our past performance report.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TriStar Gold, Inc. focuses on the acquisition, exploration, and development of precious metal prospects in the Americas with a market cap of CA$47.69 million.

Operations: TriStar Gold, Inc. currently does not report any revenue segments.

Market Cap: CA$47.69M

TriStar Gold, Inc. is a pre-revenue company with a market cap of CA$47.69 million, focusing on precious metal exploration in the Americas. Despite being debt-free and having an experienced board and management team, it faces financial challenges with a net loss of US$1.93 million reported for 2024 and ongoing concerns about its ability to continue as a going concern. Recent private placements raised CA$1.08 million, providing some liquidity but not enough to cover long-term liabilities fully. The share price remains highly volatile, reflecting investor uncertainty amidst these financial difficulties and operational risks.

- Take a closer look at TriStar Gold's potential here in our financial health report.

- Learn about TriStar Gold's historical performance here.

Key Takeaways

- Reveal the 930 hidden gems among our TSX Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives