Unfortunately for shareholders, when Antibe Therapeutics Inc. (CVE:ATE) reported results for the period to March 2020, its auditors, Ernst & Young LLP, expressed uncertainty about whether it can continue as a going concern. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for Antibe Therapeutics

What Is Antibe Therapeutics's Net Debt?

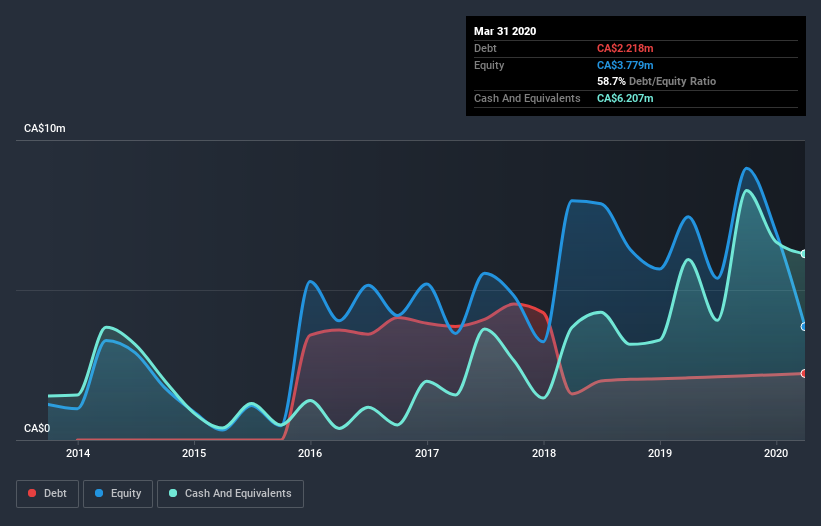

The image below, which you can click on for greater detail, shows that at March 2020 Antibe Therapeutics had debt of CA$2.22m, up from CA$2.07m in one year. But on the other hand it also has CA$6.21m in cash, leading to a CA$3.99m net cash position.

How Strong Is Antibe Therapeutics's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Antibe Therapeutics had liabilities of CA$7.60m due within 12 months and liabilities of CA$2.46m due beyond that. Offsetting this, it had CA$6.21m in cash and CA$1.31m in receivables that were due within 12 months. So its liabilities total CA$2.5m more than the combination of its cash and short-term receivables.

This state of affairs indicates that Antibe Therapeutics's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the CA$144.5m company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, Antibe Therapeutics boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Antibe Therapeutics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Antibe Therapeutics reported revenue of CA$10.0m, which is a gain of 4.7%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Antibe Therapeutics?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Antibe Therapeutics lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of CA$11.9m and booked a CA$19.3m accounting loss. Given it only has net cash of CA$3.99m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Antibe Therapeutics (of which 2 don't sit too well with us!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Antibe Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:ATE

Antibe Therapeutics

A biotechnology company, engages in developing novel therapeutics and medical devices in the areas of pain, inflammation and regenerative medicine in Canada, Europe, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives