Why Aurora Cannabis (TSX:ACB) Investors Are Watching Trump’s Endorsement of CBD for Signs of Change

Reviewed by Sasha Jovanovic

- In recent days, President Donald Trump publicly promoted cannabidiol (CBD) as a prescription drug alternative and backed its potential to transform senior healthcare, sparking optimism about possible federal regulatory changes in the U.S. that could impact cannabis businesses.

- Aurora Cannabis, which generates most of its revenue from medical cannabis, is especially exposed to benefits from regulatory shifts such as marijuana rescheduling that may ease financial and operational constraints for sector participants.

- We'll now examine how potential changes in U.S. cannabis policy, highlighted by recent presidential endorsements of CBD, may influence Aurora's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Aurora Cannabis Investment Narrative Recap

To own shares in Aurora Cannabis, an investor would need to believe that global acceptance and regulatory normalization of medical cannabis, especially in key markets like the U.S., will expand Aurora’s addressable market and improve its margins. The recent presidential endorsement of CBD in the U.S. has sharply increased optimism about impending regulatory changes, positioning Aurora to benefit if rescheduling or similar reforms are enacted. However, these policy shifts remain highly uncertain, and short-term gains could be tempered if regulatory progress stalls or competitive risks intensify.

Among Aurora’s latest announcements, the company revealed a multi-year investment in its EU-GMP facility in Leuna, Germany. This upgrade is designed to improve flower growth capacity, product quality, and cost efficiency, closely tied to the company’s catalyst of leadership in international medical cannabis markets. Such infrastructure enhancement further supports Aurora’s ability to seize opportunities arising from evolving global regulations.

By contrast, investors should also pay attention to intensifying competition in international medical cannabis markets, which may challenge…

Read the full narrative on Aurora Cannabis (it's free!)

Aurora Cannabis' outlook projects CA$418.1 million in revenue and CA$42.4 million in earnings by 2028. This scenario assumes 5.3% annual revenue growth and a CA$45.5 million increase in earnings from the current CA$-3.1 million.

Uncover how Aurora Cannabis' forecasts yield a CA$7.92 fair value, in line with its current price.

Exploring Other Perspectives

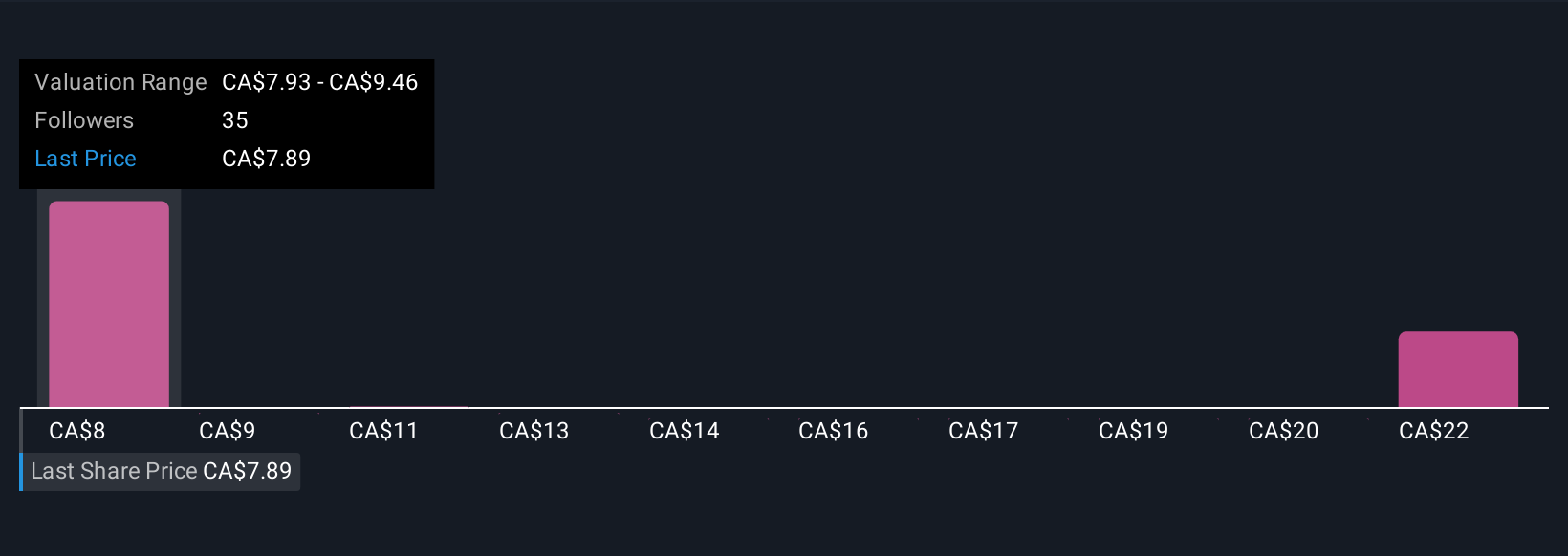

Six members of the Simply Wall St Community estimate Aurora Cannabis’ fair value between CA$7.93 and CA$23.27, showing a substantial spread in market opinions. While many focus on Aurora’s regulatory exposure, the potential for expanding margins in Europe and Australia could play a pivotal role in shaping the company’s future. Explore what others think and see how different scenarios could affect your outlook.

Explore 6 other fair value estimates on Aurora Cannabis - why the stock might be worth just CA$7.92!

Build Your Own Aurora Cannabis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aurora Cannabis research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aurora Cannabis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aurora Cannabis' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACB

Aurora Cannabis

Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives