Last Update07 Aug 25Fair value Decreased 5.93%

Despite substantial improvement in net profit margin and a sharply reduced future P/E ratio, the consensus analyst price target for Aurora Cannabis has decreased from CA$8.42 to CA$7.92.

What's in the News

- Aurora Cannabis expects year-over-year net revenue growth in Q2 2026, primarily driven by an 8%–12% increase in its Global Medical Cannabis segment (Corporate Guidance – New/Confirmed, 2025-08-06).

- The company expanded its compassionate pricing program in Canada, raising income eligibility from $40,000 to $60,000, and introduced new medical cannabis products targeting broader patient groups including seniors, veterans, and first responders (Product-Related Announcements, 2025-06-26).

- Aurora launched IndiMed TEMPO 22 in Australia via MedReleaf, offering 22% THC potency in new Sativa and Indica cultivars, reinforcing its position as a leading prescribed medical cannabis brand in Australia (Product-Related Announcements, 2025-06-05).

- The U.S. House approved an amendment allowing VA physicians to recommend medical cannabis in states where it is legal, potentially expanding addressable patient markets for companies like Aurora Cannabis (The Marijuana Herald, 2025-06-25).

- Aurora continues its international expansion through product innovation and regulatory compliance, emphasizing growth in medical cannabis access and leadership in global markets (Product-Related Announcements, 2025-06-05 & 2025-06-26).

Valuation Changes

Summary of Valuation Changes for Aurora Cannabis

- The Consensus Analyst Price Target has fallen from CA$8.42 to CA$7.92.

- The Net Profit Margin for Aurora Cannabis has significantly risen from 7.72% to 21.12%.

- The Future P/E for Aurora Cannabis has significantly fallen from 18.24x to 6.56x.

Key Takeaways

- Strategic focus on high-margin international medical cannabis and operational efficiencies strengthens profitability, margins, and resilience against market entry barriers.

- Strong financial flexibility and regulatory expertise position Aurora for expansion, market consolidation, and growth without resorting to shareholder-dilutive funding.

- Intensifying competition, rising operational costs, regulatory uncertainty, and low-margin segments threaten Aurora's profitability, market position, and long-term revenue growth.

Catalysts

About Aurora Cannabis- Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

- Expansion and leadership in fast-growing international medical cannabis markets-especially Europe (Germany, Poland, UK, Switzerland, Austria, France, Turkey, Ukraine) and Australia-positions Aurora to benefit from the accelerating global acceptance and regulatory normalization of medical cannabis, driving robust top-line revenue growth.

- Aurora's regulatory expertise, global GMP certification, and proven ability to navigate complex market entry requirements create enduring competitive advantages that foster market consolidation in key jurisdictions-supporting both revenue growth and gross/net margin expansion by limiting new entrants.

- Ongoing transition of portfolio mix toward higher-margin international medical cannabis and away from lower-margin consumer channels is driving sustained improvement in consolidated gross margins, setting up a structurally stronger, earnings-rich business model.

- Investments in new cultivation technology, yield improvements, and operational efficiencies are enabling cost reductions and higher output of premium products, directly supporting increased profitability, improved EBITDA, and stronger free cash flow conversion.

- Aurora's debt-free balance sheet with high cash reserves mitigates the need for dilutive equity offerings, safeguarding EPS and shareholder value while providing financial flexibility to capitalize on acquisition, R&D, or capacity expansion opportunities that could drive future earnings growth.

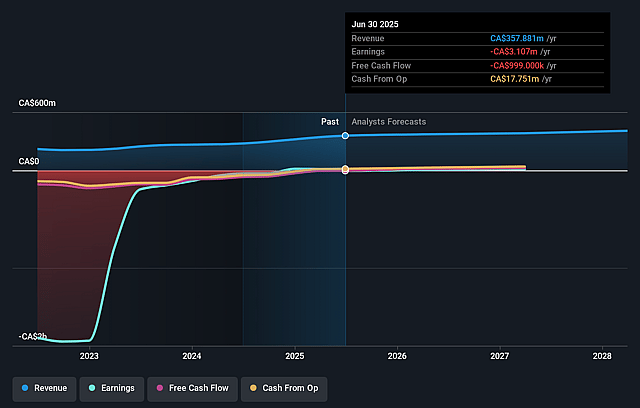

Aurora Cannabis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aurora Cannabis's revenue will grow by 5.3% annually over the next 3 years.

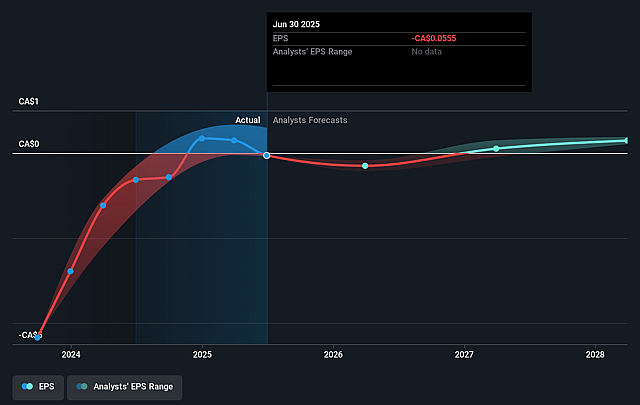

- Analysts assume that profit margins will increase from -0.9% today to 10.1% in 3 years time.

- Analysts expect earnings to reach CA$42.4 million (and earnings per share of CA$0.32) by about September 2028, up from CA$-3.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from -123.0x today. This future PE is lower than the current PE for the CA Pharmaceuticals industry at 37.5x.

- Analysts expect the number of shares outstanding to grow by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Aurora Cannabis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in key international markets such as Europe and Australia, as more producers secure necessary certifications and attempt to enter these high-margin segments, could erode Aurora's pricing power and compress future gross and net margins.

- Increasing SG&A costs tied to variable expenses (e.g., logistics, integration of acquisitions, and distribution costs) may continue to rise alongside revenues, potentially offsetting gains in EBITDA and limiting long-term earnings growth.

- Persistently low margins and volatility in Bevo's plant propagation business, as evidenced by margin declines from inventory write-offs and surplus crops, expose a portion of Aurora's consolidated earnings and free cash flow to operational risks and agricultural unpredictability.

- Regulatory uncertainty in core international markets (notably Germany and Poland), where policy tightening or shifts in government sentiment-even if sometimes beneficial for entrenched players-could reduce addressable markets or slow patient access, impacting revenue growth trajectories and long-term forecasts.

- Rising entry of vertically integrated or multinational competitors-who are building direct relationships with clinics, distributors, and pharmacies-may challenge Aurora's market share and threaten future revenue streams in both existing and emerging medical cannabis markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$7.925 for Aurora Cannabis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.0, and the most bearish reporting a price target of just CA$6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$418.1 million, earnings will come to CA$42.4 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$6.77, the analyst price target of CA$7.92 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.