Key Takeaways

- Aurora's regulatory expertise, market relationships, and product innovation position it for accelerated growth and dominant market share as global legalization expands.

- Strong financial health and operational advantages enable aggressive acquisitions, premium product leadership, and significant margin improvements across consolidating international markets.

- Regulatory uncertainty, intensifying competition, overcapacity, limited financing options, and weak brand differentiation all threaten Aurora's profitability, market share, and long-term growth.

Catalysts

About Aurora Cannabis- Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

- While analyst consensus recognizes Aurora's GMP-certified facilities and global medical expansion as drivers of revenue growth, this likely understates Aurora's potential to secure an outsized share of new international markets due to its decade-long regulatory expertise and entrenched relationships, which could significantly accelerate both top-line growth and market share capture faster than competitors expect.

- Analysts broadly agree that high-margin international medical cannabis and operational excellence will drive improved net margins, yet Aurora's sustained advancements in production technology, genetics, and premium product launches suggest even greater pricing power and margin expansion, especially as its premium products become the standard in consolidating high-barrier markets like Australia, Germany, and Poland.

- The ongoing global shift toward cannabis legalization and normalization-particularly in major developed and emerging markets-could rapidly expand Aurora's addressable market, enabling multiyear revenue compounding well in excess of existing forecasts as entire new geographies open to medical and potentially adult-use sales.

- Aurora's robust balance sheet, positive free cash flow, and zero cannabis business debt uniquely position the company for aggressive strategic acquisitions and rapid scaling, offering the ability to outcompete distressed peers, enter adjacent wellness and pharmaceutical markets, and drive exponential future earnings growth.

- Leadership in product innovation, R&D, and proprietary genetics lays the foundation for Aurora to benefit disproportionately as cannabis becomes integrated into mainstream healthcare and pharmaceutical supply chains, allowing for long-term cross-market opportunities, diversified high-value revenue streams, and superior long-term earnings power.

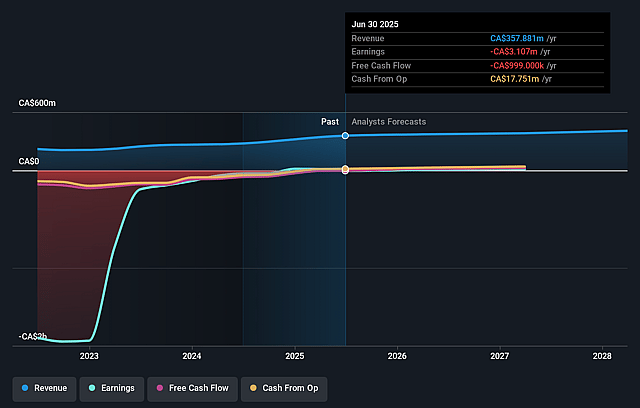

Aurora Cannabis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Aurora Cannabis compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Aurora Cannabis's revenue will grow by 5.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.9% today to 23.6% in 3 years time.

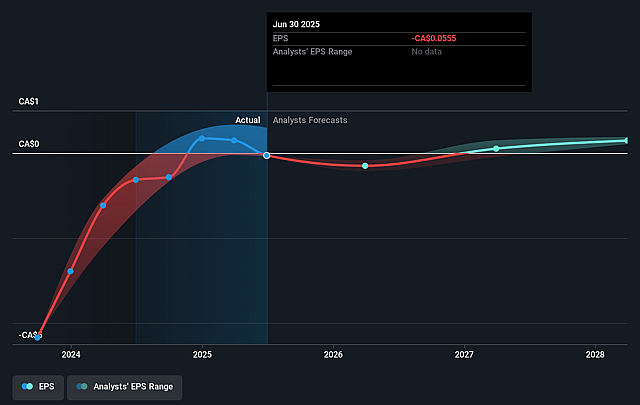

- The bullish analysts expect earnings to reach CA$99.8 million (and earnings per share of CA$0.46) by about September 2028, up from CA$-3.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.3x on those 2028 earnings, up from -126.8x today. This future PE is lower than the current PE for the CA Pharmaceuticals industry at 38.1x.

- Analysts expect the number of shares outstanding to grow by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Aurora Cannabis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory uncertainty in key international markets such as Germany and Poland, where recent or potential future changes to medical cannabis rules could disrupt operations, leading to significant swings in revenue and potentially compressing margins as compliance costs rise and market access becomes less predictable.

- Increased competition in Europe and Australia, with more companies seeking entry due to higher margin potential, could undermine Aurora's current pricing power and force the company to compete more aggressively on price, putting downward pressure on gross margins and overall profitability over the longer term.

- Signs of chronic overcapacity and the risk of future inventory write-downs are apparent, as shown by the plant propagation segment's non-recurring quality issue, which resulted in lower gross margins and demonstrates the vulnerability of earnings to costly operational missteps or persistent surplus production.

- Tightening capital markets for cannabis-related businesses raise long-term concerns about Aurora's ability to finance scale expansions, strategic acquisitions, or significant R&D investments, which may ultimately limit revenue growth and the ability to maintain healthy net margins.

- The company's limited brand differentiation and growing industry consolidation, especially as larger, better-capitalized firms expand in Europe and Australia, could erode Aurora's market share and weaken its pricing, ultimately translating into slower revenue growth and compressed earnings in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Aurora Cannabis is CA$10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aurora Cannabis's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.0, and the most bearish reporting a price target of just CA$6.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CA$423.1 million, earnings will come to CA$99.8 million, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$6.98, the bullish analyst price target of CA$10.0 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.