Key Takeaways

- Regulatory uncertainty in key international markets and environmental compliance risks could constrain Aurora's revenue growth and future profitability.

- Increased competition and scalability challenges threaten operating margins and limit the company's ability to grow earnings without sacrificing profitability.

- Strategic focus on global market expansion, strong financial health, and operational excellence positions Aurora for sustained profitability and long-term competitive advantage.

Catalysts

About Aurora Cannabis- Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

- Despite management's optimism about further international expansion, ongoing regulatory uncertainty in key international cannabis markets such as Germany and other parts of Europe may significantly slow future market penetration and cap Aurora's revenue growth, especially if government policy shifts or additional restrictions are imposed.

- As more firms target higher-margin international medical cannabis markets due to their profitability, Aurora faces intensifying competition from both established companies and aggressive new entrants, likely resulting in downward pressure on pricing and operating margins.

- The high-energy demands and resource-intensive nature of Aurora's large-scale cultivation facilities expose the company to mounting environmental regulatory scrutiny and a potential rise in compliance costs over the long term, which could erode future net margins.

- While recent results highlight improved gross margins and cash flow, the historically high and increasing selling, general and administrative expenses-aligned with revenue increases and M&A integration-signal limited scalability, making it difficult for Aurora to substantially grow earnings without sacrificing profitability as the business expands.

- The medical cannabis adoption curve remains heavily dependent on acceptance and reimbursement by healthcare providers and insurers, and if the pace of mainstream medical adoption lags or reimbursement hurdles linger, Aurora's revenue and net earnings growth from international pharmaceutical markets could fall below current bullish expectations.

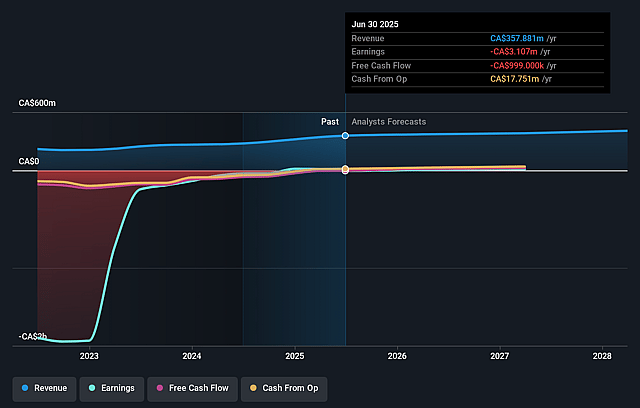

Aurora Cannabis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Aurora Cannabis compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Aurora Cannabis's revenue will grow by 4.8% annually over the next 3 years.

- The bearish analysts are not forecasting that Aurora Cannabis will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Aurora Cannabis's profit margin will increase from -0.9% to the average CA Pharmaceuticals industry of 1.2% in 3 years.

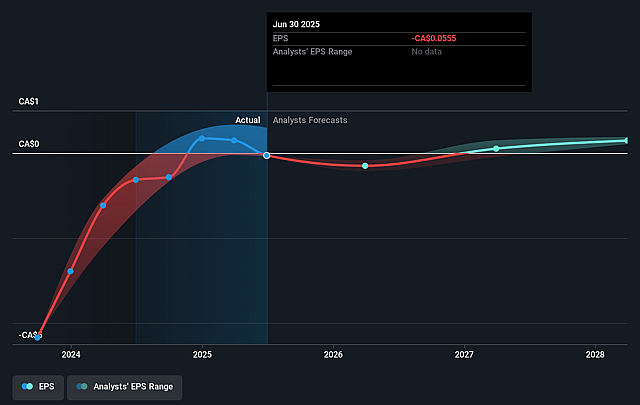

- If Aurora Cannabis's profit margin were to converge on the industry average, you could expect earnings to reach CA$5.0 million (and earnings per share of CA$0.08) by about September 2028, up from CA$-3.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 87.7x on those 2028 earnings, up from -123.0x today. This future PE is greater than the current PE for the CA Pharmaceuticals industry at 38.5x.

- Analysts expect the number of shares outstanding to grow by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Aurora Cannabis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global medical cannabis markets are expanding, with Aurora holding leading positions in high-margin regions such as Canada, Australia, Germany, Poland, and the UK, which suggests room for significant revenue growth over the long term.

- Aurora consistently generates positive free cash flow, maintains a strong cash balance of $186 million, and operates its cannabis business debt-free, enhancing its flexibility to invest in growth initiatives and supporting net margin strength.

- The company's focus on obtaining regulatory certifications, developing scientific expertise, and investing in genetics and new product formats creates substantial competitive barriers, likely aiding long-term pricing power and gross margin improvement.

- Recent operational improvements, including sustainable cost reductions, yield optimization, and expanded premium product offerings, have driven adjusted gross margins higher to 52 percent, indicating a trend toward improved profitability and higher earnings potential.

- Aurora's ability to rapidly enter and expand in new international markets with high barriers to entry, along with its established distributor and pharmacy relationships, positions it to benefit from the ongoing global legalization and acceptance of medical cannabis, bolstering long-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Aurora Cannabis is CA$6.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aurora Cannabis's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.0, and the most bearish reporting a price target of just CA$6.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$412.1 million, earnings will come to CA$5.0 million, and it would be trading on a PE ratio of 87.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$6.77, the bearish analyst price target of CA$6.0 is 12.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.