Red White & Bloom Brands' (CSE:RWB) Promising Earnings May Rest On Soft Foundations

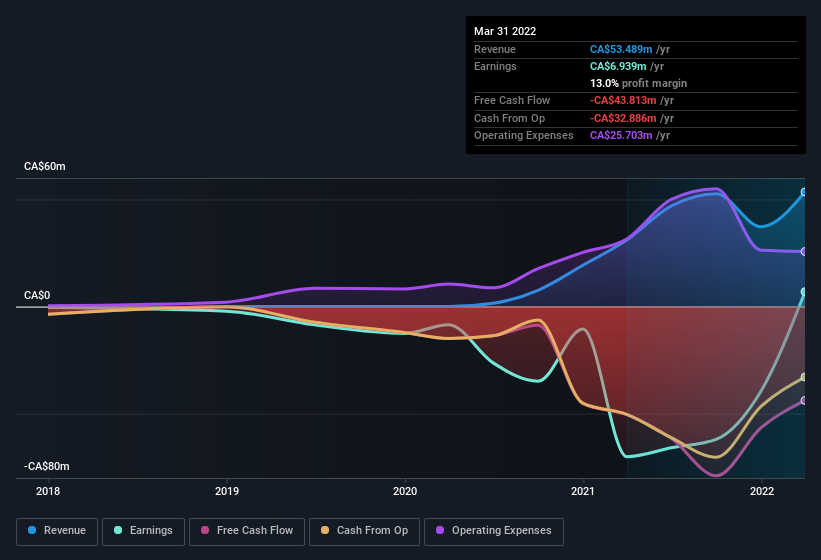

Despite posting some strong earnings, the market for Red White & Bloom Brands Inc.'s (CSE:RWB) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

See our latest analysis for Red White & Bloom Brands

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Red White & Bloom Brands expanded the number of shares on issue by 101% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Red White & Bloom Brands' EPS by clicking here.

How Is Dilution Impacting Red White & Bloom Brands' Earnings Per Share (EPS)?

Red White & Bloom Brands was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If Red White & Bloom Brands' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Red White & Bloom Brands.

Our Take On Red White & Bloom Brands' Profit Performance

Red White & Bloom Brands issued shares during the year, and that means its EPS performance lags its net income growth. For this reason, we think that Red White & Bloom Brands' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Red White & Bloom Brands has 3 warning signs (2 make us uncomfortable!) that deserve your attention before going any further with your analysis.

This note has only looked at a single factor that sheds light on the nature of Red White & Bloom Brands' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:RWB

Red White & Bloom Brands

Manufactures and distributes cannabis products and accessories in the United States, Canada, and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success