- Canada

- /

- Real Estate

- /

- CNSX:PWR

TSX Penny Stocks: 3 Picks Under CA$70M Market Cap

Reviewed by Simply Wall St

The Canadian market, like its global counterparts, is navigating the complexities of potential tariff impacts and broader economic shifts. Despite these challenges, opportunities for diversification remain key, particularly as investors seek to balance risk and return in their portfolios. Penny stocks, often representing smaller or emerging companies with strong financials, continue to offer intriguing possibilities for those looking beyond traditional investments. In this article, we explore three such penny stocks that demonstrate financial resilience and growth potential amidst current market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$177.31M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$439.49M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$120.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$236.24M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$628.96M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$0.97 | CA$26.06M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.18 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Intellabridge Technology (CNSX:KASH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intellabridge Technology Corp. is a financial technology company offering financial services in the United States, with a market cap of CA$8.71 million.

Operations: Intellabridge Technology Corp. does not have any reported revenue segments at this time.

Market Cap: CA$8.71M

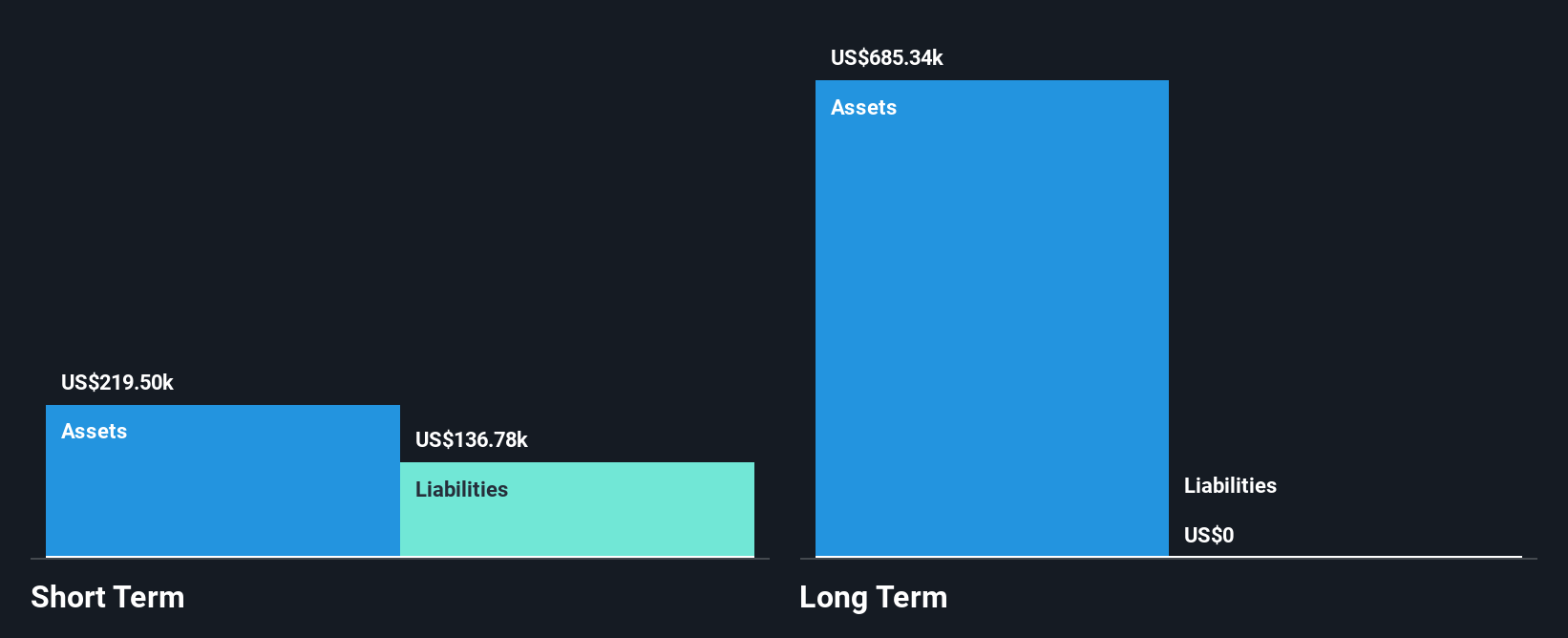

Intellabridge Technology Corp., with a market cap of CA$8.71 million, is a pre-revenue financial technology company operating in the U.S. Despite its seasoned management and board, the company faces challenges with high volatility and negative return on equity due to unprofitability. Recent earnings reports show minimal revenue and increasing losses over five years. The company's cash runway is less than a year, highlighting potential liquidity concerns if free cash flow continues to decline. However, Intellabridge remains debt-free with short-term assets exceeding liabilities, providing some financial stability amidst these challenges.

- Take a closer look at Intellabridge Technology's potential here in our financial health report.

- Understand Intellabridge Technology's track record by examining our performance history report.

Captiva Verde Wellness (CNSX:PWR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Captiva Verde Wellness Corp. is a real estate company that invests in sports and wellness opportunities, with a market cap of CA$17.91 million.

Operations: Captiva Verde Wellness Corp. has not reported any revenue segments.

Market Cap: CA$17.91M

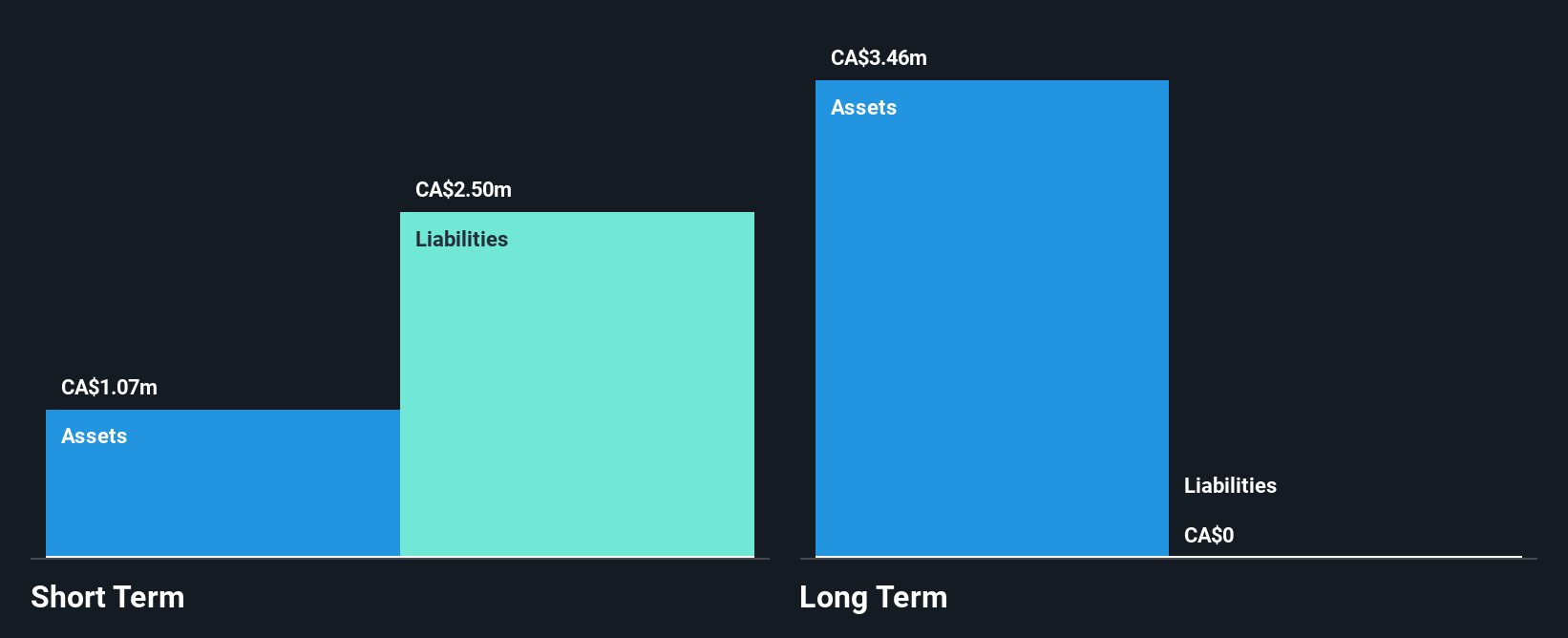

Captiva Verde Wellness Corp., with a market cap of CA$17.91 million, is a pre-revenue real estate company focused on sports and wellness investments. The company is debt-free but faces financial challenges, as its short-term assets of CA$111.7K do not cover liabilities of CA$3.4M, indicating liquidity issues despite recent capital raises. It has experienced board members with an average tenure of 7.8 years, yet the lack of revenue and increasing losses over five years highlight significant operational hurdles. Moreover, the stock's high volatility further complicates investor sentiment in the penny stock landscape in Canada.

- Click here and access our complete financial health analysis report to understand the dynamics of Captiva Verde Wellness.

- Review our historical performance report to gain insights into Captiva Verde Wellness' track record.

E3 Lithium (TSXV:ETL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E3 Lithium Limited focuses on developing and extracting lithium resources in Alberta, with a market cap of CA$66.24 million.

Operations: E3 Lithium Limited currently does not report any revenue segments.

Market Cap: CA$66.24M

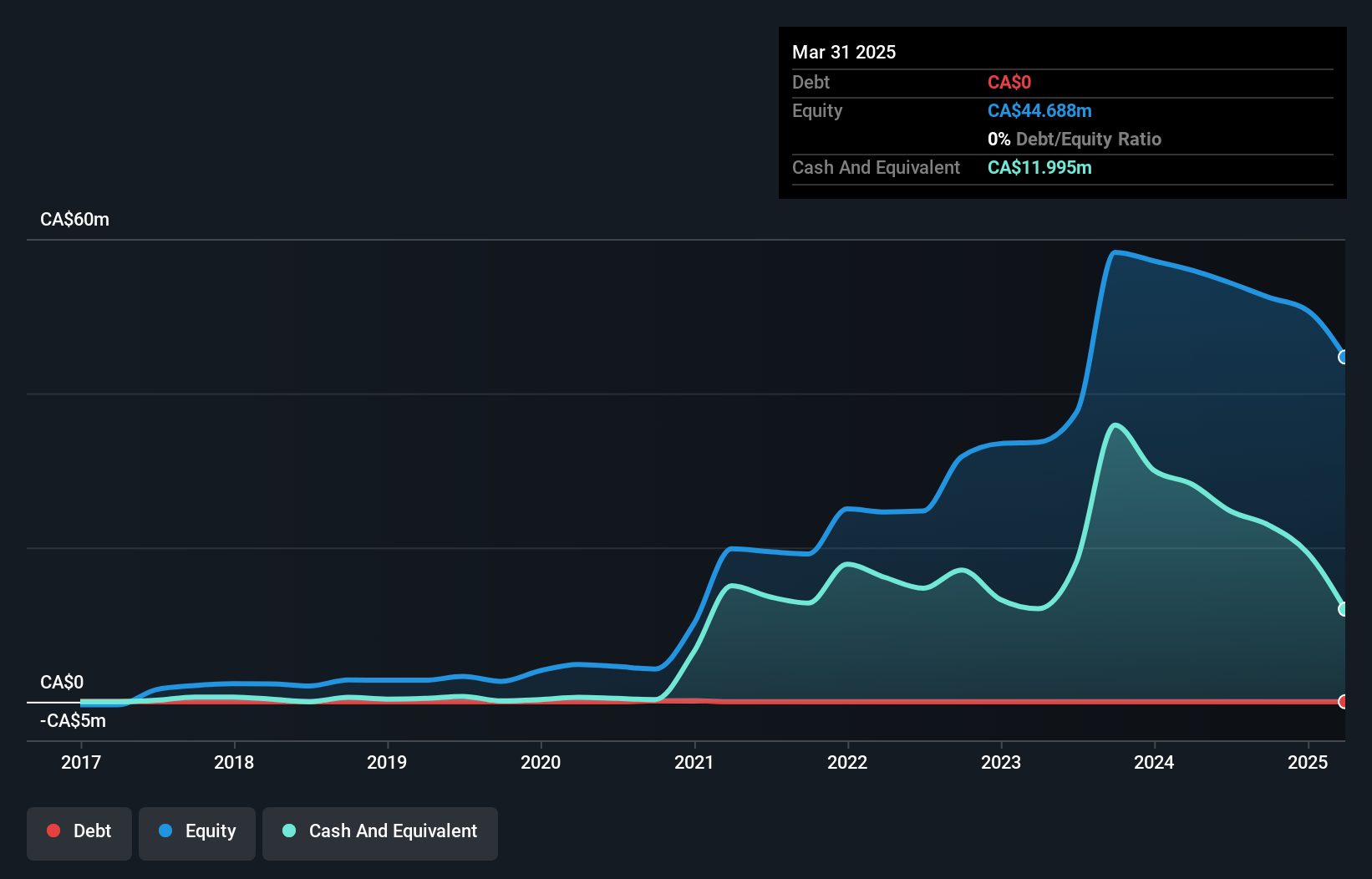

E3 Lithium Limited, with a market cap of CA$66.24 million, remains pre-revenue but has recently achieved a significant milestone by producing battery-quality lithium carbonate from Leduc brines. This development could enhance its attractiveness to potential partners as it progresses towards full-scale production. The company is debt-free and maintains a stable cash runway exceeding one year, supported by short-term assets of CA$25.1 million that cover both short- and long-term liabilities. Despite being unprofitable with increasing losses over five years, E3's experienced management team continues to advance its strategic objectives in the lithium sector.

- Click to explore a detailed breakdown of our findings in E3 Lithium's financial health report.

- Review our growth performance report to gain insights into E3 Lithium's future.

Key Takeaways

- Dive into all 938 of the TSX Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:PWR

Moderate with mediocre balance sheet.

Market Insights

Community Narratives