- Canada

- /

- Metals and Mining

- /

- TSXV:GPH

3 Promising TSX Penny Stocks With Market Caps Under CA$300M

Reviewed by Simply Wall St

While recent shifts in bond yields have influenced Canadian investment-grade bonds, they also suggest potential opportunities for stronger performance as the yield curve evolves. For investors exploring beyond established names, penny stocks—often representing smaller or emerging companies—continue to hold relevance despite their somewhat outdated label. These stocks can offer surprising value and growth potential, especially when backed by solid financial fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$121.5M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$939.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.13 | CA$370M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.23M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.03 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Captiva Verde Wellness (CNSX:PWR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Captiva Verde Wellness Corp. is a real estate company that invests in sports and wellness opportunities, with a market cap of CA$7.16 million.

Operations: Captiva Verde Wellness Corp. has not reported any revenue segments.

Market Cap: CA$7.16M

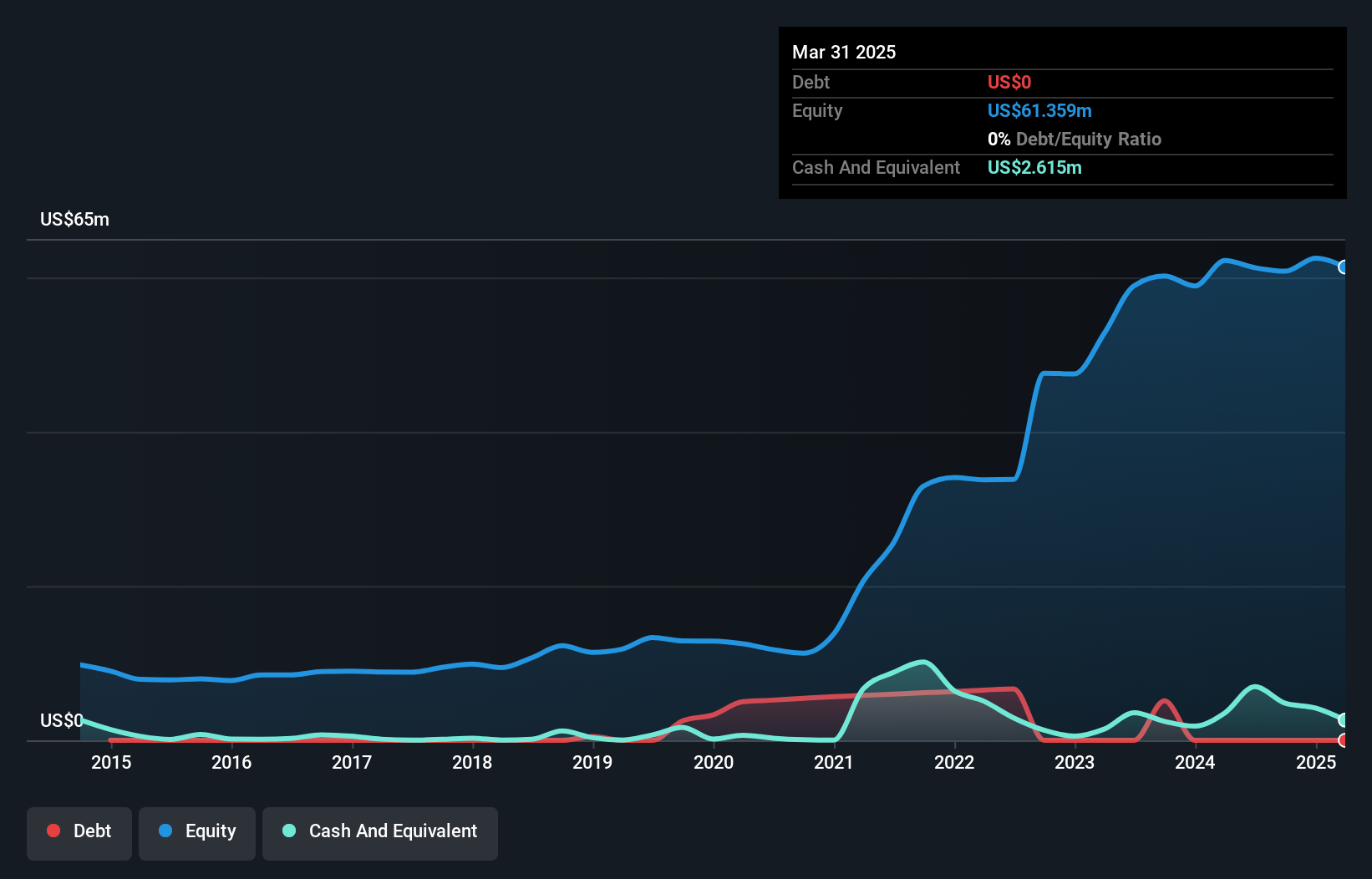

Captiva Verde Wellness Corp., with a market cap of CA$7.16 million, is pre-revenue, generating less than US$1 million annually (CA$175K). The company has no long-term liabilities and remains debt-free but faces challenges with short-term liabilities exceeding its assets by CA$3.29 million. Despite raising additional capital, it lacks a cash runway based on free cash flow estimates. Its board is experienced with an average tenure of 7.8 years; however, the management team's experience remains unclear. The stock's price has been highly volatile recently, and the company continues to be unprofitable with increasing losses over five years at 38.2% annually.

- Navigate through the intricacies of Captiva Verde Wellness with our comprehensive balance sheet health report here.

- Understand Captiva Verde Wellness' track record by examining our performance history report.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform across Canada, the United States, and internationally with a market cap of CA$204.14 million.

Operations: The company's revenue segment primarily comprises $64.95 million from the development, marketing, and support management of its cloud-based platform.

Market Cap: CA$204.14M

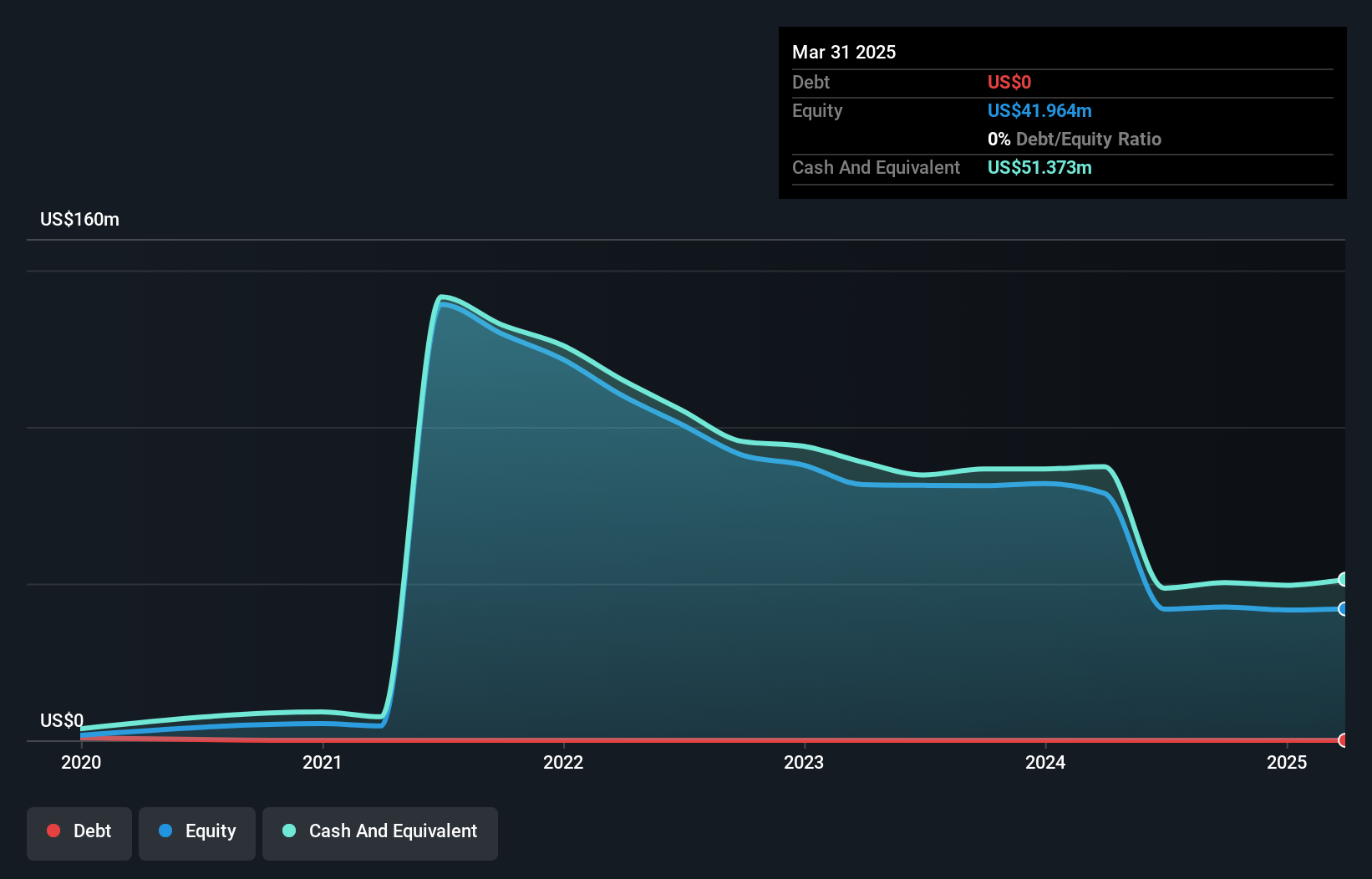

Thinkific Labs Inc., with a market cap of CA$204.14 million, has recently integrated AI features into its platform to enhance digital product creation and marketing, potentially boosting user engagement and revenue. Despite being debt-free with strong short-term assets of $58.6M exceeding liabilities, the company faces challenges with an inexperienced management team and board. Revenue is forecasted to grow by 12.91% annually, but earnings are expected to decline significantly over the next three years. The stock trades at a substantial discount compared to its estimated fair value, offering potential upside as per analyst consensus projections.

- Jump into the full analysis health report here for a deeper understanding of Thinkific Labs.

- Assess Thinkific Labs' future earnings estimates with our detailed growth reports.

Graphite One (TSXV:GPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Graphite One Inc. is a mineral exploration company operating in the United States with a market cap of CA$94.50 million.

Operations: Graphite One Inc. does not currently report any revenue segments.

Market Cap: CA$94.5M

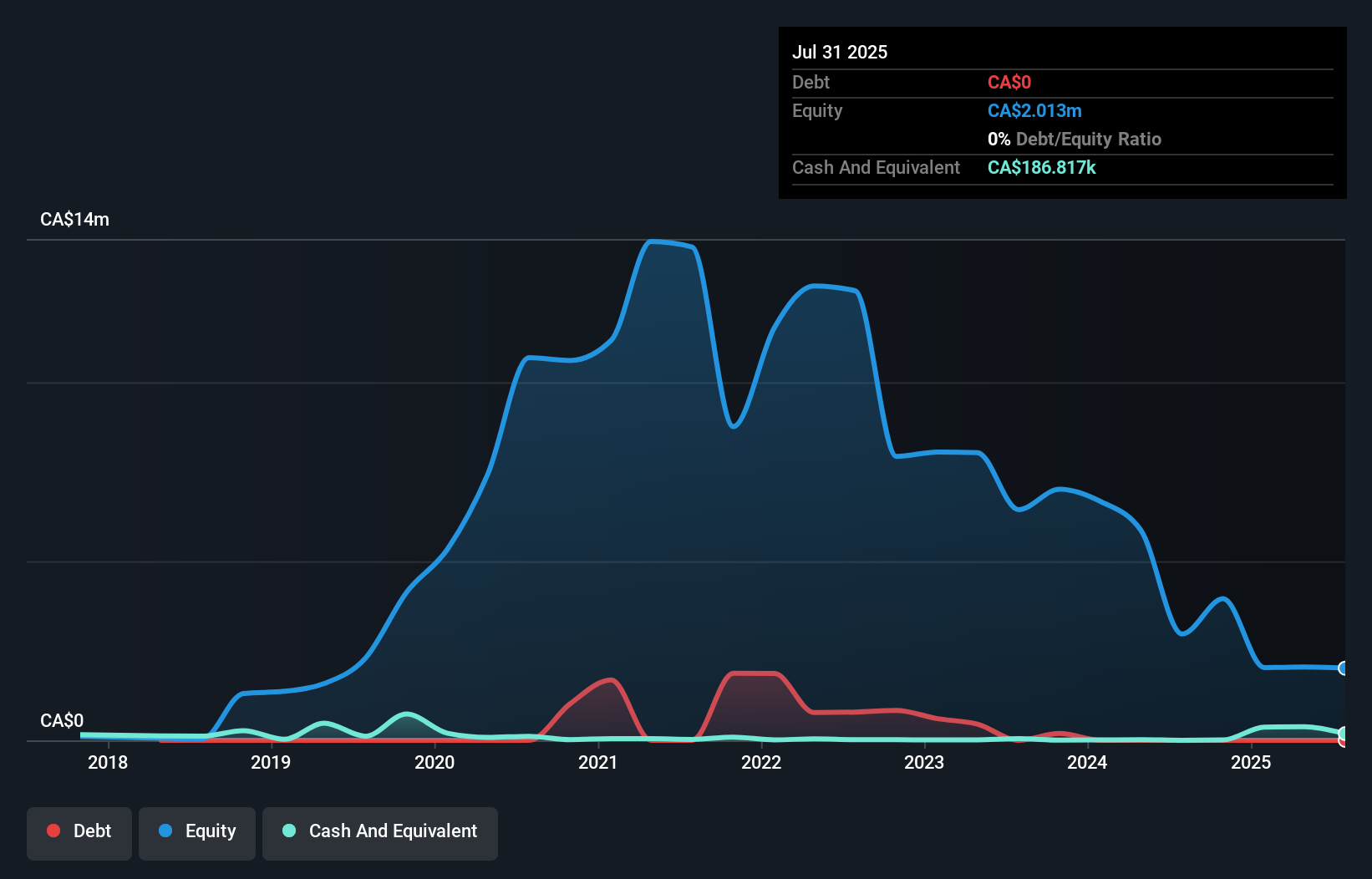

Graphite One Inc., with a market cap of CA$94.50 million, is pre-revenue and currently unprofitable, reporting a net loss of US$4.35 million for the first nine months of 2024. The company has no debt and its short-term assets (US$6.2M) exceed liabilities (US$5.7M). Despite shareholder dilution over the past year, Graphite One recently raised capital through private placements totaling CAD 7.5 million to extend its cash runway beyond two months based on prior free cash flow estimates. The management team is experienced but faces challenges in achieving profitability amid declining earnings over five years at an annual rate of 27.2%.

- Get an in-depth perspective on Graphite One's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Graphite One's track record.

Next Steps

- Click through to start exploring the rest of the 944 TSX Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GPH

Graphite One

Operates as mineral exploration company in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives