Green Thumb Industries (CSE:GTII) shareholders have lost 56% over 1 year, earnings decline likely the culprit

The nature of investing is that you win some, and you lose some. And unfortunately for Green Thumb Industries Inc. (CSE:GTII) shareholders, the stock is a lot lower today than it was a year ago. The share price is down a hefty 56% in that time. The silver lining (for longer term investors) is that the stock is still 25% higher than it was three years ago. More recently, the share price has dropped a further 15% in a month.

After losing 4.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Green Thumb Industries

Given that Green Thumb Industries only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Green Thumb Industries saw its revenue grow by 14%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 56% in the last year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

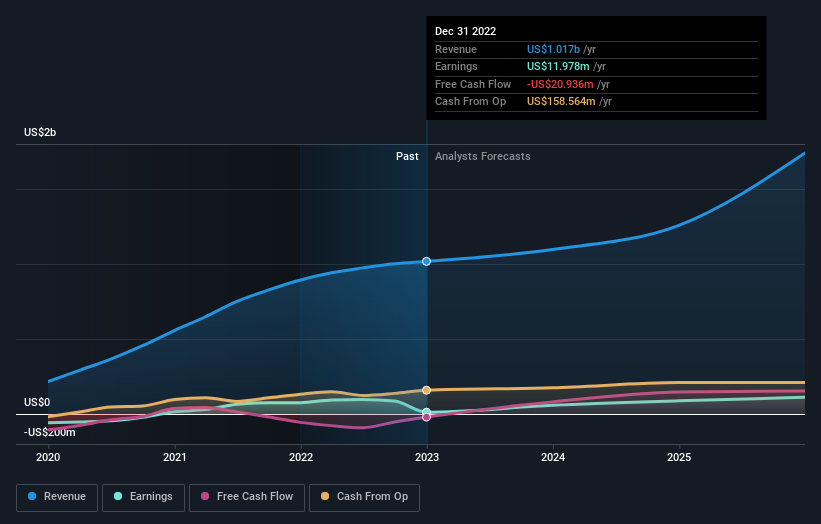

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Green Thumb Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Green Thumb Industries will earn in the future (free analyst consensus estimates)

A Different Perspective

Green Thumb Industries shareholders are down 56% for the year, falling short of the market return. The market shed around 6.3%, no doubt weighing on the stock price. Investors are up over three years, booking 8% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Green Thumb Industries better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Green Thumb Industries you should know about.

We will like Green Thumb Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives