As the Canadian market navigates a landscape shaped by fluctuating bond yields and central bank policies, investors are increasingly evaluating their strategies in light of potential rate cuts and yield curve dynamics. In this context, penny stocks—though an outdated term—remain relevant for those seeking opportunities in smaller or newer companies that may offer unique growth potential. By focusing on financial strength and solid fundamentals, these stocks can present attractive prospects for investors looking to uncover hidden value amidst broader market shifts.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.92 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.20 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.26 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.84 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

C21 Investments (CNSX:CXXI)

Simply Wall St Financial Health Rating: ★★★★☆☆

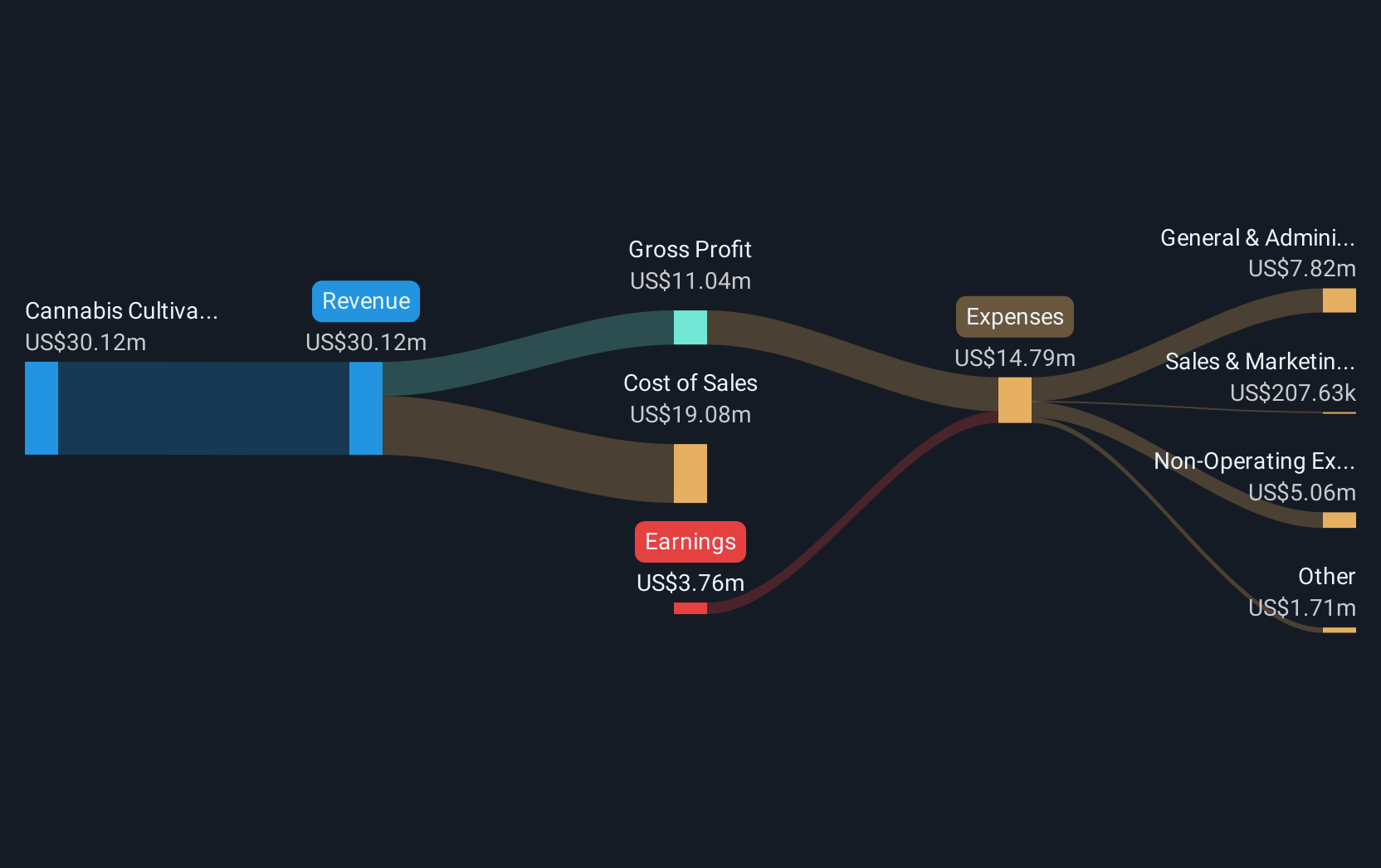

Overview: C21 Investments Inc. is an integrated cannabis company that cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States, with a market cap of CA$31.81 million.

Operations: C21 Investments generates revenue from its cannabis cultivation segment, amounting to $26.79 million.

Market Cap: CA$31.81M

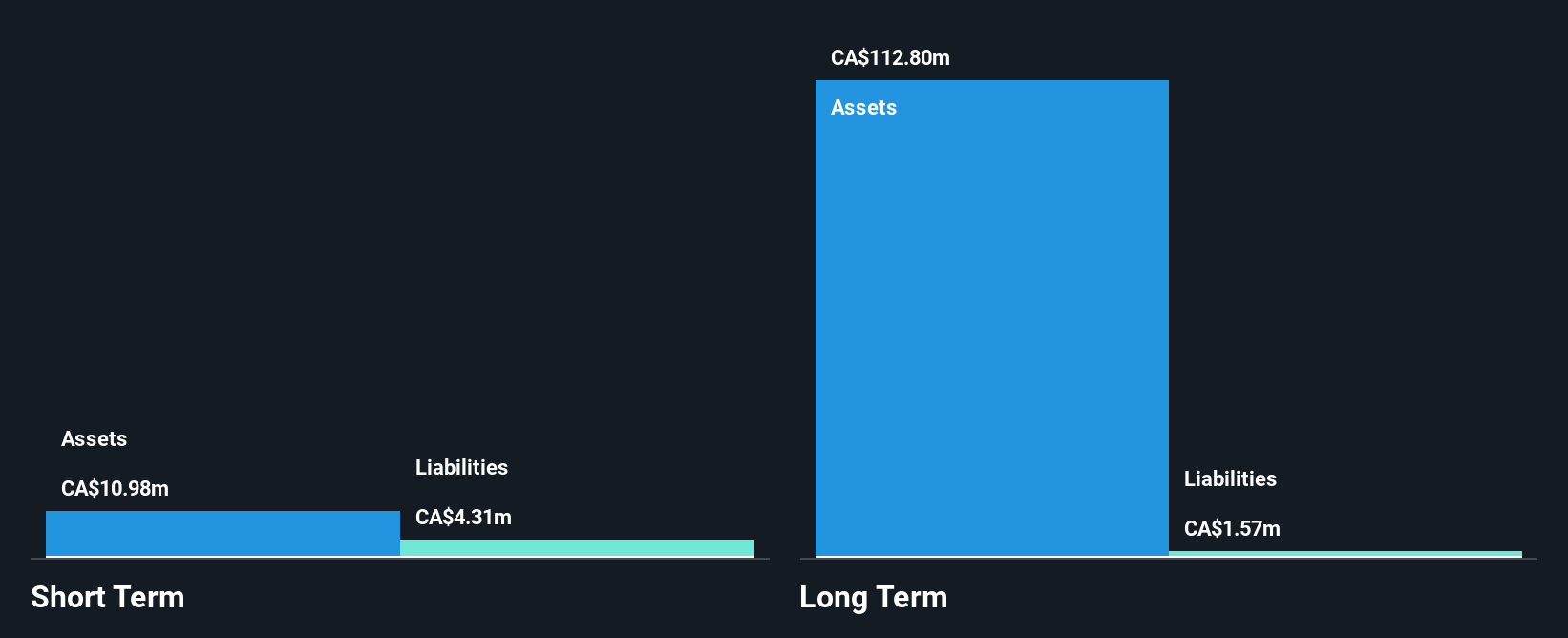

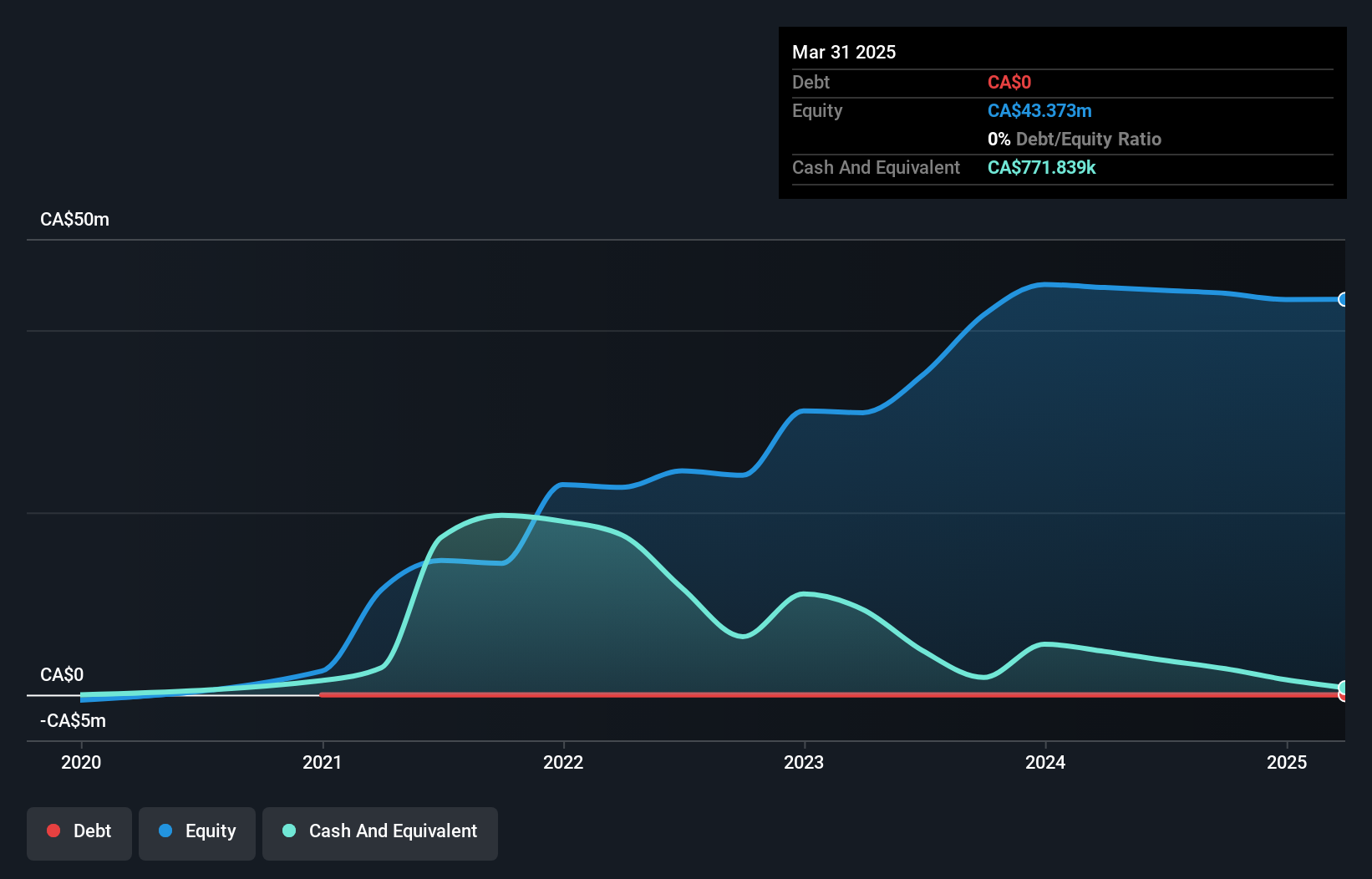

C21 Investments Inc., with a market cap of CA$31.81 million, operates in the cannabis sector and has shown resilience despite current unprofitability. The company reported US$14.1 million in sales for the first half of 2024 but a net loss of US$2.26 million. It has successfully reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, ensuring a cash runway exceeding three years due to positive free cash flow growth. Recent announcements include a share buyback program aimed at repurchasing up to 5% of its shares, reflecting management's confidence in future prospects despite short-term liabilities exceeding assets.

- Click to explore a detailed breakdown of our findings in C21 Investments' financial health report.

- Explore historical data to track C21 Investments' performance over time in our past results report.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company that focuses on acquiring, exploring, and developing gold assets in the Americas, with a market cap of CA$219.99 million.

Operations: GoldMining Inc. does not report specific revenue segments.

Market Cap: CA$219.99M

GoldMining Inc., with a market cap of CA$219.99 million, remains pre-revenue and unprofitable, yet its recent exploration activities show promise. The company's auger drilling at the Sao Jorge Project in Brazil has identified significant gold-in-bedrock targets, enhancing its exploration potential. Despite shareholder dilution over the past year and ongoing losses, GoldMining is debt-free with short-term assets exceeding liabilities. The renewed at-the-market equity program aims to raise up to US$50 million for further development and acquisitions, potentially bolstering its asset base while navigating the challenges of early-stage mineral exploration.

- Click here to discover the nuances of GoldMining with our detailed analytical financial health report.

- Gain insights into GoldMining's outlook and expected performance with our report on the company's earnings estimates.

Canadian North Resources (TSXV:CNRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canadian North Resources Inc. focuses on the exploration and development of mineral properties in Canada, with a market cap of CA$114.53 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$114.53M

Canadian North Resources Inc., with a market cap of CA$114.53 million, is pre-revenue and unprofitable, yet it shows potential through its exploration activities at the Ferguson Lake Project. Recent bioleaching tests indicate efficient metal extraction capabilities, potentially simplifying mineral processing and reducing costs. The company remains debt-free with short-term assets exceeding liabilities but faces challenges with high share price volatility and limited cash runway under a year. Despite earnings declines over five years, recent board changes bring seasoned expertise to support strategic initiatives in advancing its mineral projects in Canada.

- Click here and access our complete financial health analysis report to understand the dynamics of Canadian North Resources.

- Assess Canadian North Resources' previous results with our detailed historical performance reports.

Next Steps

- Reveal the 958 hidden gems among our TSX Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:CXXI

C21 Investments

An integrated cannabis company, cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States.

Low and slightly overvalued.

Market Insights

Community Narratives