Shareholders in Curaleaf Holdings (CSE:CURA) are in the red if they invested a year ago

Even the best stock pickers will make plenty of bad investments. Anyone who held Curaleaf Holdings, Inc. (CSE:CURA) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 61%. However, the longer term returns haven't been so bad, with the stock down 16% in the last three years. The falls have accelerated recently, with the share price down 33% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Curaleaf Holdings

Given that Curaleaf Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Curaleaf Holdings grew its revenue by 93% over the last year. That's a strong result which is better than most other loss making companies. In contrast the share price is down 61% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

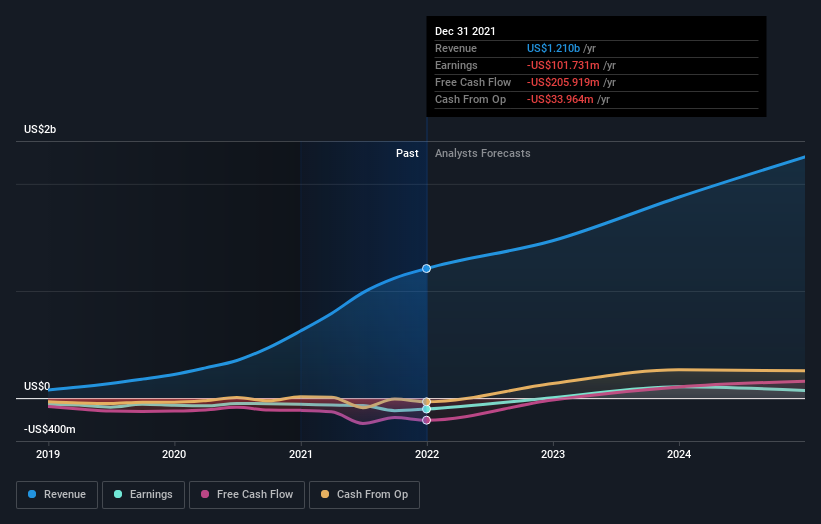

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Curaleaf Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Curaleaf Holdings in this interactive graph of future profit estimates.

A Different Perspective

Over the last year, Curaleaf Holdings shareholders took a loss of 61%. In contrast the market gained about 16%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 5% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Curaleaf Holdings that you should be aware of before investing here.

Of course Curaleaf Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives