Yellow Pages' (TSE:Y) Dividend Will Be Increased To CA$0.15

Yellow Pages Limited (TSE:Y) has announced that it will be increasing its dividend on the 30th of June to CA$0.15. This will take the dividend yield to an attractive 3.2%, providing a nice boost to shareholder returns.

View our latest analysis for Yellow Pages

Yellow Pages' Earnings Easily Cover the Distributions

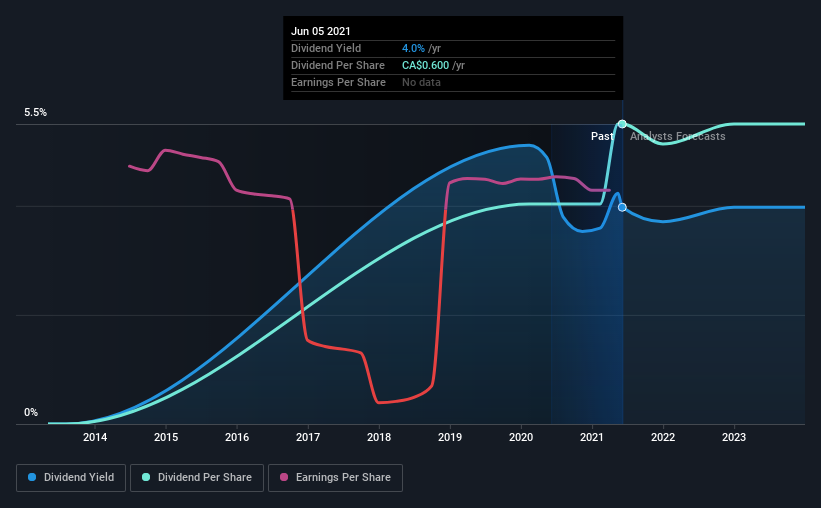

If the payments aren't sustainable, a high yield for a few years won't matter that much. However, prior to this announcement, Yellow Pages' dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 4.3% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 20% by next year, which is in a pretty sustainable range.

Yellow Pages Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 4.3% a year for the past five years, which isn't massive but still better than seeing them shrink. While EPS growth is quite low, Yellow Pages has the option to increase the payout ratio to return more cash to shareholders.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Yellow Pages that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:Y

Yellow Pages

Through its subsidiaries, provides digital and print media, and marketing solutions to small and medium-sized enterprises in Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026