- Canada

- /

- Entertainment

- /

- TSX:WILD

Loss-making WildBrain (TSE:WILD) has seen earnings and shareholder returns follow the same downward trajectory over past -45%

It is doubtless a positive to see that the WildBrain Ltd. (TSE:WILD) share price has gained some 43% in the last three months. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 45% in the last three years, falling well short of the market return.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for WildBrain

WildBrain wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, WildBrain saw its revenue grow by 3.2% per year, compound. That's not a very high growth rate considering it doesn't make profits. The stock dropped 13% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

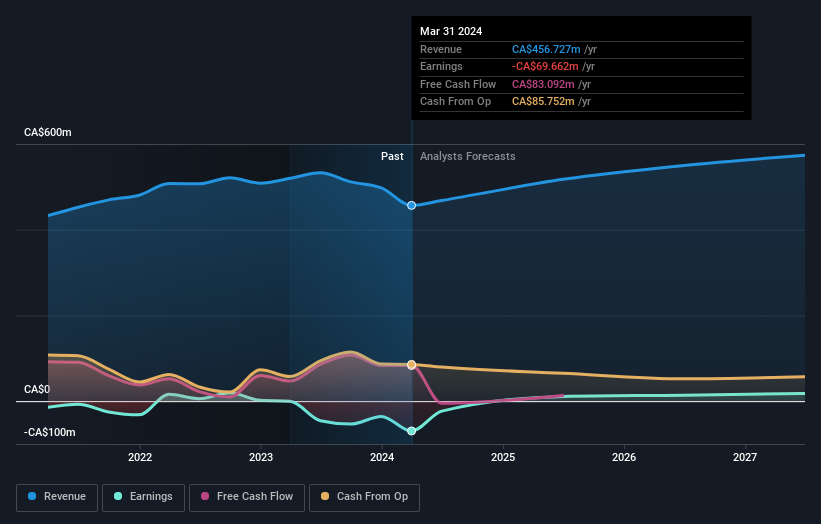

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 15% in the last year, WildBrain shareholders lost 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of WildBrain's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WildBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WILD

WildBrain

Engages in the development, production, and distribution of films and television programs in Canada, the United States, the United Kingdom, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives