Amidst a backdrop of moderating inflation and anticipated interest rate cuts, the Canadian market presents a nuanced landscape for investors. Companies with high insider ownership often signal strong confidence in the business’s prospects, potentially making them attractive in these evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Payfare (TSX:PAY) | 15% | 46.7% |

| goeasy (TSX:GSY) | 21.7% | 15.8% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

| Aritzia (TSX:ATZ) | 19% | 51.2% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

| Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

| Ivanhoe Mines (TSX:IVN) | 13% | 65.5% |

| Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

We'll examine a selection from our screener results.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

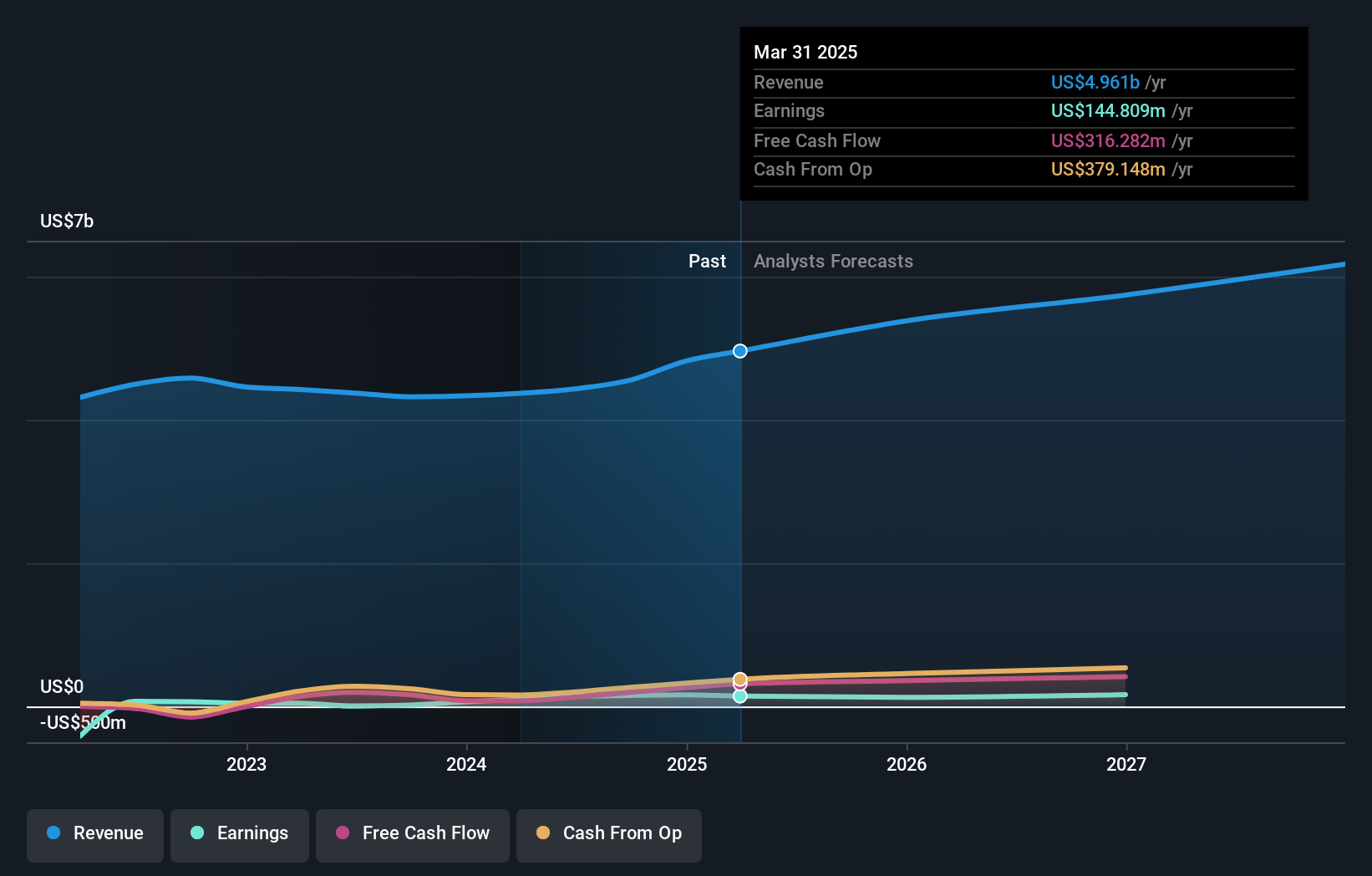

Overview: Aritzia Inc. is a company that designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$4.22 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel and accessories segment.

Insider Ownership: 19%

Return On Equity Forecast: 25% (2027 estimate)

Aritzia, a Canadian retailer, is experiencing mixed financial dynamics. While its revenue growth at 11% per year outpaces the Canadian market average of 7.2%, its profit margins have declined from 8.5% to 3.4%. Despite this, Aritzia's earnings are projected to grow significantly by 51.19% annually over the next three years, substantially above the market forecast of 14.7%. The company also remains active in shareholder return initiatives with recent share buybacks totaling CAD 30 million.

- Unlock comprehensive insights into our analysis of Aritzia stock in this growth report.

- The valuation report we've compiled suggests that Aritzia's current price could be quite moderate.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.62 billion.

Operations: The company generates revenue across various regions, with the Americas contributing CA$2.53 billion, Asia Pacific CA$616.58 million, Investment Management CA$489.23 million, and Europe, Middle East & Africa (EMEA) CA$730.10 million.

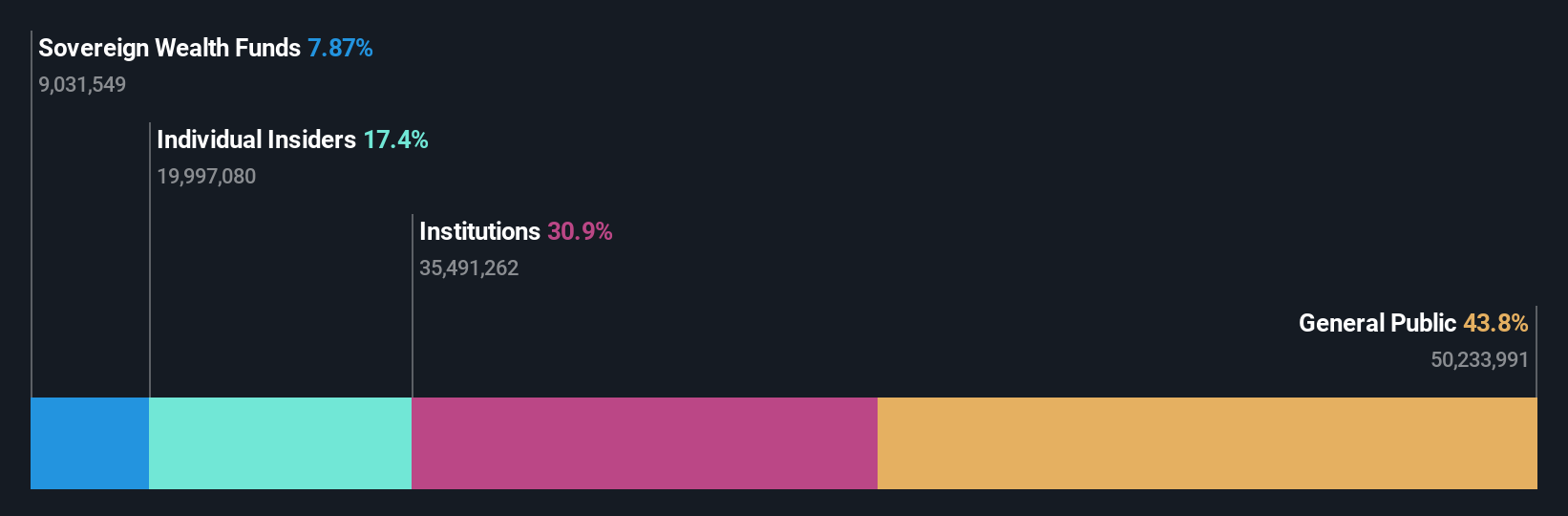

Insider Ownership: 14.3%

Return On Equity Forecast: N/A (2027 estimate)

Colliers International Group, despite trading at 56.2% below its estimated fair value, shows promising financial growth with earnings that have increased by 119.8% over the past year and are expected to continue growing at a rate of 38.34% annually. However, the company's debt is poorly covered by operating cash flow, reflecting some financial vulnerability. Recent engagements include marketing a significant property in Mississippi, highlighting its active role in substantial projects which could influence future performance.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Colliers International Group shares in the market.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

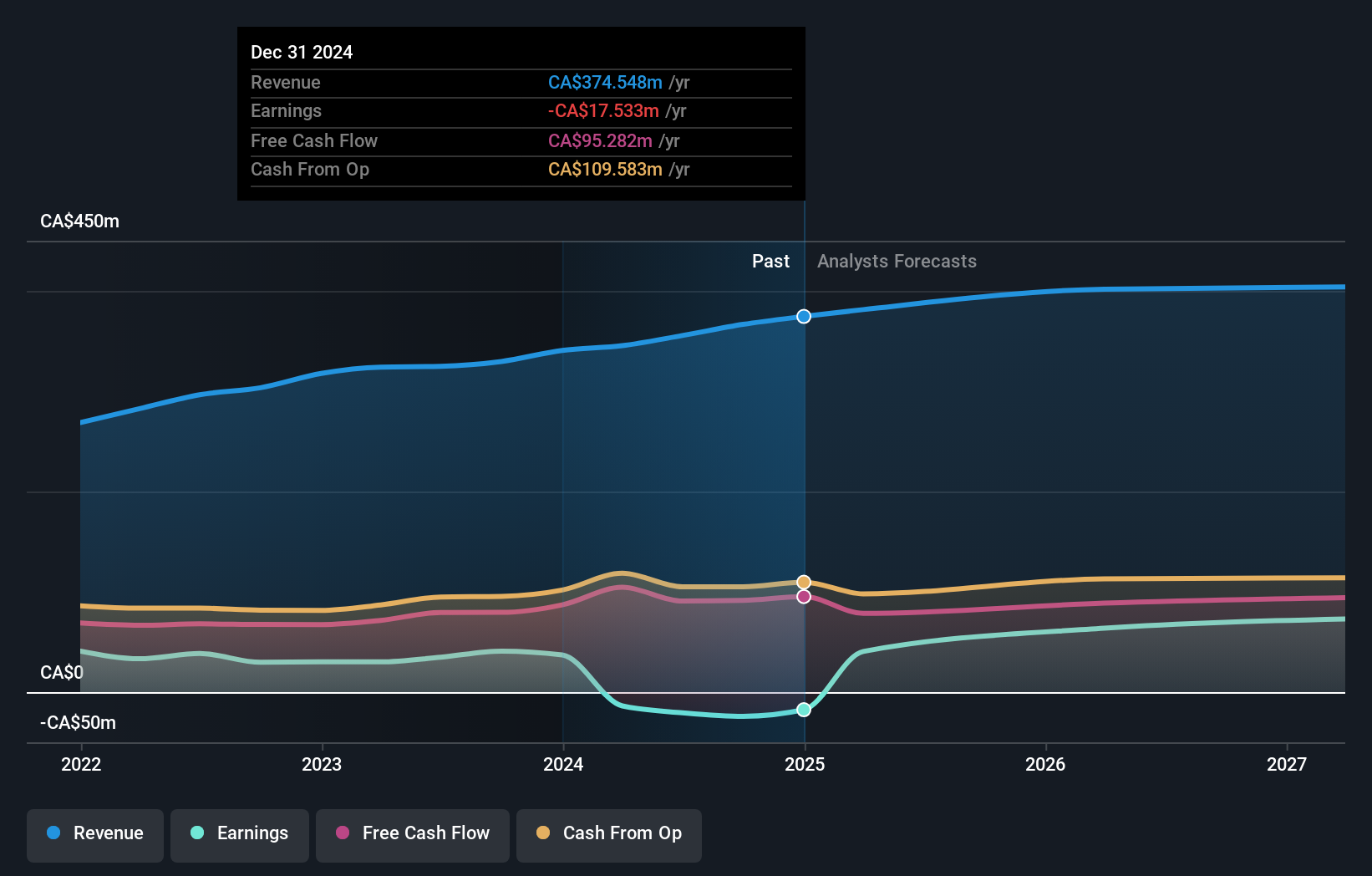

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of approximately CA$522.37 million.

Operations: The company generates revenue through two primary segments: Radio, which brings in CA$129.37 million, and Broadcasting and Commercial Music, accounting for CA$216.06 million.

Insider Ownership: 14.0%

Return On Equity Forecast: 22% (2027 estimate)

Stingray Group is currently trading at a significant discount, perceived to be 62.1% below its estimated fair value, suggesting potential undervaluation. Despite recent financial setbacks including a shift from net income to a net loss in the latest fiscal year, analysts anticipate a turnaround with profitability expected within three years alongside robust annual earnings growth. However, its revenue growth projections remain below the market average and it carries high debt levels which could constrain financial flexibility.

- Navigate through the intricacies of Stingray Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Stingray Group's share price might be too pessimistic.

Summing It All Up

- Click through to start exploring the rest of the 26 Fast Growing TSX Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

Exceptional growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)