As global markets navigate a volatile landscape marked by fluctuating corporate earnings and competitive pressures from emerging technologies like DeepSeek's AI advancements, investors are closely watching the tech sector for signs of resilience and growth. In this environment, identifying high-growth tech stocks with robust fundamentals and innovative capabilities can be crucial for those looking to capitalize on potential opportunities within the ever-evolving technology landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

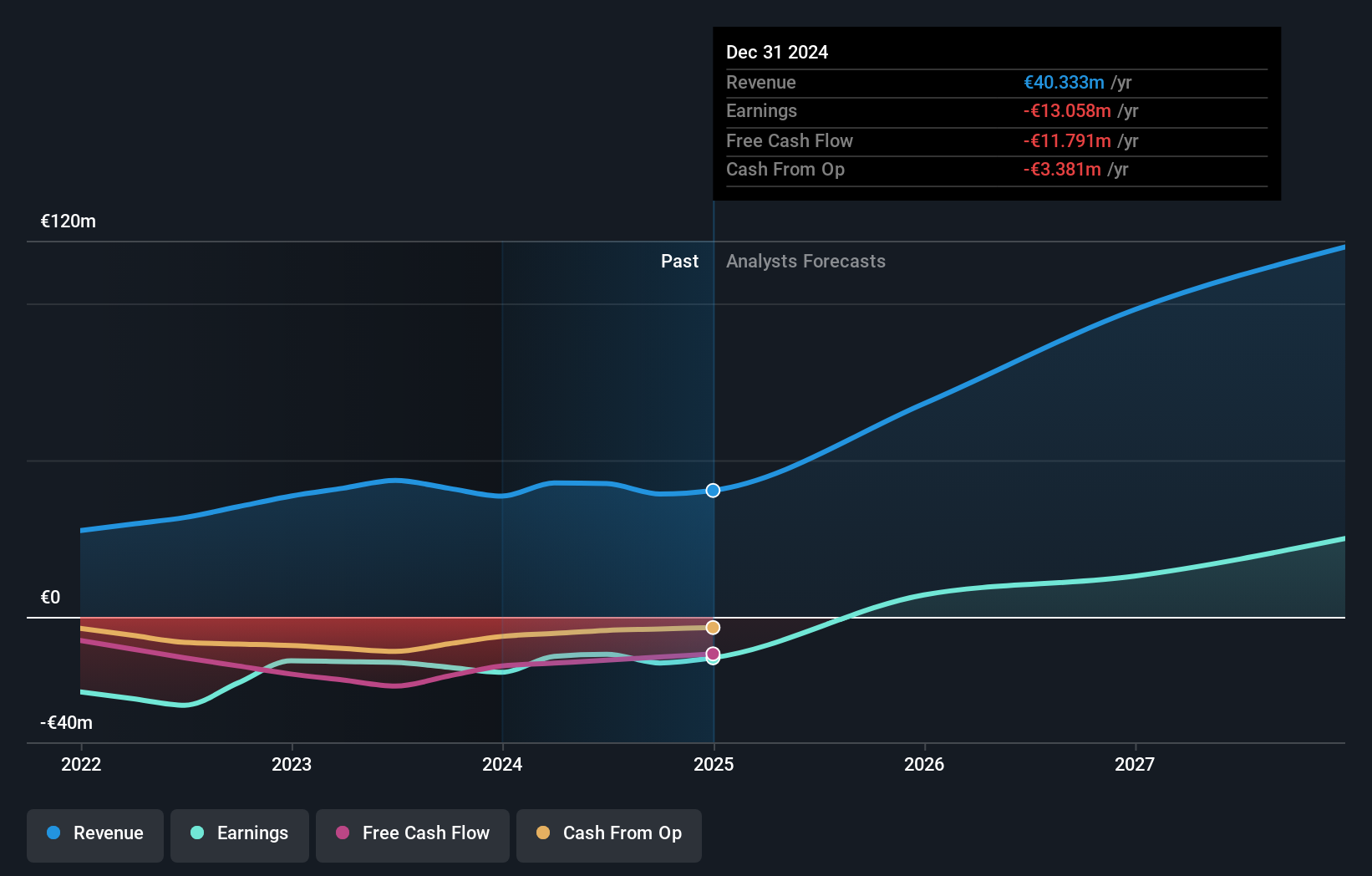

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €246.71 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for €42.50 million.

MotorK, poised for significant growth, is navigating the competitive landscape of the software industry with a strategic focus on innovation. Despite current unprofitability, the company's revenue is expected to surge by 22.1% annually, outpacing the Dutch market's 8.1% growth rate. This trajectory is supported by a forecasted earnings increase of 108.4% per year over the next three years, underscoring MotorK's potential to transition from its present financial position to profitability. The firm’s commitment to research and development (R&D) aligns with its ambitious revenue targets, ensuring continuous improvement and adaptation in its offerings amidst evolving market demands.

- Click here and access our complete health analysis report to understand the dynamics of MotorK.

Understand MotorK's track record by examining our Past report.

Jinyu Bio-technology (SHSE:600201)

Simply Wall St Growth Rating: ★★★★★☆

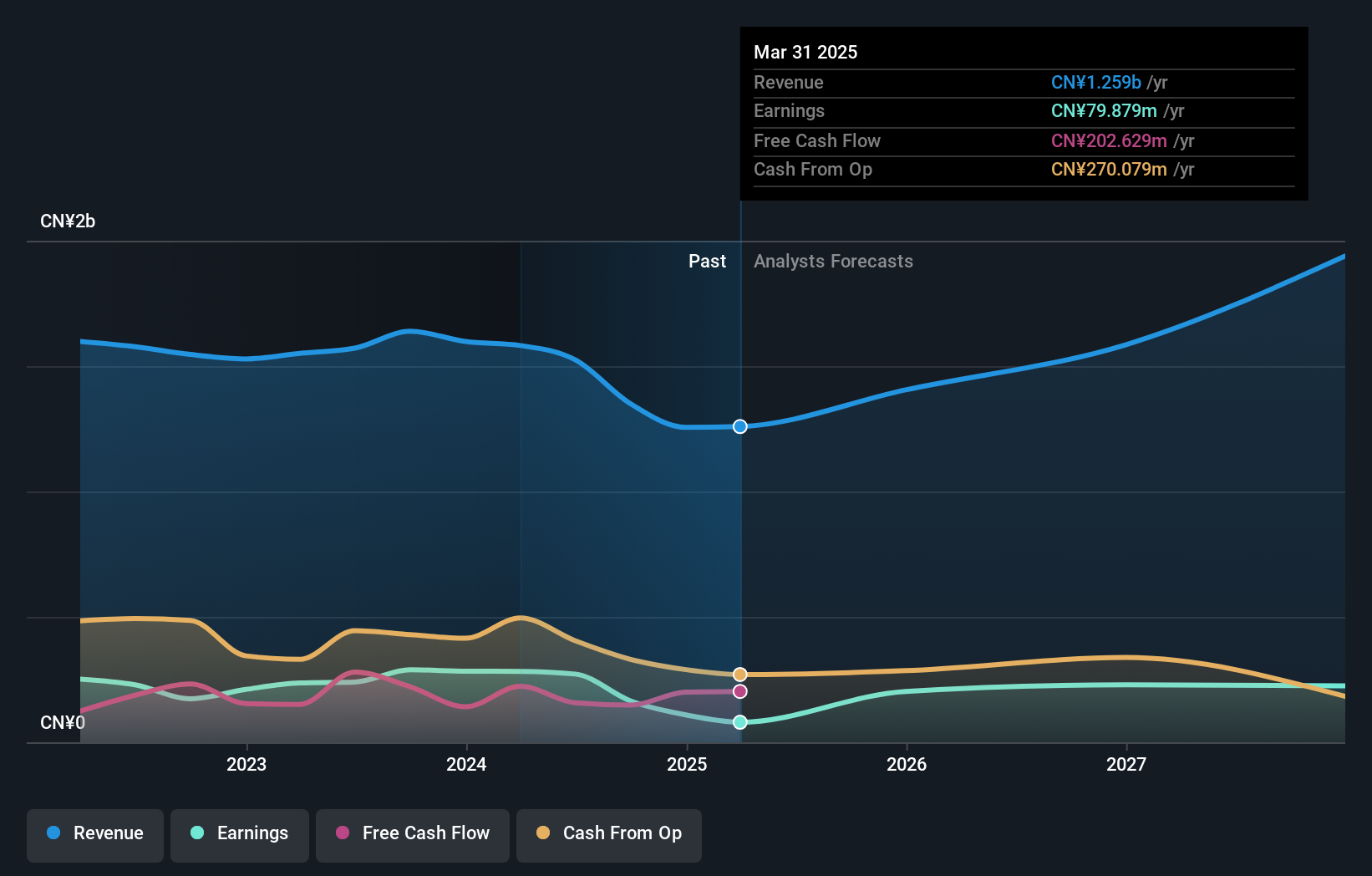

Overview: Jinyu Bio-technology Co., Ltd. focuses on the research, development, production, and sale of veterinary products in China, with a market capitalization of CN¥7.41 billion.

Operations: Jinyu Bio-technology Co., Ltd. generates revenue primarily through the sale of veterinary products within China. The company's cost structure includes expenses related to research and development, production, and distribution of these products.

Jinyu Bio-technology is navigating a dynamic phase, with projected annual revenue growth of 27.6%, significantly outpacing the Chinese market's average of 13.3%. This growth is underpinned by robust earnings forecasts, expected to surge by 48.5% annually, highlighting the company's potential in a competitive biotechnology landscape. Despite recent challenges reflected in a profit margin decrease from 17.6% to 12.2% last year, Jinyu continues to invest in innovation, crucial for maintaining its competitive edge and addressing evolving market demands effectively.

- Click to explore a detailed breakdown of our findings in Jinyu Bio-technology's health report.

Assess Jinyu Bio-technology's past performance with our detailed historical performance reports.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

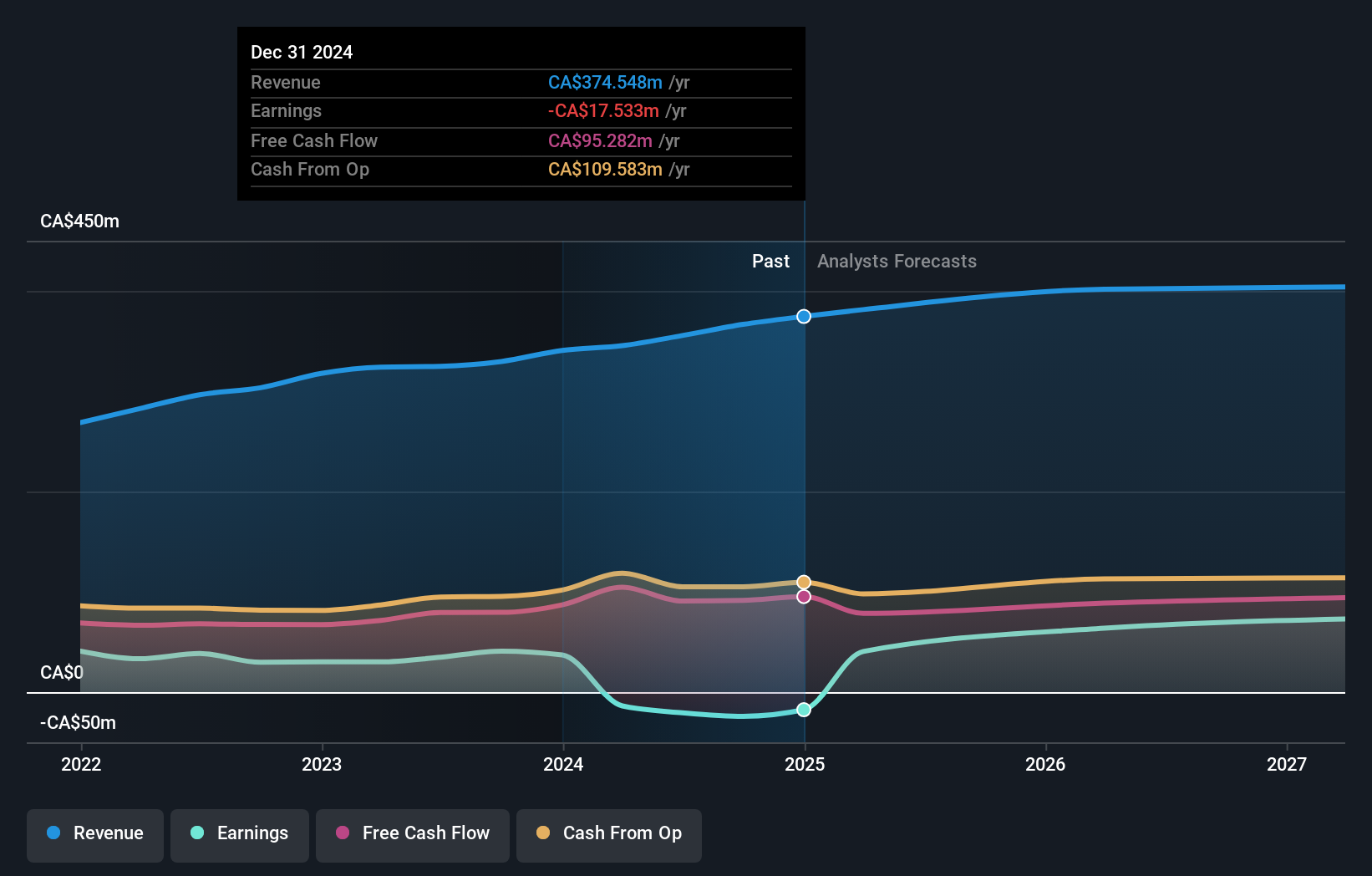

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$568.77 million.

Operations: Stingray Group generates revenue primarily through its Broadcasting and Commercial Music segment, which contributes CA$236.80 million, and its Radio segment, adding CA$129.80 million. The company operates globally in the music, media, and technology sectors.

Stingray Group, amidst a competitive media landscape, is leveraging strategic partnerships and technological innovations to enhance its market presence. Notably, the company's collaboration with Sony Honda Mobility to integrate Stingray Karaoke into AFEELA vehicles underscores its commitment to expanding in-car entertainment options. This move taps into a growing consumer demand for enhanced vehicle experiences, potentially increasing user engagement and revenue streams. Financially, Stingray reported a modest annual revenue growth of 4.4%, slightly below the Canadian market average of 4.7%. However, its earnings are expected to surge by an impressive 81.5% annually over the next three years, signaling potential profitability and robust financial health ahead despite current unprofitability and high debt levels. These developments suggest that while facing challenges, Stingray is strategically positioning itself for future growth through innovative service offerings and strategic partnerships.

- Take a closer look at Stingray Group's potential here in our health report.

Review our historical performance report to gain insights into Stingray Group's's past performance.

Key Takeaways

- Take a closer look at our High Growth Tech and AI Stocks list of 1230 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

Exceptional growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)