As the Canadian market navigates the complexities of a volatile fourth quarter, driven by global uncertainties and economic shifts, investors are keenly observing how sectors like technology respond to these dynamics. In this environment, high-growth tech stocks in Canada can offer intriguing opportunities for investors seeking innovation-driven growth potential amid broader market fluctuations.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that focuses on developing and licensing reservoir simulation and seismic interpretation software, with a market capitalization of CA$962.62 million.

Operations: CMG generates revenue primarily from the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. The company's operations focus on providing specialized software solutions for the energy sector.

Computer Modelling Group Ltd. (CMG) is making significant strides in the high-growth tech sector in Canada, particularly with its latest product launch and inclusion in a major index. The company's new Focus CCS tool, designed to enhance CO2 storage site selection, showcases CMG's commitment to innovation and sector leadership. This aligns with their recent addition to the S&P Global BMI Index, reflecting broader market recognition. Financially, CMG is poised for robust growth with earnings expected to surge by 24.6% annually and revenue growth projected at 11.5% per year, outpacing the general Canadian market forecast of 7%. Despite a slight dip in net profit margins from 29.2% last year to 19.7%, these developments underscore CMG's potential as a key player in technology dedicated to sustainability and advanced simulation solutions.

- Delve into the full analysis health report here for a deeper understanding of Computer Modelling Group.

Gain insights into Computer Modelling Group's past trends and performance with our Past report.

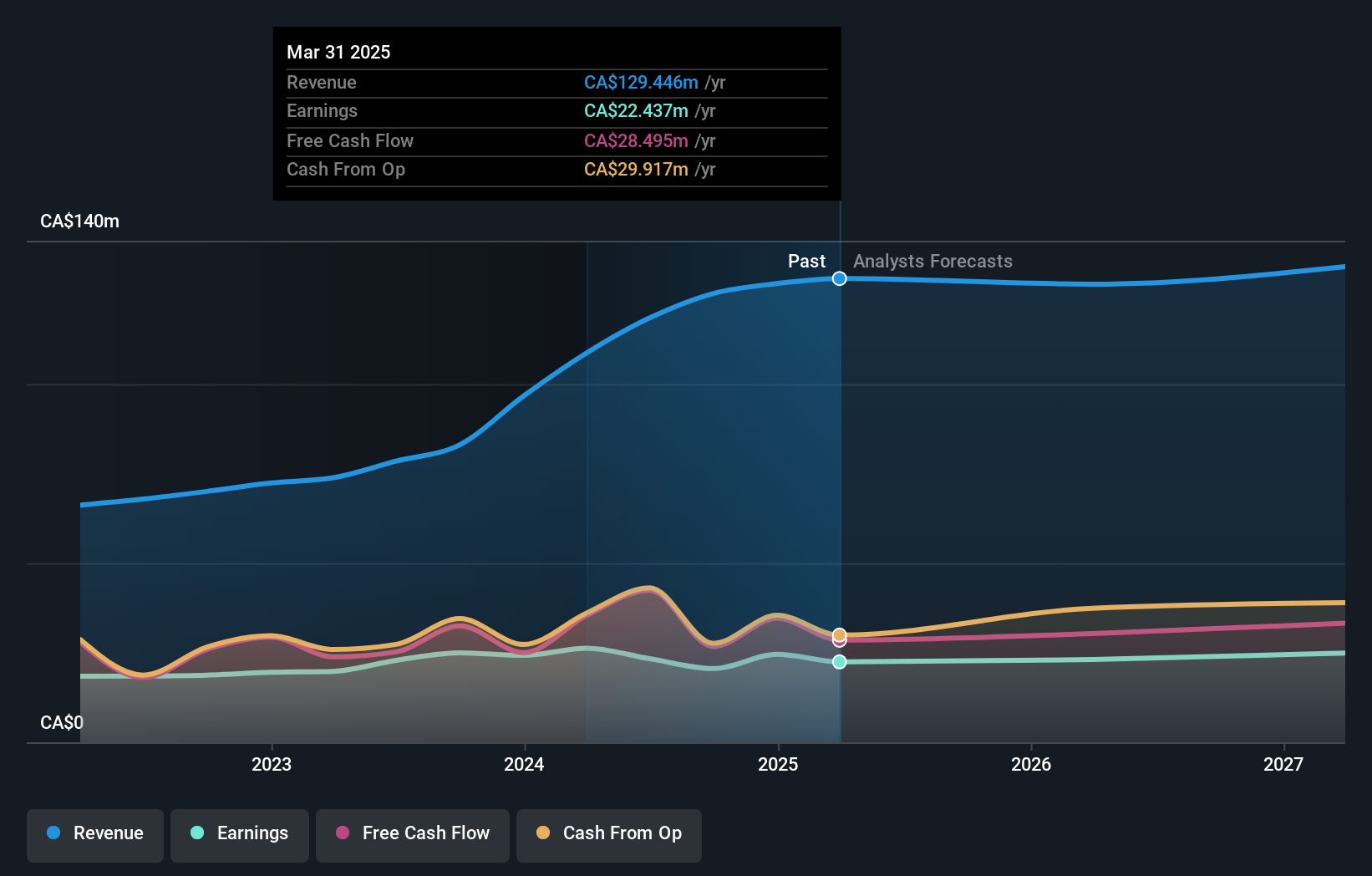

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$521.79 million.

Operations: The company generates revenue primarily through its Broadcasting and Commercial Music segment, contributing CA$201.10 million, followed by the Radio segment at CA$154.41 million.

Stingray Group's recent strategic initiatives, including the launch of its karaoke app on VIZIO and repurchase of 3.54 million shares, underscore its commitment to enhancing user engagement and shareholder value. Despite a revenue growth forecast of 4.9%, slower than the industry average, Stingray is poised for significant profit growth with earnings expected to surge by 69.2% annually. The company's focus on expanding its digital content offerings through platforms like Amazon Fire TV Channels reflects a robust adaptation to media consumption trends, promising future growth in an evolving market landscape.

- Navigate through the intricacies of Stingray Group with our comprehensive health report here.

Assess Stingray Group's past performance with our detailed historical performance reports.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across various regions, including Canada, the United States, the United Kingdom, Australia, and Western Asia, with a market cap of CA$456.33 million.

Operations: Vitalhub Corp. generates revenue primarily through its healthcare software segment, which accounts for CA$58.32 million.

Vitalhub, recently added to the S&P Global BMI Index, is navigating a challenging landscape with its latest financials revealing a shift from net income to a net loss. Despite this, the company's revenue surged to CAD 31.49 million over six months, marking a significant 22.6% increase from the previous year. This growth is underpinned by an aggressive R&D investment strategy which has been crucial in driving innovation and maintaining competitive edge in healthcare technology solutions. Moreover, with earnings projected to grow at an impressive rate of 65.9% annually, Vitalhub is poised for robust future performance as it continues to expand its technological offerings and adapt effectively within the dynamic healthcare sector.

- Dive into the specifics of Vitalhub here with our thorough health report.

Explore historical data to track Vitalhub's performance over time in our Past section.

Next Steps

- Embark on your investment journey to our 24 TSX High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company worldwide.

Reasonable growth potential and fair value.