- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

3 TSX Growth Stocks With High Insider Ownership And 18% Earnings Growth

Reviewed by Simply Wall St

As Canada's core inflation is expected to tick up and the U.S. Federal Reserve leans toward potential rate cuts, the market landscape remains cautiously optimistic with resilient economic indicators. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Robex Resources (TSXV:RBX) | 24.4% | 99.4% |

| Propel Holdings (TSX:PRL) | 36.2% | 31.8% |

| PowerBank (NEOE:SUNN) | 16% | 52.1% |

| Orla Mining (TSX:OLA) | 11.2% | 74% |

| First National Financial (TSX:FN) | 38.4% | 22.1% |

| Enterprise Group (TSX:E) | 32.1% | 29.5% |

| Discovery Silver (TSX:DSV) | 13.6% | 57.8% |

| CEMATRIX (TSX:CEMX) | 10.5% | 76.6% |

| Aritzia (TSX:ATZ) | 17.2% | 29.6% |

| Allied Gold (TSX:AAUC) | 16% | 86.5% |

We'll examine a selection from our screener results.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market cap of CA$8.77 billion.

Operations: The company generates revenue primarily from its apparel segment, which amounted to CA$2.90 billion.

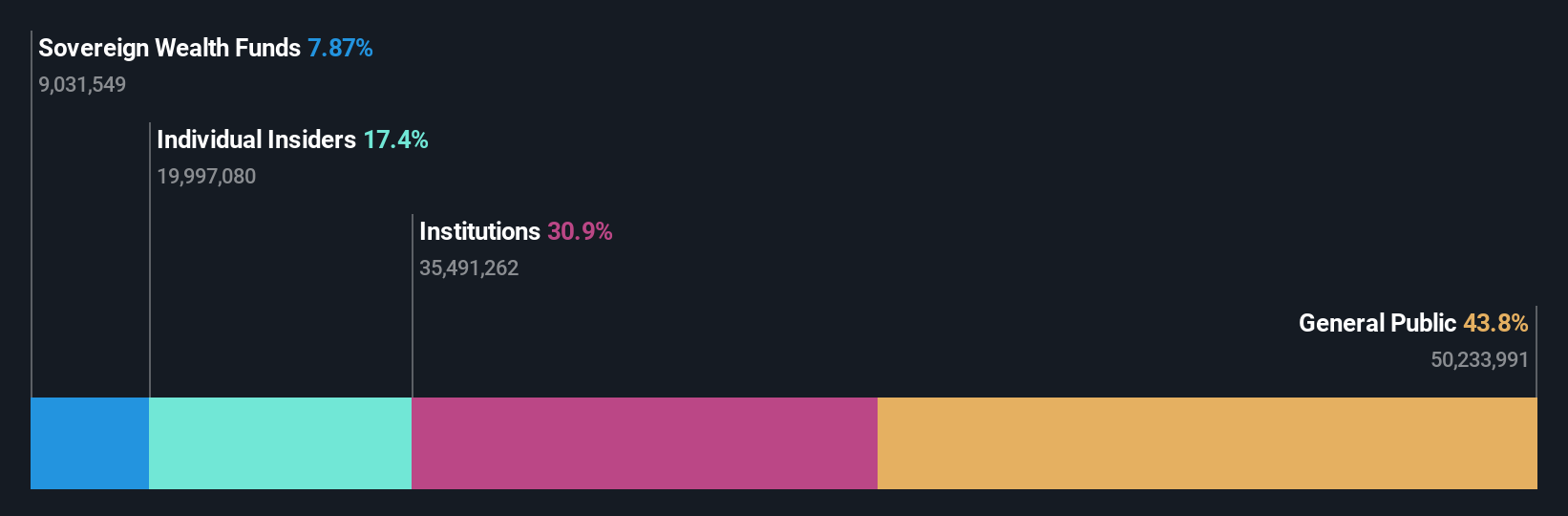

Insider Ownership: 17.2%

Earnings Growth Forecast: 29.6% p.a.

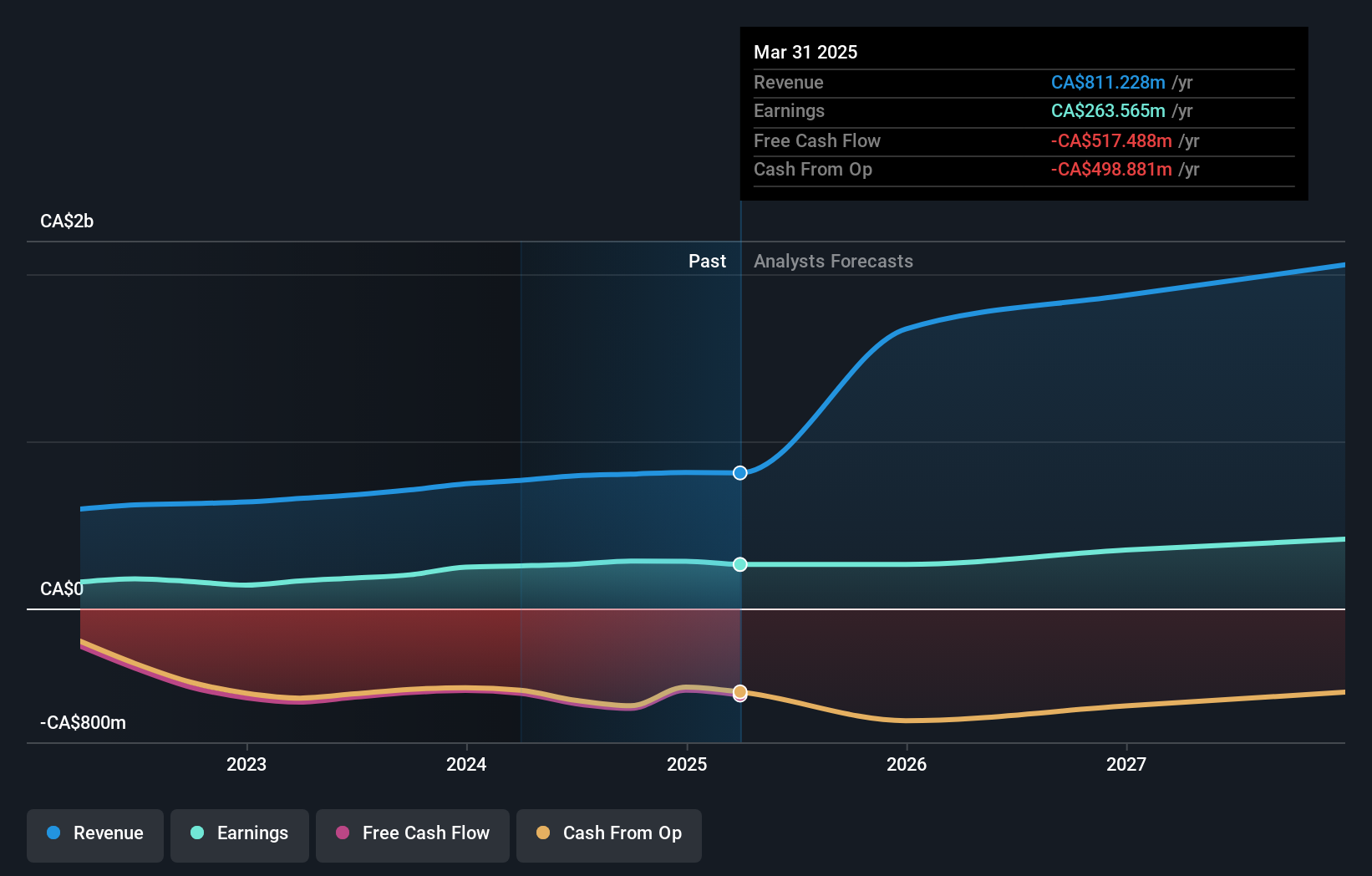

Aritzia's earnings are forecast to grow significantly at 29.6% annually, outpacing the Canadian market. Recent results show strong financial performance with a net income increase from CAD 15.83 million to CAD 42.39 million year-over-year, and revenue growth projected between 13% and 19% for fiscal year 2026. Although insider buying isn't substantial, insiders have purchased more shares than sold recently, suggesting confidence in its growth trajectory despite trading below estimated fair value by a large margin.

- Click to explore a detailed breakdown of our findings in Aritzia's earnings growth report.

- The analysis detailed in our Aritzia valuation report hints at an deflated share price compared to its estimated value.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market capitalization of CA$3.28 billion.

Operations: The company's revenue is derived from its easyhome segment, contributing CA$150.03 million, and its easyfinancial segment, generating CA$1.45 billion.

Insider Ownership: 21.9%

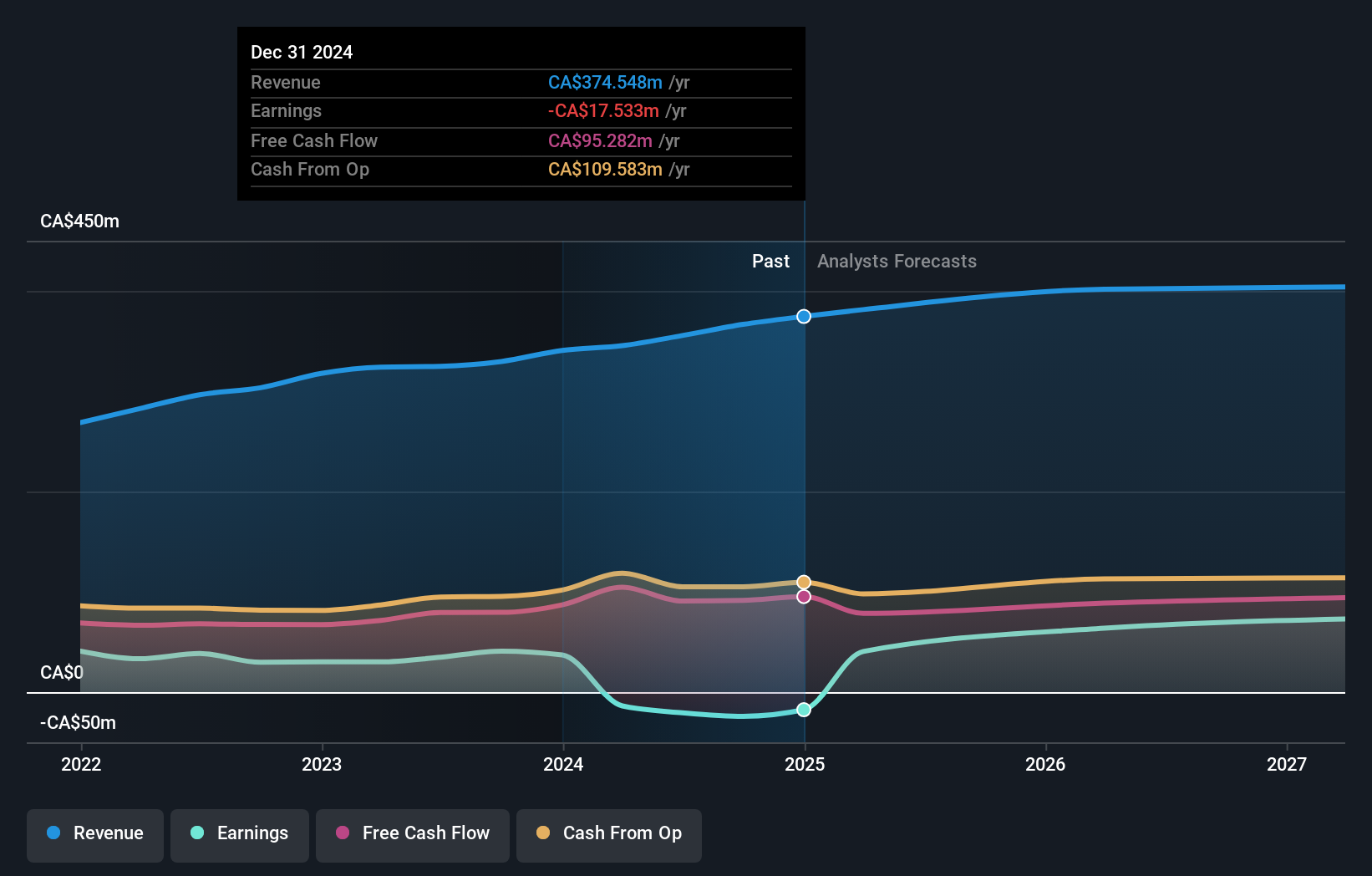

Earnings Growth Forecast: 18.9% p.a.

goeasy's revenue is forecast to grow at 30.2% annually, significantly outpacing the Canadian market. Recent earnings reveal a net income increase from CAD 65.4 million to CAD 86.54 million year-over-year, with earnings projected to rise by 18.9% annually, surpassing market averages. Insider activity shows more buying than selling recently, indicating confidence despite trading below fair value estimates and challenges in covering dividends with free cash flow amidst recent debt financing activities totaling approximately US$450 million and CAD 175 million.

- Click here to discover the nuances of goeasy with our detailed analytical future growth report.

- Our valuation report here indicates goeasy may be undervalued.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a music, media, and technology company operating in Canada, the United States, and internationally with a market cap of CA$677.51 million.

Operations: The company's revenue is derived from two main segments: Radio, contributing CA$134.34 million, and Broadcasting and Commercial Music, accounting for CA$259.12 million.

Insider Ownership: 22.9%

Earnings Growth Forecast: 19.3% p.a.

Stingray Group's revenue growth is projected at 6.1% annually, outpacing the Canadian market but below higher growth benchmarks. Despite high debt levels, recent earnings show a significant increase in net income to CAD 16.78 million from CAD 7.3 million year-over-year. Analysts expect a stock price rise of 31.7%, with shares trading well below fair value estimates, though insider activity shows substantial selling recently amidst strategic expansions and consistent dividend payments of $0.075 per share.

- Take a closer look at Stingray Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Stingray Group is trading behind its estimated value.

Taking Advantage

- Click here to access our complete index of 44 Fast Growing TSX Companies With High Insider Ownership.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives