Those Who Purchased Corus Entertainment (TSE:CJR.B) Shares Five Years Ago Have A 80% Loss To Show For It

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the Corus Entertainment Inc. (TSE:CJR.B) share price dropped 80% in the last half decade. That is extremely sub-optimal, to say the least. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Corus Entertainment

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

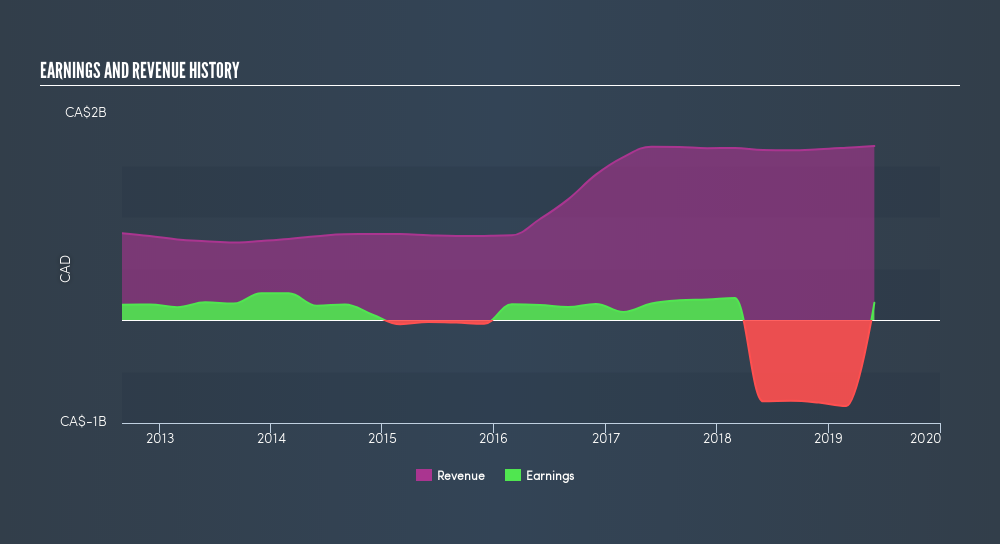

Corus Entertainment became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Corus Entertainment will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Corus Entertainment the TSR over the last 5 years was -70%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Corus Entertainment has rewarded shareholders with a total shareholder return of 26% in the last twelve months. That's including the dividend. Notably the five-year annualised TSR loss of 21% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Corus Entertainment is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CJR.B

Corus Entertainment

A media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally.

Undervalued low.

Similar Companies

Market Insights

Community Narratives