- Canada

- /

- Entertainment

- /

- TSX:BRMI

Boat Rocker Media (TSE:BRMI shareholders incur further losses as stock declines 11% this week, taking one-year losses to 43%

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Boat Rocker Media Inc. (TSE:BRMI) share price is down 43% in the last year. That's disappointing when you consider the market declined 2.9%. Boat Rocker Media may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 21% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Boat Rocker Media

Boat Rocker Media wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Boat Rocker Media's revenue didn't grow at all in the last year. In fact, it fell 41%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 43% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

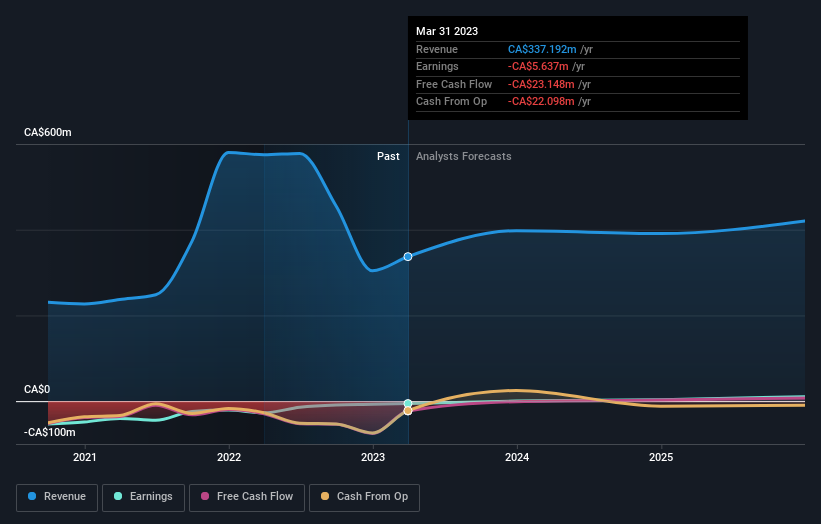

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Boat Rocker Media stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We doubt Boat Rocker Media shareholders are happy with the loss of 43% over twelve months. That falls short of the market, which lost 2.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 21%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Boat Rocker Media better, we need to consider many other factors. Take risks, for example - Boat Rocker Media has 1 warning sign we think you should be aware of.

Boat Rocker Media is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Boat Rocker Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRMI

Boat Rocker Media

An entertainment company, creates, produces, and distributes television and film content in Canada, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives