Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Aimia Inc. (TSE:AIM) share price dropped 82% in the last half decade. That is extremely sub-optimal, to say the least. On top of that, the share price has dropped a further 14% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Aimia

Aimia isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

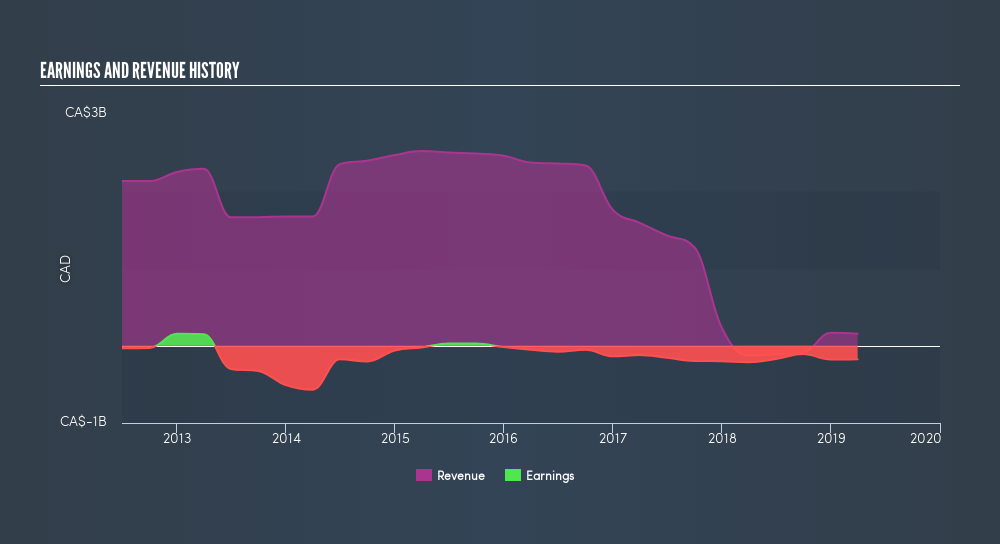

In the last five years Aimia saw its revenue shrink by 37% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 29% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Aimia stock, you should check out this free report showing analyst profit forecasts.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, Aimia generated a TSR of -60%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

We're pleased to report that Aimia shareholders have received a total shareholder return of 156% over one year. There's no doubt those recent returns are much better than the TSR loss of 17% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Aimia is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:AIM

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives