- Canada

- /

- Entertainment

- /

- CNSX:GSQ

GameSquare Esports Inc.'s (CSE:GSQ) recent CA$3.7m market cap decline means a loss of CA$104k for insiders who bought this year

Insiders who acquired CA$186k worth of GameSquare Esports Inc.'s (CSE:GSQ) stock at an average price of CA$0.29 in the past 12 months may be dismayed by the recent 10% price decline. Insiders invest with the hopes of seeing their money grow in value over time. However, as a result of recent losses, their initial investment is now only worth CA$82k, which is not what they expected.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for GameSquare Esports

The Last 12 Months Of Insider Transactions At GameSquare Esports

In the last twelve months, the biggest single purchase by an insider was when Director Travis Goff bought CA$137k worth of shares at a price of CA$0.28 per share. That means that an insider was happy to buy shares at above the current price of CA$0.13. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

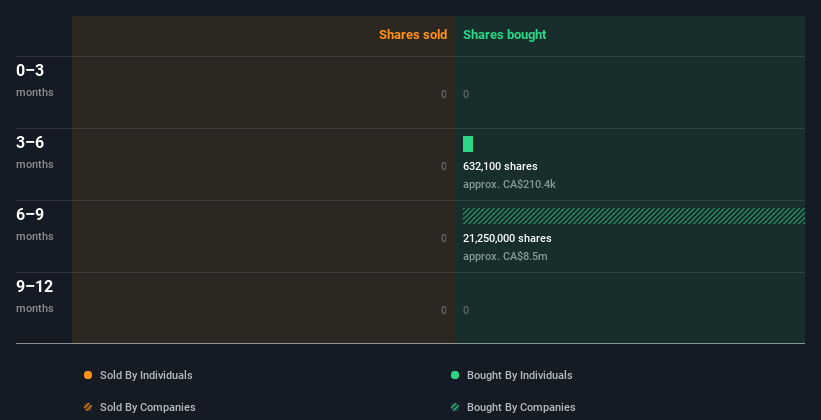

While GameSquare Esports insiders bought shares during the last year, they didn't sell. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

GameSquare Esports is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does GameSquare Esports Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. From our data, it seems that GameSquare Esports insiders own 9.1% of the company, worth about CA$2.9m. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. We do generally prefer see higher levels of insider ownership.

So What Does This Data Suggest About GameSquare Esports Insiders?

The fact that there have been no GameSquare Esports insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. While we have no worries about the insider transactions, we'd be more comfortable if they owned more GameSquare Esports stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 4 warning signs for GameSquare Esports (of which 1 is concerning!) you should know about.

But note: GameSquare Esports may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:GSQ

GameSquare Esports

Operates as a media, entertainment, and technology company.

Mediocre balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion