We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Ximen Mining Corp. (CVE:XIM), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

Check out our latest analysis for Ximen Mining

Ximen Mining Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the President, Christopher Anderson, for CA$91k worth of shares, at about CA$0.37 per share. That means that an insider was selling shares at slightly below the current price (CA$0.38). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 5.5% of Christopher Anderson's stake. Notably Christopher Anderson was also the biggest buyer, having purchased CA$142k worth of shares.

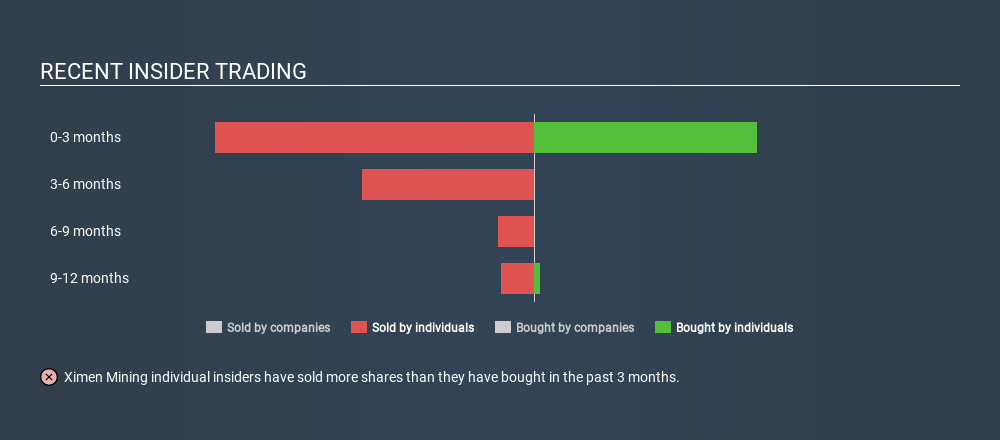

In the last twelve months insiders purchased 352.31k shares for CA$142k. On the other hand they divested 861100 shares, for CA$363k. Over the last year we saw more insider selling of Ximen Mining shares, than buying. The chart below shows insider transactions (by individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders at Ximen Mining Have Sold Stock Recently

We have seen a bit of insider selling at Ximen Mining, over the last three months. President Christopher Anderson sold CA$195k worth of shares in that time. But the good news is that there was purchasing too , worth CA$136k. While it's not great to see insider selling, the net amount sold isn't enough for us to want to read anything into it.

Does Ximen Mining Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that Ximen Mining insiders own about CA$1.8m worth of shares (which is 9.4% of the company). Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

What Might The Insider Transactions At Ximen Mining Tell Us?

Unfortunately, there has been more insider selling of Ximen Mining stock, than buying, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Ximen Mining. To help with this, we've discovered 6 warning signs (3 don't sit too well with us!) that you ought to be aware of before buying any shares in Ximen Mining.

But note: Ximen Mining may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:XIM

Ximen Mining

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Medium-low risk with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026