- Canada

- /

- Metals and Mining

- /

- TSXV:UCU

Ucore Rare Metals (TSXV:UCU) Is Up 12.8% After Securing Expanded US Government Support and New Tech Partnership

Reviewed by Sasha Jovanovic

- Recently, Ucore Rare Metals announced an extension of its US government contract for a rare earth separation plant in Louisiana, including a US$22.4 million modified agreement with the US Army Contracting Command and a new technology partnership with Australia’s Metallium to create a flexible supply chain using both mining concentrates and recycled materials.

- These moves highlight Ucore’s efforts to position itself as an independent Western provider of rare earths, aligning its operations with US priorities for securing critical materials.

- We'll explore how expanding US government support for Ucore’s commercial-scale RapidSX machine shapes the company’s investment narrative moving forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Ucore Rare Metals' Investment Narrative?

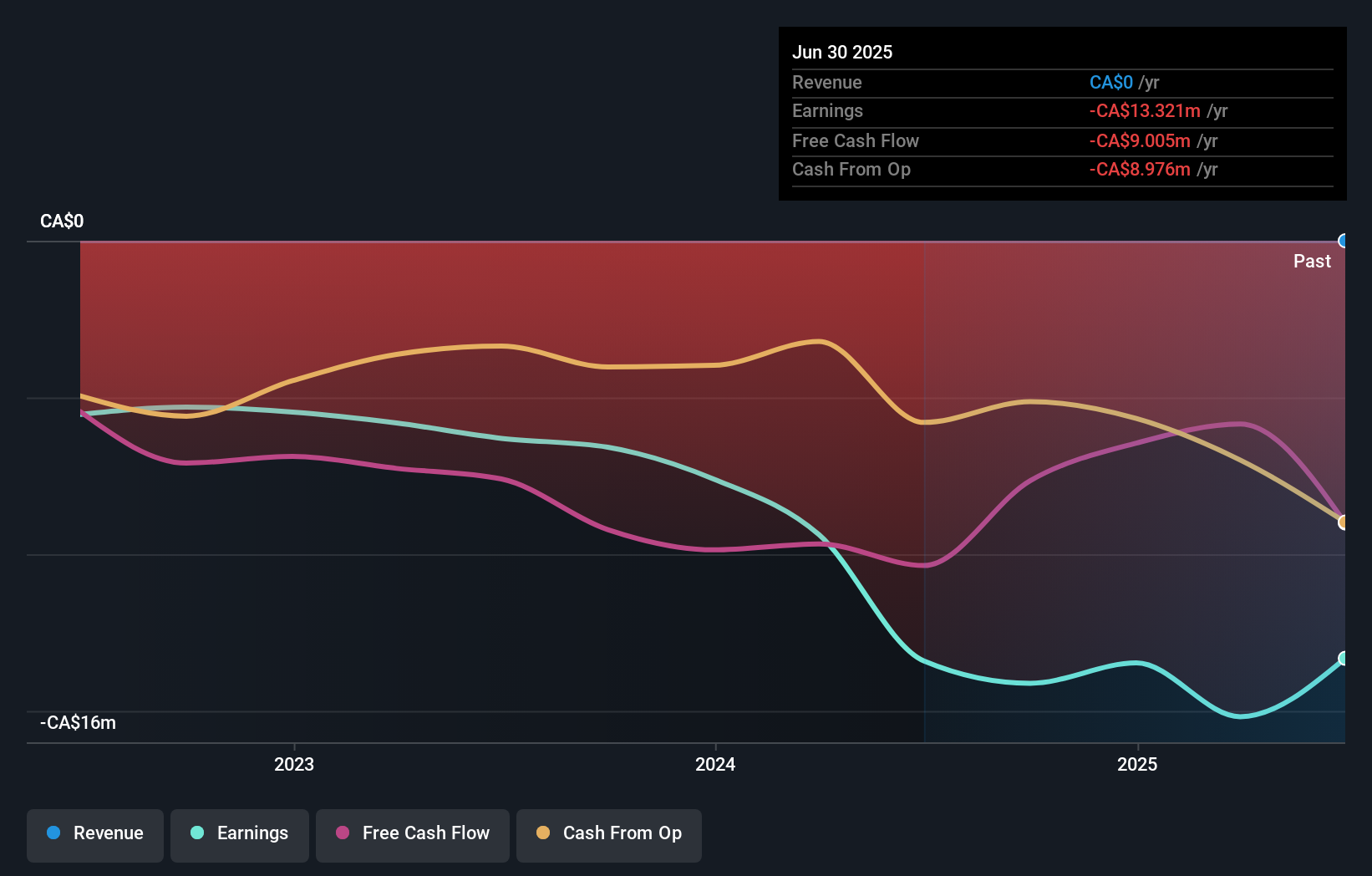

To be a shareholder in Ucore Rare Metals right now, you’ve got to believe in the thesis that Western re-shoring of rare earth processing is an urgent, government-backed priority with financial muscle behind it. The latest extension of Ucore’s US government contract and the expanded US$22.4 million award signal a material boost to the company’s near-term catalysts by accelerating construction of the RapidSX separation plant in Louisiana and deepening Ucore’s integration with the US supply chain. These moves meaningfully reduce immediate funding and commercial risk, especially compared to the business’ prior dependence on smaller, earlier-stage awards and private placements. However, several important risks remain front and center: the company is still unprofitable, reporting losses, and auditor concerns about going concern status haven’t disappeared. Government partnerships may fund the present, but commercial viability and positive cashflow remain open questions. On the other hand, government support may not address long-running dilution and losses, here’s what investors should watch.

Our expertly prepared valuation report on Ucore Rare Metals implies its share price may be too high.Exploring Other Perspectives

Build Your Own Ucore Rare Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ucore Rare Metals research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Ucore Rare Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ucore Rare Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UCU

Ucore Rare Metals

Engages in the extraction, beneficiation, and separation of rare and critical metal resources in Canada and the United States.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives