- Canada

- /

- Metals and Mining

- /

- TSXV:UCU

Ucore Rare Metals (CVE:UCU) Has Debt But No Earnings; Should You Worry?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Ucore Rare Metals Inc. (CVE:UCU) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Ucore Rare Metals

How Much Debt Does Ucore Rare Metals Carry?

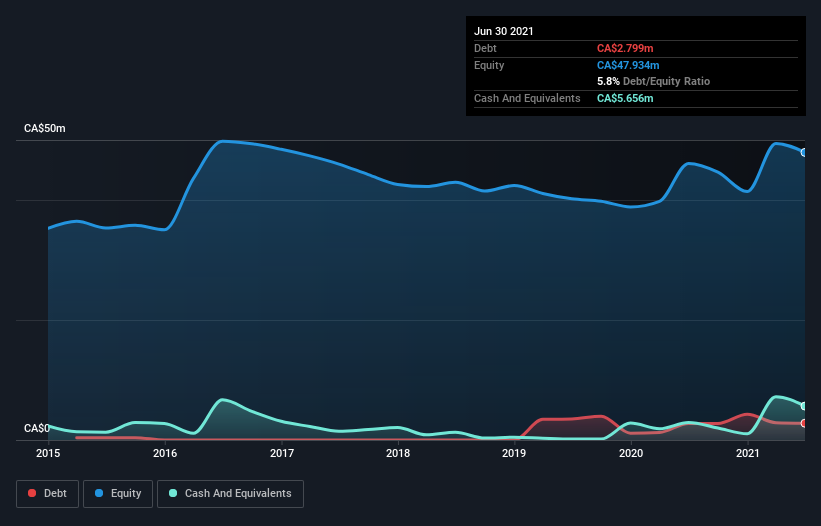

As you can see below, Ucore Rare Metals had CA$2.80m of debt, at June 2021, which is about the same as the year before. You can click the chart for greater detail. However, it does have CA$5.66m in cash offsetting this, leading to net cash of CA$2.86m.

How Strong Is Ucore Rare Metals' Balance Sheet?

We can see from the most recent balance sheet that Ucore Rare Metals had liabilities of CA$1.63m falling due within a year, and liabilities of CA$1.77m due beyond that. On the other hand, it had cash of CA$5.66m and CA$679.8k worth of receivables due within a year. So it can boast CA$2.94m more liquid assets than total liabilities.

This surplus suggests that Ucore Rare Metals has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Ucore Rare Metals boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Ucore Rare Metals's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Since Ucore Rare Metals has no significant operating revenue, shareholders probably hope it will develop a valuable new mine before too long.

So How Risky Is Ucore Rare Metals?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Ucore Rare Metals had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through CA$5.2m of cash and made a loss of CA$4.8m. With only CA$2.86m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 6 warning signs for Ucore Rare Metals (of which 3 make us uncomfortable!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:UCU

Ucore Rare Metals

Engages in the extraction, beneficiation, and separation of rare and critical metal resources in Canada and the United States.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives