- Canada

- /

- Metals and Mining

- /

- TSXV:MTA

TSX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian market faces a complex landscape shaped by potential tariff impacts and evolving trade dynamics. Despite these challenges, the underlying economic fundamentals remain robust, with above-trend growth and historically low unemployment rates. In this context, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential value and growth opportunities. By focusing on those with strong financials and clear growth trajectories, investors can explore promising candidates that may offer both stability and upside in a diversified portfolio.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.79M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$129.13M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$434.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$656.3M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.32M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$25.79M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$411.5M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$181.56M | ★★★★★☆ |

Click here to see the full list of 941 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$435.86 million.

Operations: The company generates revenue of $5.05 million from its activities related to the acquisition and management of precious metal royalties, streams, and similar production-based interests.

Market Cap: CA$435.86M

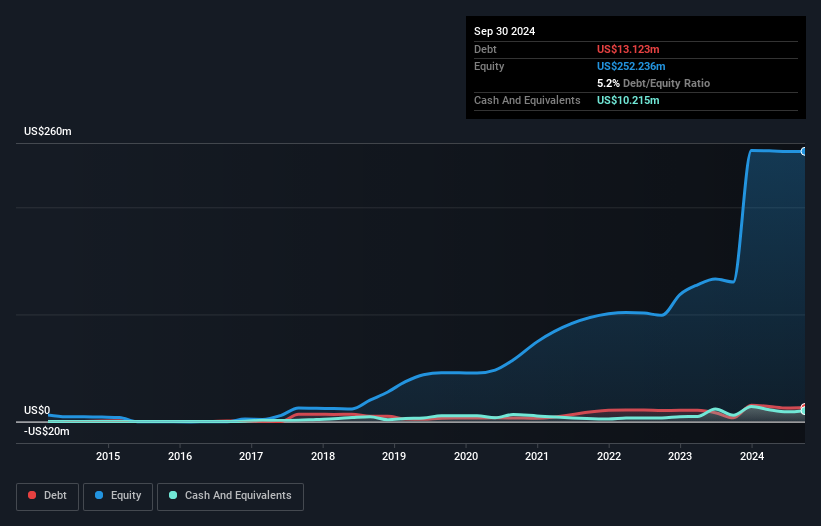

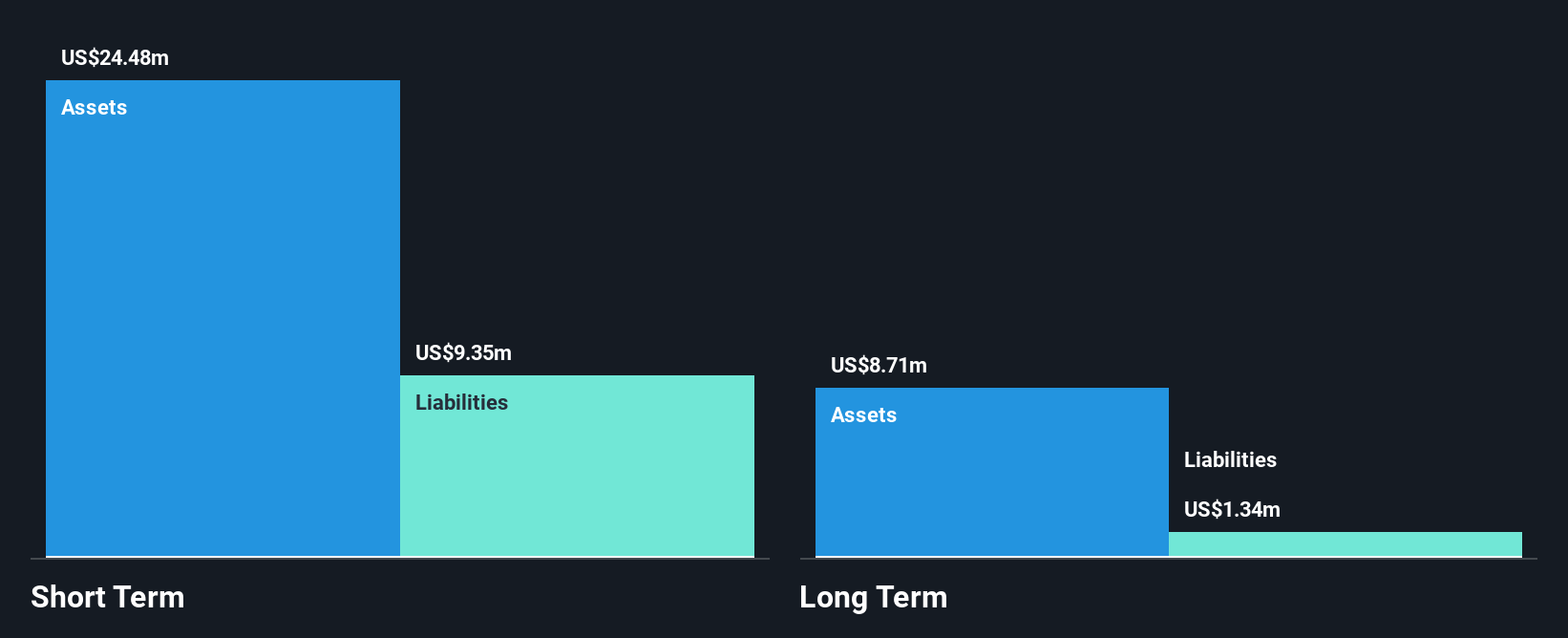

Metalla Royalty & Streaming Ltd., with a market cap of CA$435.86 million, focuses on precious metals royalties and streams, generating revenue of US$5.05 million. Despite being unprofitable with increasing losses over the past five years, it trades at a significant discount to its estimated fair value. Recent board changes include the appointment of Chris Beer, bringing extensive mining finance expertise. While short-term liabilities exceed assets by US$1.5 million, long-term liabilities are well-covered by assets. Analysts predict substantial earnings growth and a potential stock price increase of 50.6%. The company maintains low debt levels and stable volatility.

- Click here to discover the nuances of Metalla Royalty & Streaming with our detailed analytical financial health report.

- Gain insights into Metalla Royalty & Streaming's future direction by reviewing our growth report.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and dealing mineral properties in Canada, with a market cap of CA$64.10 million.

Operations: Teuton Resources Corp. has not reported any revenue segments.

Market Cap: CA$64.1M

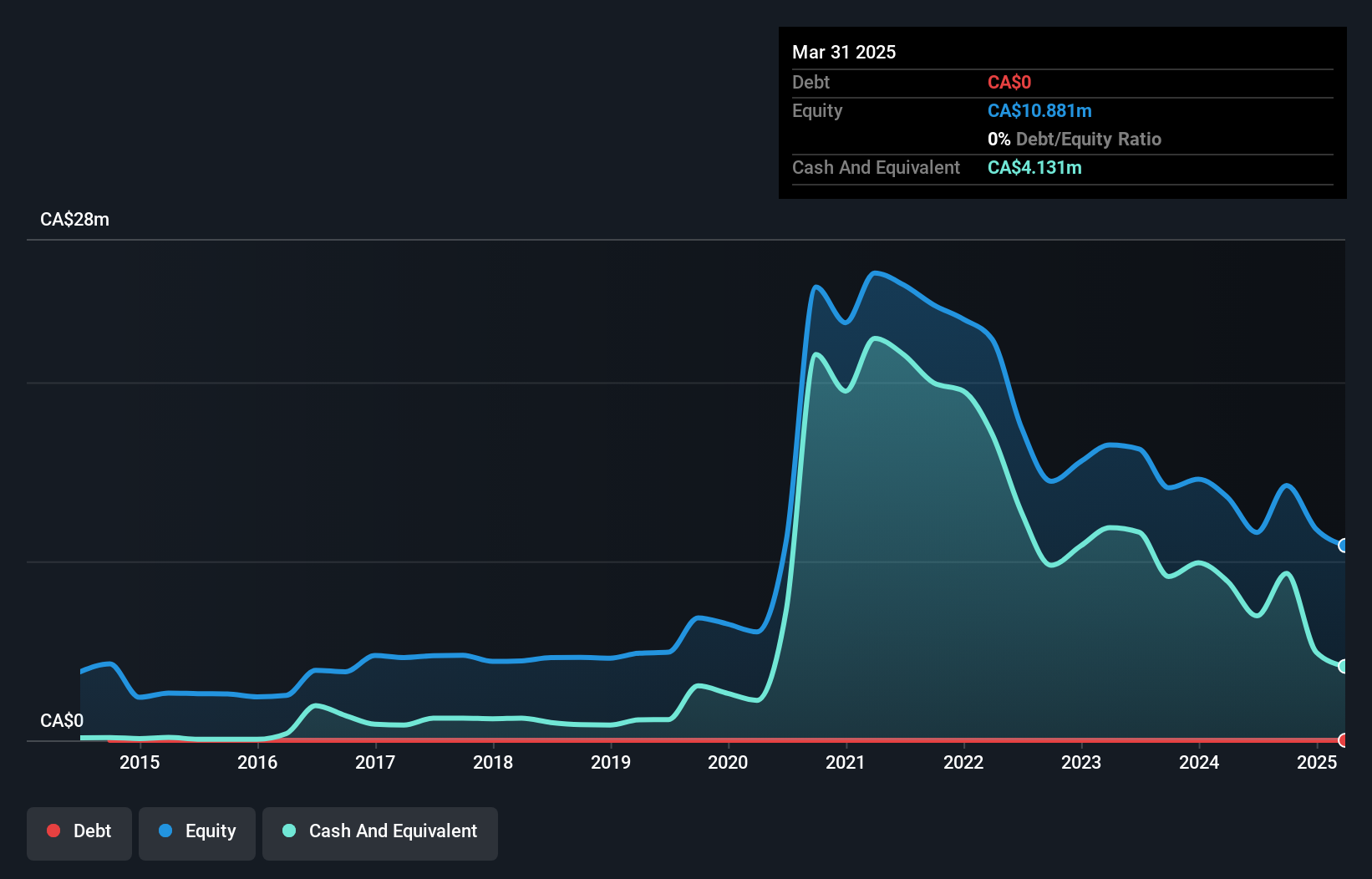

Teuton Resources Corp., with a market cap of CA$64.10 million, is pre-revenue and recently became profitable, reporting a net income of CA$2.62 million for Q3 2024 compared to a loss the previous year. Despite no debt, significant insider selling was observed in the past quarter. The company's short-term assets far exceed its liabilities, indicating strong liquidity. However, profitability was influenced by a large one-off gain of CA$741.9K over the last year, raising questions about earnings quality and sustainability without recurring revenue streams or substantial operational income sources yet established.

- Click to explore a detailed breakdown of our findings in Teuton Resources' financial health report.

- Learn about Teuton Resources' historical performance here.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. is a global marketing technology company specializing in user acquisition and engagement, with a market cap of CA$75.98 million.

Operations: The company generates revenue of $46.95 million from its Internet Software & Services segment.

Market Cap: CA$75.98M

Zoomd Technologies Ltd., with a market cap of CA$75.98 million, has demonstrated strong financial performance, becoming profitable in the past year with net income of US$5.85 million for the first nine months of 2024. The company reported third-quarter sales of US$16.71 million, significantly up from the previous year, reflecting robust growth in its Internet Software & Services segment. Despite high share price volatility and recent insider selling, Zoomd maintains a solid balance sheet with short-term assets exceeding both short-term and long-term liabilities. Its experienced board and management team further support its operational stability and strategic direction.

- Take a closer look at Zoomd Technologies' potential here in our financial health report.

- Understand Zoomd Technologies' track record by examining our performance history report.

Next Steps

- Discover the full array of 941 TSX Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MTA

Metalla Royalty & Streaming

A precious metals royalty and streaming company, engages in the acquisition and management of gold, silver, copper royalties, streams, and related production-based interests in Canada.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives